Crude Oil and Stock Index Futures: Small Bounce or Short-Term Bottom?

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Economic Reports for Tuesday May 22, 2012

Hello Traders,

We started the week with nice bounce on stock indices, crude oil and gold continue to hold.

The big question: Is this a small correction/ bounce after the strong sell off last week or is this a short term bottom?

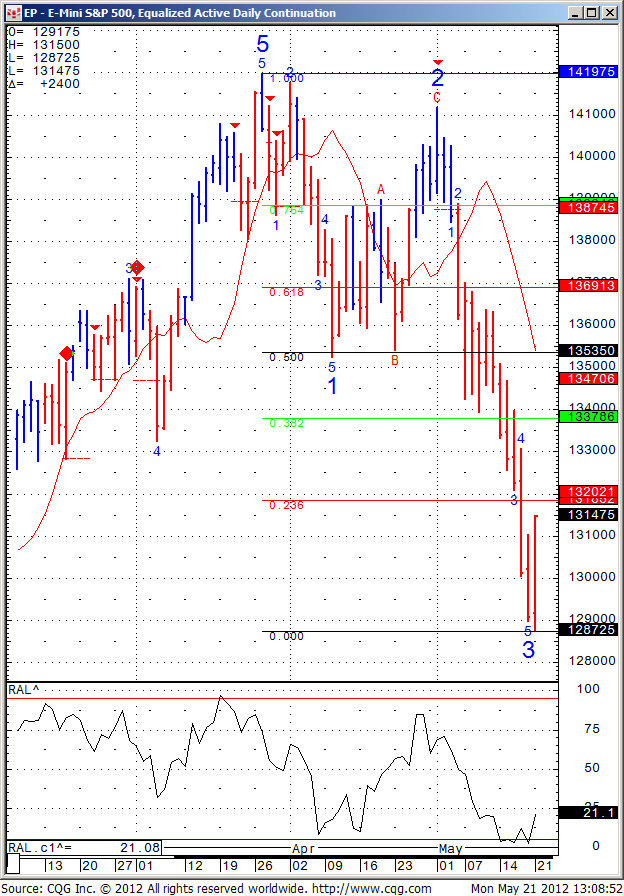

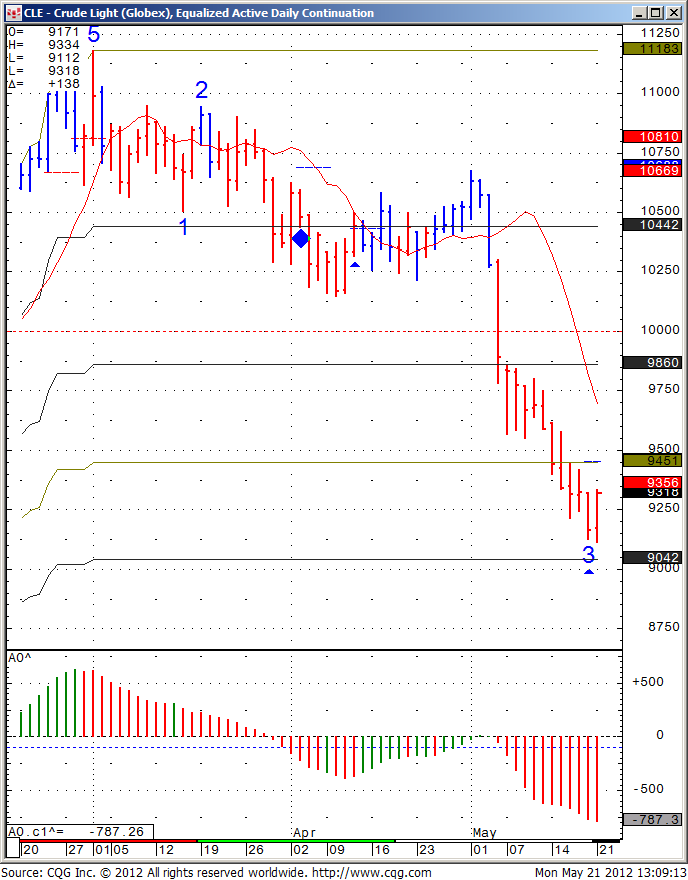

My opinion is that it is just a normal bounce after strong sell off and that there is more room on the downside but we will need to see the market reaction if we can climb up to 1320 and 1337 on the SP and 94.50 on the crude oil

Daily charts of both below for your review:

Mini SP daily Chart

Crude Oil Futures Daily chart

GOOD TRADING!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract June 2012 | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell | Dollar Index |

| Resistance 3 | 1342.33 | 2634.50 | 12640 | 790.93 | 81.95 |

| Resistance 2 | 1328.57 | 2590.00 | 12560 | 777.17 | 81.75 |

| Resistance 1 | 1321.53 | 2567.00 | 12520 | 769.83 | 81.41 |

| Pivot | 1307.77 | 2522.50 | 12440 | 756.07 | 81.22 |

| Support 1 | 1300.73 | 2499.50 | 12400 | 748.73 | 80.88 |

| Support 2 | 1286.97 | 2455.00 | 12320 | 734.97 | 80.68 |

| Support 3 | 1279.93 | 2432.00 | 12280 | 727.63 | 80.34 |

3. Support & Resistance Levels for Gold, Euro, Crude Oil, and U.S. T-Bonds

| Contract | June Gold | June Euro | July Crude Oil | June Bonds |

| Resistance 3 | 1613.9 | 1.2954 | 96.26 | 148 31/32 |

| Resistance 2 | 1606.5 | 1.2890 | 94.80 | 148 17/32 |

| Resistance 1 | 1599.4 | 1.2854 | 94.04 | 148 5/32 |

| Pivot | 1592.0 | 1.2790 | 92.58 | 147 23/32 |

| Support 1 | 1584.9 | 1.2754 | 91.82 | 147 11/32 |

| Support 2 | 1577.5 | 1.2690 | 90.36 | 146 29/32 |

| Support 3 | 1570.4 | 1.2654 | 89.60 | 146 17/32 |

4. Support & Resistance Levels for Corn, Wheat, Beans and Silver

| Contract | July Corn | July Wheat | July Beans | July Silver |

| Resistance 3 | 648.8 | 718.2 | 1430.67 | 2969.2 |

| Resistance 2 | 644.0 | 711.3 | 1425.83 | 2927.3 |

| Resistance 1 | 638.5 | 707.7 | 1419.17 | 2887.2 |

| Pivot | 633.8 | 700.8 | 1414.33 | 2845.3 |

| Support 1 | 628.3 | 697.2 | 1407.7 | 2805.2 |

| Support 2 | 623.5 | 690.3 | 1402.83 | 2763.3 |

| Support 3 | 618.0 | 686.7 | 1396.17 | 2723.2 |

| 5. Economic Reports, source: http://www.forexfactory.com/calendar.phpAll times are Eastern time Zone (EST) |

|

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!