|

|

|

|

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

|

|

|

|

|

|

|

|

Standard and Poor’s 500 futures, commonly known as S&P 500 futures or SP500 index futures, are among the most widely traded financial instruments in global markets. These contracts offer exposure to the performance of the S&P 500 index, a benchmark that represents the performance of 500 large-cap U.S. companies. Whether used by institutions for hedging or speculators for profit opportunities, S&P futures play a pivotal role in the financial ecosystem. This detailed exploration delves into the mechanics of the S&P 500 futures contract, its components, trading strategies, and its appeal to various market participants.

S&P 500 futures are derivatives contracts that derive their value from the S&P 500 index. These contracts allow traders and investors to speculate on or hedge against the future performance of the index. Each S&P 500 futures contract represents a fixed dollar amount multiplied by the current index level. For instance, the standard S&P 500 futures contract has a multiplier of $50, while the micro SP futures contract has a multiplier of $5, making it more accessible to individual investors.

The contracts are traded on regulated exchanges, primarily the Chicago Mercantile Exchange (CME), under the product name E-mini S&P 500 futures and Micro E-mini S&P 500 futures. These products are available for trading nearly 24 hours a day, five days a week, ensuring flexibility for participants across time zones.

Trading the S&P 500 futures index requires understanding the contract’s specifications and the market dynamics. Here are the steps and considerations for trading:

The participants in the S&P 500 futures market are diverse, each with unique motivations. They include institutional investors, individual traders, and high-frequency trading firms.

Institutional Investors: Hedging and Portfolio Management

Institutions such as mutual funds, pension funds, and insurance companies frequently use S&P 500 futures to hedge their equity exposure. Hedging involves taking an opposite position in futures to offset potential losses in a portfolio. For instance, if a portfolio manager expects market volatility or a downturn, they might sell S&P 500 futures contracts. This allows them to lock in the current value of their holdings, reducing the impact of adverse price movements.

Speculators: Profiting from Price Movements

Speculators, including retail traders and hedge funds, are drawn to S&P 500 futures for their liquidity, leverage, and potential profitability. Unlike institutional hedgers, speculators aim to profit from price fluctuations in the S&P futures market. They can go long (buy) if they anticipate a market rally or go short (sell) if they expect a decline. The high liquidity of the S&P 500 futures index ensures minimal slippage, even for large trades, making it an attractive choice for speculative strategies.

Arbitrageurs and Market Makers

Arbitrageurs exploit price discrepancies between S&P 500 futures and the underlying index or related financial products. For example, if the futures price deviates significantly from the index value, arbitrageurs may simultaneously buy the underpriced asset and sell the overpriced one, locking in risk-free profits. Market makers, on the other hand, provide liquidity by quoting buy and sell prices, ensuring smooth market functioning.

The S&P 500 futures contract is closely tied to the S&P 500 index, which is composed of 500 large-cap U.S. companies across various sectors. Key components include:

Institutions favor S&P 500 futures for hedging due to their efficiency, liquidity, and alignment with broad market benchmarks. Here’s why these contracts are essential tools for risk management:

Speculators gravitate toward the S&P futures market for its unique features that cater to active trading strategies:

The Standard and Poor’s 500 futures market is a cornerstone of modern financial markets, serving the diverse needs of institutional hedgers and retail speculators alike. By providing exposure to the broad U.S. equity market, the S&P 500 futures index plays a critical role in risk management, price discovery, and speculative trading.

Institutions rely on the futures SP market for efficient hedging and portfolio protection, while speculators are drawn to its liquidity, leverage, and profit potential. With a detailed understanding of contract specifications, trading strategies, and market dynamics, participants can harness the full potential of the S&P 500 futures contract, whether as Micro SP futures or standard-sized contracts.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

Futures brokers are instrumental in the dynamic landscape of futures trading. They bridge the gap between traders and futures markets by offering more than just execution services. A trusted futures broker provides educational resources, tools, and on-demand support, equipping both new and experienced traders with the knowledge needed to succeed.

