5 Critical Pitfalls to Avoid When Choosing a Futures Trading Platform

In today’s fast-paced financial world, traders and investors alike are constantly seeking the most effective and feature-rich tools to gain an edge in the market. Among the most vital tools is the best futures trading platform, which can make or break a trader’s ability to succeed. With numerous options available for both retail and institutional traders, identifying the best trading platform futures can be overwhelming. This comprehensive paper explores what features define the best platforms for futures trading, how traders can leverage these features to choose the right fit for their needs, and why CannonX, developed by Cannon Trading Company, is the top contender in the space.

We will also explore the broader offering of Cannon Trading Company, from its professional-grade institutional trading platform support to their exceptional customer service, making it not just about CannonX, but about a complete ecosystem for futures online trading platform excellence.

Defining the Best Futures Trading Platform

The term best futures trading platform encompasses a wide range of features and criteria that traders look for to meet their unique goals. Some of these features include:

- Low latency execution

- Advanced charting and technical analysis tools

- Real-time futures quotes

- Customizable interface and workspace

- Mobile app platform compatibility

- Depth of market (DOM) visibility

- Risk management tools

- Integration with APIs and algorithmic trading systems

- Regulatory compliance and security

- Customer service and broker support

Each of these features plays a significant role in defining the best trading platform futures users seek, especially those engaging in futures contract trading where timing, information, and execution precision are paramount.

Key Features and Risk Assessment

Low Latency Execution

Speed is a critical factor when trading futures contracts. A delay of even a fraction of a second can mean the difference between profit and loss.

- Risk Assessment: Traders relying on high-speed executions for scalping strategies may suffer losses if latency is high.

- Why It Matters: The best futures trading platform will prioritize infrastructure that minimizes latency, allowing traders to enter and exit positions swiftly.

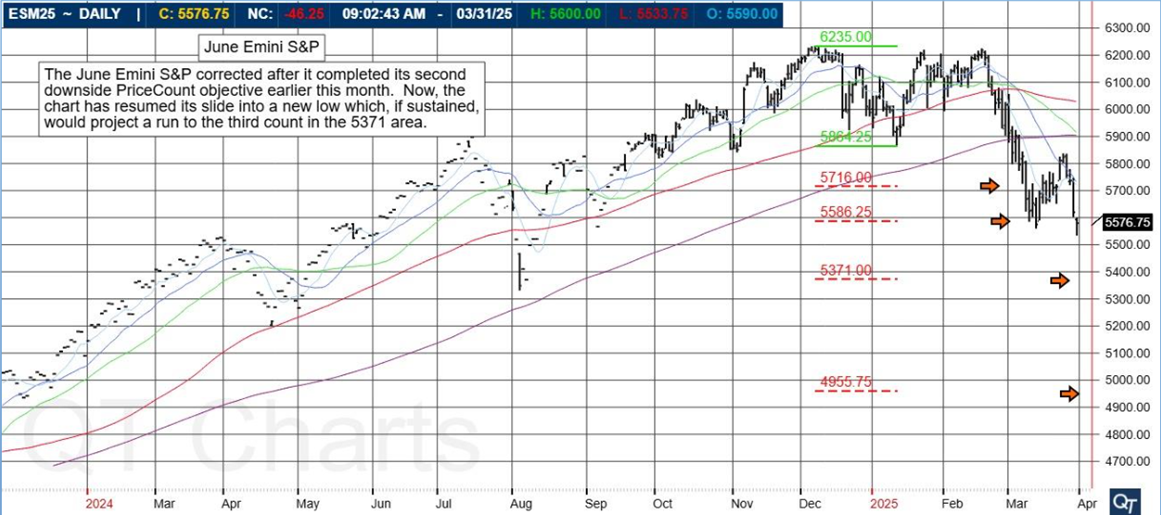

Advanced Charting and Technical Tools

Charting capabilities help traders visualize market patterns and execute trades based on technical indicators.

- Risk Assessment: Over-reliance on technical indicators without fundamental analysis can lead to poor decision-making.

- Why It Matters: A futures online trading platform should offer multiple chart types, custom indicators, and drawing tools to accommodate all strategies.

Real-Time Futures Quotes

Access to real-time futures quotes is crucial to ensure traders are making decisions based on current market conditions.

- Risk Assessment: Delayed quotes can result in traders buying or selling at unfavorable prices.

- Why It Matters: The best platforms for futures trading ensure the quotes are updated in milliseconds and synced across devices.

Customizable Interface and Workspace

A customizable layout allows traders to organize their screens for optimal workflow.

- Risk Assessment: Too much customization can lead to clutter, which could slow down decision-making.

- Why It Matters: Traders should be able to build a personalized dashboard on their futures app or desktop platform that reflects their strategy and preferences.

Mobile App Platform Compatibility

Modern trading requires the ability to act from anywhere. A robust mobile app platform allows traders to manage positions on the go.

- Risk Assessment: Mobile platforms may lack full functionality, increasing risk when trading large volumes.

- Why It Matters: The best futures trading platform integrates mobile features seamlessly with its desktop counterpart.

Depth of Market (DOM) and Order Book Visibility

DOM provides insights into market liquidity and potential price movement.

- Risk Assessment: Misreading the DOM can lead to incorrect trade entries or exits.

- Why It Matters: DOM is essential for short-term traders and scalpers relying on market depth for quick decisions.

Risk Management Tools

Risk tools such as stop-loss, take-profit, and margin alerts are essential for responsible trading.

- Risk Assessment: Improper configuration can result in automatic liquidation or larger-than-expected losses.

- Why It Matters: The best platforms for futures trading provide customizable risk settings and real-time alerts.

