Dear Traders,

Yesterday we hosted a very interesting webinar with Bookmap about order flow, buy and sell zones, liquidity of large orders and MUCH MORE.

On a personal level I really enjoyed the information as I am the type of guy who has been looking at indicators/ volume charts, range bar charts and probably many of the things that many of futures traders are used to. The data and information shared yesterday during live market hours with forward thinking analysis was very interesting to me and I will do more homework on the topic.

If you did not attend the webinar and would like to see a recording, CLICK HERE.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

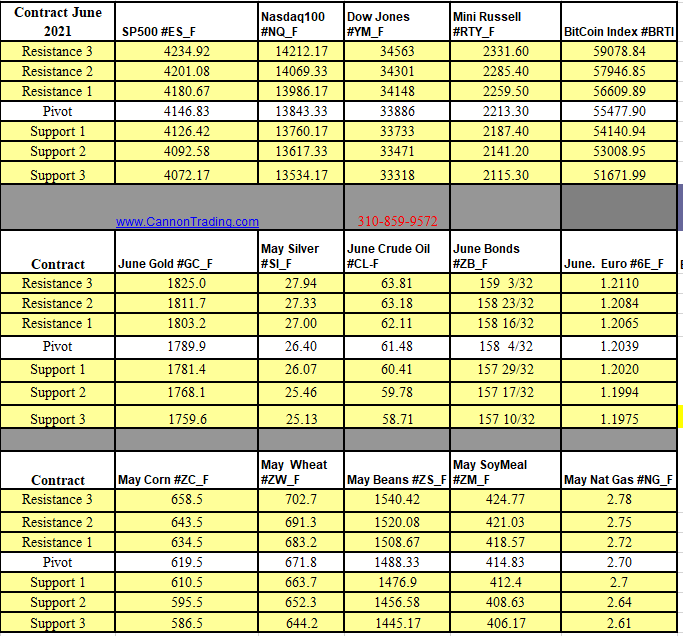

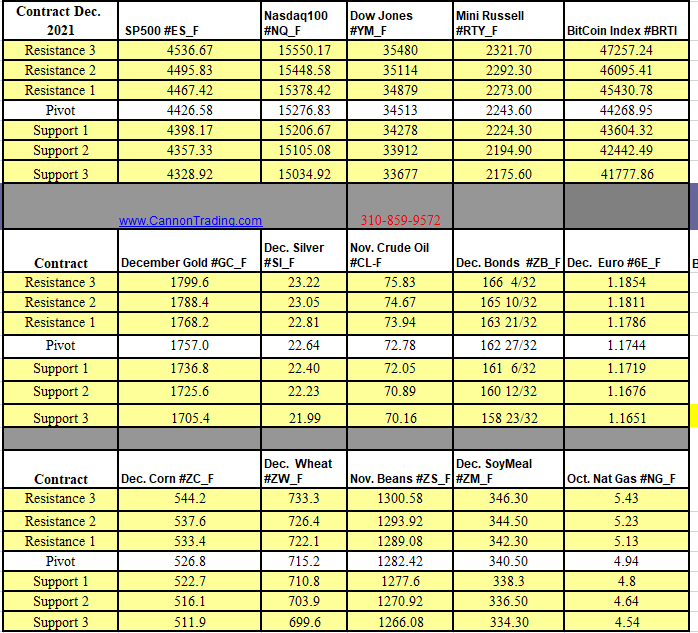

Futures Trading Levels

9-24-2021

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.