Trading futures requires an understanding of the markets and the risks involved. By ensuring access to continuous education and robust support, brokers empower active traders to maximize their potential. In this article, we’ll dive deep into the value futures brokers bring, focusing on their educational initiatives, support systems, and the tools they offer to make trading seamless.

A futures broker facilitates the buying and selling of futures contracts, including commodities, micro e-minis, and financial futures. They offer a trading platform, insights, and strategies tailored to the needs of traders. These brokers are essential intermediaries between traders and exchanges.

Trade Execution: Ensuring trades are executed efficiently and accurately.

Market Analysis: Providing access to real-time data, charts, and market updates.

Risk Management Advice: Assisting traders in managing leverage and minimizing potential losses.

Futures markets, including e-minis and micro e-mini contracts, are fast-paced and ever-changing. Staying informed is critical, especially for active traders navigating price fluctuations. Education helps traders understand tools like data feeds and real-time charts, which are vital for making informed decisions.

Leverage in futures trading amplifies both profit potential and risk exposure. Brokers offer resources to educate traders on risk, helping them hedge effectively and assist in managing risk..

A well-developed strategy is key to trading futures successfully. By accessing broker-provided webinars, tutorials, and live trading sessions, traders learn to craft strategies aligned with market conditions.

Many brokers offer free webinars on topics like risk management, advanced features of desktop platforms, and trading e-minis. These are designed for beginners and professional futures traders alike, ensuring accessibility for all levels.

Reports include:

Commodity Trends: Updates on precious metals and other commodities.

Futures Markets Insights: Projections for micro contracts and standard contracts.

Economic Data Analysis: How global events impact futures prices.

These resources help traders stay ahead of market trends and make data-driven decisions.

Personalized mentoring services allow traders to interact directly with brokers. Mentorship focuses on:

Brokers provide on-demand support to address technical issues, answer questions, and guide traders through their trading journey. This ensures minimal downtime during critical trading sessions.

Futures trading platforms are integral for executing trades. Support includes:

Many brokers host forums and virtual meetups where active traders and speculators can share insights, strategies, and market updates.

Access to real-time data feeds and charts is essential for analyzing markets. These tools allow traders to spot opportunities in any market including micro contracts, e-minis, and precious metals.

Modern trading platforms feature mobile compatibility and advanced tools, enabling traders to manage accounts, execute trades, and monitor markets on the go.

Some brokers offer low margins and commissions, ensuring cost-effective trading. Always review NFA fees, monthly fees, and other costs before committing.

Broker Accreditation: Ensure your broker is licensed and regulated.

User Reviews: Read testimonials from other traders.

Trial Accounts: Use free demo accounts to evaluate the broker’s platform and services.

Review monthly fees, leverage options, and whether the broker offers free educational resources. Low commissions can significantly impact profitability over time.

One trader improved her trading by integrating broker-provided insights into their strategy. With access to personalized mentorship and real-time data, they transitioned from basic to advanced trading.

Educational resources, while often free, may involve fees for advanced features, live trading sessions, or premium data feeds. Evaluate these costs against your trading goals.

Not all brokers offer the same level of on-demand support or community engagement. Research to find brokers with proven track records.

While futures brokers provide essential tools and education, traders should maintain independence and develop their analytical skills.

Futures brokers are indispensable partners for futures traders, providing the education, tools, and support needed to succeed. By utilizing resources like webinars, market analysis, and low-commission platforms, traders can enhance their strategies and achieve better results.

Remember, the right futures broker plays a pivotal role in your trading journey. Take time to evaluate brokers based on their support quality, educational offerings, and trading platform features.

The best broker depends on your needs. Look for brokers with strong accreditation, low margins, and robust educational resources.

A futures broker facilitates trades, provides market insights, and offers educational and technical support to traders.

Yes, Cannon Trading allows you to trade futures using its platform.

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this chart are of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.