API and Algorithmic Trading Support

Traders using automated strategies need access to open APIs.

- Risk Assessment: Poorly tested bots can make incorrect trades and accumulate losses rapidly.

- Why It Matters: A reliable institutional trading platform must offer robust API support for algorithmic systems.

Regulatory Compliance and Security

Platform integrity relies heavily on strong cybersecurity and compliance with financial regulations.

- Risk Assessment: A non-compliant platform can be shut down or expose users to data breaches.

- Why It Matters: A trustworthy futures online trading platform should be fully regulated and use best-in-class encryption.

Customer Service and Broker Access

Direct access to experienced brokers provides a huge edge.

- Risk Assessment: Delayed responses during market volatility can result in significant losses.

- Why It Matters: Having brokers available at the moment you need them is essential. This is where Cannon Trading Company excels.

CannonX: A Top Futures Trading Platform in Action

CannonX embodies every single one of the features outlined above. Here’s how it stands out as the best trading platform futures solution today:

- Low Latency: Engineered for speed with direct market access.

- Charting: Packed with advanced charting and drawing tools for all trader levels.

- Real-Time Quotes: Offers blazing-fast futures quotes with Level 1 and Level 2 data.

- Custom UI: Fully adjustable workspace.

- Mobile Integration: CannonX’s futures app synchronizes seamlessly with its desktop version.

- DOM Access: Integrated DOM panel with multiple visualization options.

- Risk Tools: Includes position management, trailing stops, and alert systems.

- API Support: Fully compatible with trading bots and institutional-grade APIs.

- Secure and Regulated: Adheres to all U.S. futures trading regulations.

- Broker Support: Comes with Cannon Trading’s hallmark customer service and expert brokers.

It is not simply a tool, but a complete ecosystem that caters to both retail and institutional needs, making CannonX the undisputed best futures trading platform.

Why Cannon Trading Company is More Than Just CannonX

While CannonX is the flagship futures online trading platform, Cannon Trading Company delivers far beyond a single product. Here’s what makes them a superior brokerage:

- Free Trading Platforms: Cannon offers access to more than 10 futures online trading platform options, free of charge.

- Top Ratings: Dozens of 5/5 TrustPilot reviews reflect their reliability and service.

- Experienced Brokers: Onsite brokers with decades of experience are available to assist.

- Instant Communication: They answer the phone immediately—no bots, no holds.

- Institutional Support: Offers tailored institutional trading platform services for large-scale traders.

- Educational Resources: Webinars, blogs, and live training sessions.

- Transparent Pricing: Clear commission structures without hidden fees.

- Global Access: Provides platforms for international clients engaged in futures contract trading.

- Mobile App Options: Multiple mobile app platform choices to suit different needs.

- Demo Accounts: Try before you buy with access to simulated trading.

How to Pick the Best Futures Trading Platform for You

When choosing a futures online trading platform, consider the following:

- Trading Style: Are you scalping, swing trading, or hedging futures positions?

- Data Needs: Do you require real-time futures quotes and DOM data?

- Mobility: Will you be trading mostly from a mobile app platform or desktop?

- Integration: Do you need API or third-party tool support?

- Support: Is customer service accessible and knowledgeable?

- Security: Is your data and capital protected?

By cross-referencing these factors with what CannonX and Cannon Trading Company offer, it becomes evident why they provide one of the best platforms for futures trading.

Why CannonX and Cannon Trading Company Are in a League of Their Own

In a crowded landscape of trading platforms, the best futures trading platform isn’t just about having the most buttons and indicators. It’s about synergy—how all these features work together to support your trading goals. CannonX exemplifies this synergy with its seamless blend of speed, depth, control, and mobility. When paired with Cannon Trading Company’s unmatched brokerage support, you get not only the best trading platform futures traders can ask for but also the most reliable and empowering trading experience in the industry.

From real-time futures quotes to high-end institutional trading platform tools and unbeatable customer support, Cannon Trading Company has earned its reputation as the top choice for futures contract trading. Whether you’re a day trader looking for a responsive futures app, or a fund manager needing precision and compliance, this is where you find your trading home.

For more information, click here.

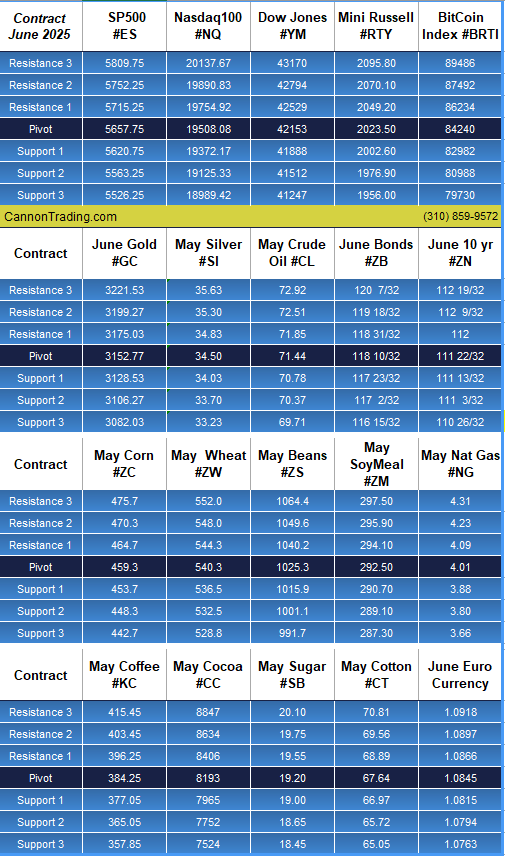

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading