Markets Pick Up Volatility | Support & Resistance Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Friday May 18, 2012

Hello Traders,

Markets have picked up some volatility. Indices, energies, metals, grains – are all experiencing some big moves and higher volatility.

Couple of tips I want to share:

1. Higher volatility requires SMALLER trading size, since the trading bands are now going to be wider.

2. It’s ok to “miss a trade” better than a bad trade, so don’t chase the market…

3. If you are daytrading, try the following: place your entry level very close to where you were originally going to place your stop order and place your stop order higher or lower than that. Yes you will “miss ” more than a few trades but this may help increase your chances of a good trades when you get in rather than get stopped out

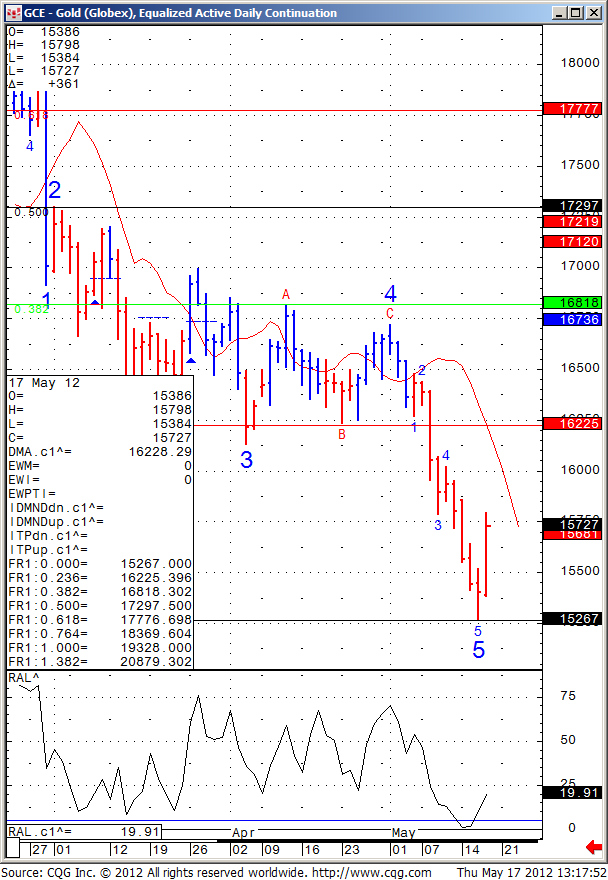

Below you will see two charts of the GOLD market. Weekly and daily. Gold has hit a strong support level and may be due for a nice bounce. I think if tomorrow we can have a strong weekly and daily close, than chances for a strong bounce are higher, on the other hand failure to finish the week with momentum may trigger another run at the lows and perhaps breaking these lows.

“Plan your trade, trade your plan!”

GOLD WEEKLY

GOLD DAILY

GOOD TRADING!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (June 2012) | SP500(big & Mini) | Nasdaq100(big & Mini) | Dow Jones(big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1339.83 | 2605.00 | 12695 | 791.53 | 82.27 |

| Resistance 2 | 1332.12 | 2585.00 | 12640 | 783.77 | 82.05 |

| Resistance 1 | 1316.93 | 2546.00 | 12530 | 768.13 | 81.84 |

| Pivot | 1309.22 | 2526.00 | 12475 | 760.37 | 81.62 |

| Support 1 | 1294.03 | 2487.00 | 12365 | 744.73 | 81.41 |

| Support 2 | 1286.32 | 2467.00 | 12310 | 736.97 | 81.19 |

| Support 3 | 1271.13 | 2428.00 | 12200 | 721.33 | 80.98 |

3. Support & Resistance Levels for Gold, Euro, Crude Oil, and U.S. T-Bonds

| Contract | June Gold | June Euro | June Crude Oil | June Bonds |

| Resistance 3 | 1630.6 | 1.2828 | 95.33 | 151 5/32 |

| Resistance 2 | 1605.2 | 1.2790 | 94.60 | 149 25/32 |

| Resistance 1 | 1589.2 | 1.2744 | 93.54 | 149 4/32 |

| Pivot | 1563.8 | 1.2706 | 92.81 | 147 24/32 |

| Support 1 | 1547.8 | 1.2660 | 91.75 | 147 3/32 |

| Support 2 | 1522.4 | 1.2622 | 91.02 | 145 23/32 |

| Support 3 | 1506.4 | 1.2576 | 89.96 | 145 2/32 |

4. Support & Resistance Levels for Corn, Wheat, Beans and Silver

| Contract | July Corn | July Wheat | July Beans | July Silver |

| Resistance 3 | 639.1 | 680.1 | 1467.33 | 2959.5 |

| Resistance 2 | 632.7 | 668.9 | 1458.67 | 2894.5 |

| Resistance 1 | 628.8 | 663.3 | 1448.33 | 2847.5 |

| Pivot | 622.4 | 652.2 | 1439.67 | 2782.5 |

| Support 1 | 618.6 | 646.6 | 1429.3 | 2735.5 |

| Support 2 | 612.2 | 635.4 | 1420.67 | 2670.5 |

| Support 3 | 608.3 | 629.8 | 1410.33 | 2623.5 |

5. Economic Reports

2:00am EUR

German PPI m/m

Day 1 ALL

G8 Meetings

Tentative USD

Treasury Currency Report

(Saturday) Day 2 ALL

G8 Meetings