Commodity brokerage is a cornerstone of the global financial markets, connecting traders to opportunities in futures and options. Among the many players in this competitive industry, Cannon Trading Company has emerged as a trusted name, celebrated for its enduring commitment to excellence, innovation, and client success. Established in 1988, Cannon Trading’s journey reflects the evolution of the futures markets and exemplifies why it continues to stand out as a top-tier choice for traders.

Cannon Trading Company began its journey in Los Angeles in 1988, founded with the vision of empowering traders to access the dynamic world of futures and options markets. From its inception, the firm was committed to delivering exceptional customer service and personalized guidance—a philosophy that remains at the heart of its operations today. At a time when commodity brokers were largely confined to traditional office-based interactions, Cannon Trading sought to redefine the client experience by embracing accessibility and transparency.

The 1990s were a transformative decade for the financial industry, as the advent of the internet revolutionized how markets operated. Recognizing the potential of this technological leap, Cannon Trading became an early adopter of online trading. By developing and offering some of the industry’s first online trading platforms, the firm empowered futures traders to execute trades with speed and efficiency, breaking barriers that had previously limited market access.

This pioneering move positioned Cannon Trading as a forward-thinking commodity brokerage, setting it apart from competitors who were slower to adapt. For the first time, traders could manage their portfolios, analyze market data, and execute trades—all from the comfort of their homes. Cannon’s embrace of online trading not only enhanced its reputation as an innovative futures broker but also laid the groundwork for the modern futures trading landscape.

As the futures markets evolved, so did Cannon Trading. Over the decades, the firm has built a reputation as a trusted commodity broker, offering clients access to a wide range of markets, including agricultural commodities, energy products, metals, financial futures, and indices. This breadth of expertise has made Cannon Trading a one-stop solution for traders looking to diversify their portfolios and explore opportunities in multiple asset classes.

Cannon Trading’s team of professional futures brokers brings decades of combined experience to the table, helping clients navigate the complexities of futures trading. Whether a client is new to the markets or an experienced futures trader, Cannon’s brokers provide tailored advice, technical analysis, and risk management strategies to help them achieve their trading goals.

One of the hallmarks of a reliable commodity brokerage is its adherence to industry standards and regulations. Cannon Trading is a proud member of the National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). These affiliations underscore the company’s commitment to maintaining the highest levels of integrity, transparency, and compliance in its operations.

Cannon Trading has also earned a stellar reputation among its clients, reflected in its consistent 5 out of 5-star ratings on TrustPilot. This recognition speaks volumes about the firm’s dedication to client satisfaction and the quality of its services. In an industry where trust is paramount, Cannon Trading has built a legacy of reliability that few commodity brokers can match.

In today’s competitive trading environment, access to robust tools and technology is essential for success. Cannon Trading offers a suite of free trading platforms, catering to the diverse needs of its clients. Whether a trader prefers a user-friendly interface for basic order execution or advanced charting and algorithmic trading capabilities, Cannon’s platforms provide the functionality required to excel in futures trading.

Some of the popular platforms offered by Cannon Trading include:

These platforms are complemented by real-time market data, advanced charting tools, and educational resources, ensuring that Cannon’s clients have everything they need to succeed in trading futures.

Cannon Trading’s success is rooted in its unwavering commitment to its clients. Unlike many commodity brokers who prioritize transactional relationships, Cannon takes a consultative approach, focusing on building long-term partnerships. The firm’s brokers take the time to understand each client’s unique needs, trading style, and risk tolerance, tailoring their recommendations accordingly.

This personalized approach is particularly valuable for new futures traders, who often require guidance to navigate the complexities of the market. Cannon’s brokers provide educational resources, one-on-one consultations, and continuous support, empowering clients to make informed decisions and build their confidence in futures trading.

As the futures markets continue to evolve, Cannon Trading remains at the forefront of innovation. The firm has embraced advancements in algorithmic trading, artificial intelligence, and data analytics, ensuring that its clients have access to the latest tools and strategies. By staying ahead of industry trends, Cannon Trading continues to solidify its position as a leading commodity brokerage.

