Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

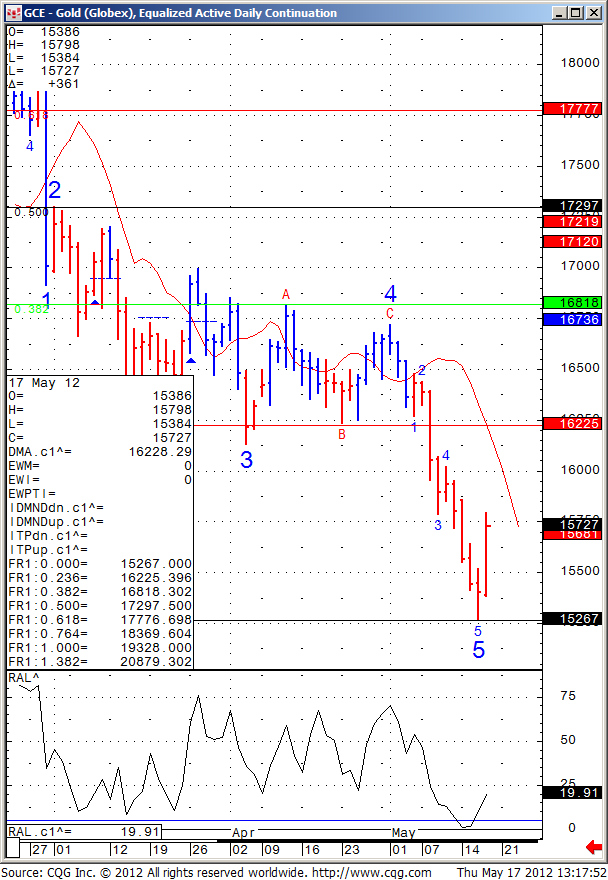

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Tuesday May 22, 2012

Hello Traders,

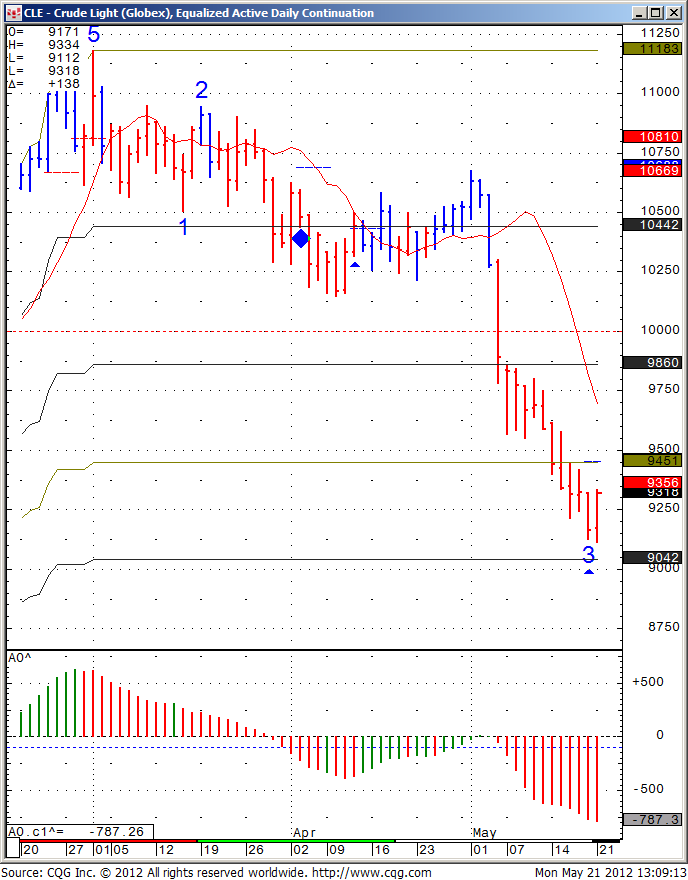

We started the week with nice bounce on stock indices, crude oil and gold continue to hold.

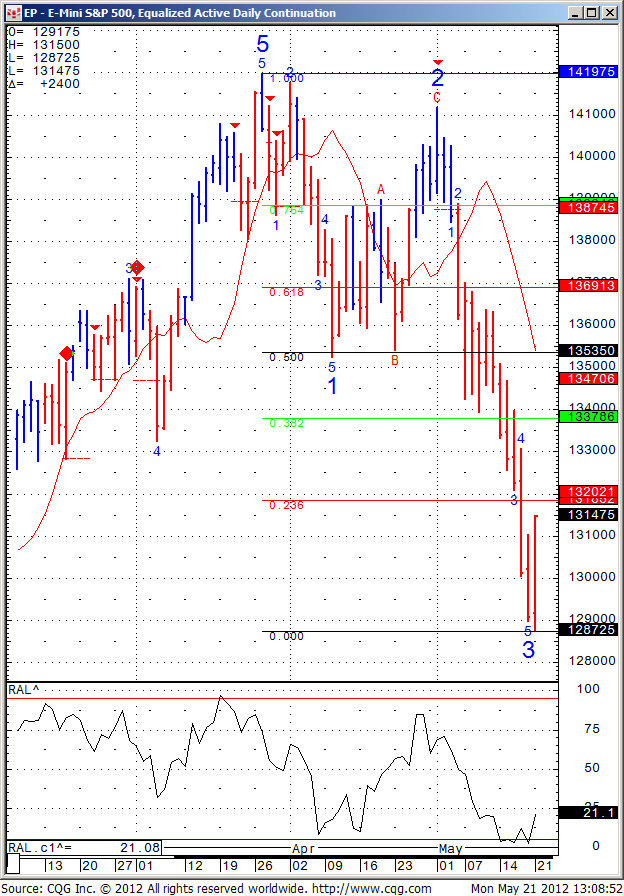

The big question: Is this a small correction/ bounce after the strong sell off last week or is this a short term bottom?

My opinion is that it is just a normal bounce after strong sell off and that there is more room on the downside but we will need to see the market reaction if we can climb up to 1320 and 1337 on the SP and 94.50 on the crude oil

Daily charts of both below for your review:

Mini SP daily Chart

Crude Oil Futures Daily chart

Continue reading “Crude Oil and Stock Index Futures: Small Bounce or Short-Term Bottom?”