Cannon’s focus on education is another key factor in its success. The firm regularly publishes market analysis, trading tips, and educational content, helping its clients stay informed about market developments. This commitment to education reflects Cannon’s belief that an informed trader is a successful trader.

With over three decades of experience, Cannon Trading offers a unique combination of expertise, innovation, and client-focused service. Here are some of the key reasons why traders continue to choose Cannon as their futures broker:

Cannon Trading Company has come a long way since its humble beginnings in Los Angeles in 1988. From pioneering online trading in the 1990s to serving as a trusted futures broker in today’s fast-paced markets, Cannon Trading has consistently demonstrated its commitment to innovation, integrity, and client success. Its decades of experience, regulatory excellence, and top-tier client ratings make it an unparalleled choice for traders looking to navigate the exciting world of futures trading.

Whether you’re an experienced futures trader or just starting your journey in trading futures, Cannon Trading offers the expertise, tools, and support you need to achieve your goals. As a leading name in commodity brokerage, Cannon Trading Company stands as a shining example of what a modern commodity broker should be.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

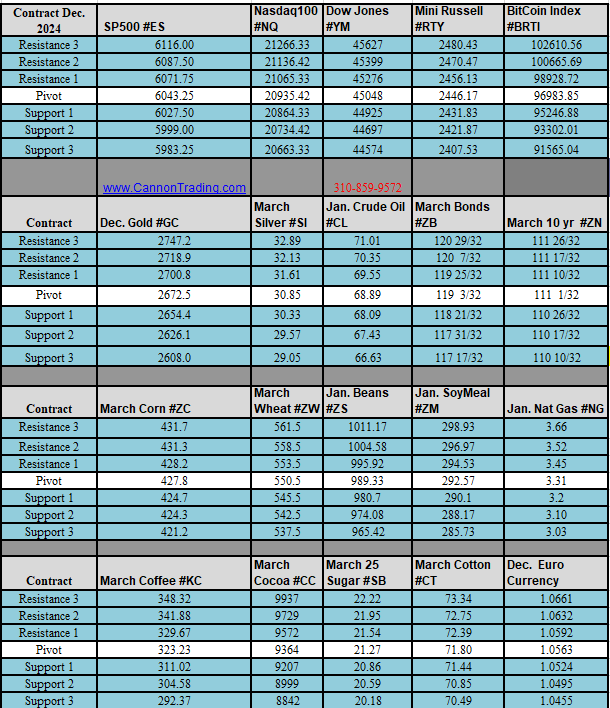

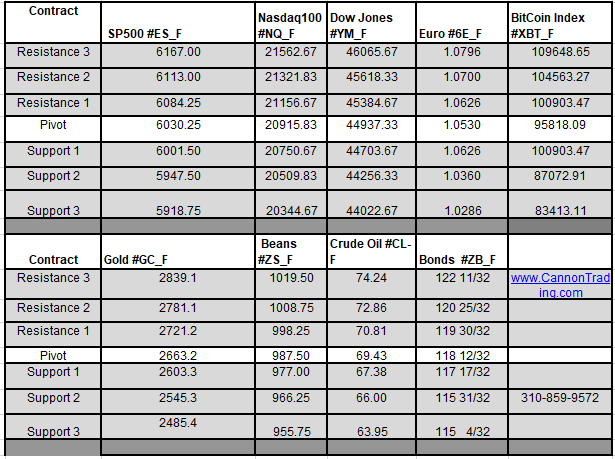

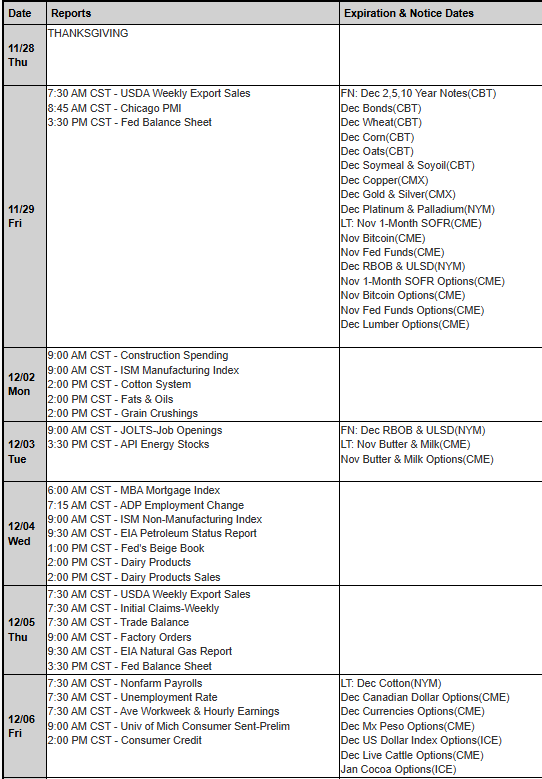

Daily Levels for December 2nd

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The NQ futures contract, also known as the Nasdaq-100 futures contract or the E-mini Nasdaq-100 futures contract, is a cornerstone of modern futures trading. Representing 100 of the largest non-financial companies listed on the Nasdaq stock exchange, this contract is highly favored for its liquidity, volatility, and utility in both speculative and hedging strategies. In this article, we delve into the origins, evolution, and impact of the NQ futures contract, exploring its top historical turning points, contract size evolution, hedging applications, and why Cannon Trading Company stands out as a premier choice among futures brokers.

At its inception, the Nasdaq-100 futures contract was designed with a larger notional value, making it suitable primarily for institutional investors. With the introduction of the E-mini Nasdaq-100 futures contract, the size was reduced to 20 times the index’s value, significantly increasing accessibility.

Today, traders can choose from multiple contract sizes:

This tiered structure ensures that traders of all scales—from retail investors to institutional hedgers—can find a product that aligns with their risk tolerance and trading objectives.

The NQ futures contract is not just for speculation—it’s a powerful hedging tool. For investors with significant exposure to Nasdaq-listed equities, trading the NQ futures contract or its options can mitigate potential losses during market downturns.

Example 1: Protecting a Technology-Heavy Portfolio

Imagine an investor with a $500,000 portfolio heavily concentrated in technology stocks like Apple, Microsoft, and Nvidia. If the investor anticipates a short-term decline in the tech sector, they can sell NQ futures contracts to offset potential losses. A single E-mini Nasdaq-100 futures contract moves in $20 increments for each point change in the index, offering precise risk management.

Example 2: Using Options on NQ Futures

Options on the Nasdaq-100 futures contract provide additional flexibility. For example:

Options on E-mini Nasdaq-100 futures contracts are particularly popular due to their smaller contract size and manageable margin requirements, making them an excellent tool for hedging Nasdaq exposure.

When trading Nasdaq-100 futures contracts, selecting the right futures broker is critical. Cannon Trading Company consistently earns accolades from traders for several compelling reasons:

The NQ futures contract has evolved from its origins as a tool for institutional hedging to a versatile instrument accessible to all levels of traders. From the introduction of the Nasdaq-100 index to the launch of Micro E-mini contracts, the product’s history is marked by innovation and adaptation to market needs. Today, the combination of diverse contract sizes, robust hedging applications, and user-friendly platforms makes the Nasdaq-100 futures contract a cornerstone of futures trading.

For those seeking a reliable futures broker to navigate this dynamic market, Cannon Trading Company stands out. With its free trading platform, 5-star TrustPilot ratings, experienced brokers, and commitment to regulatory excellence, Cannon Trading offers unparalleled support for traders of E-mini Nasdaq-100 futures contracts and beyond. Whether hedging a portfolio or exploring speculative opportunities, partnering with a trusted broker like Cannon Trading ensures a seamless and rewarding trading experience.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|