Get the latest Russian Ruble Currency futures prices, monthly Russian Ruble Currency futures trading charts, breaking Russian Ruble Currency futures news and Russian Ruble Currency futures contract specifications.

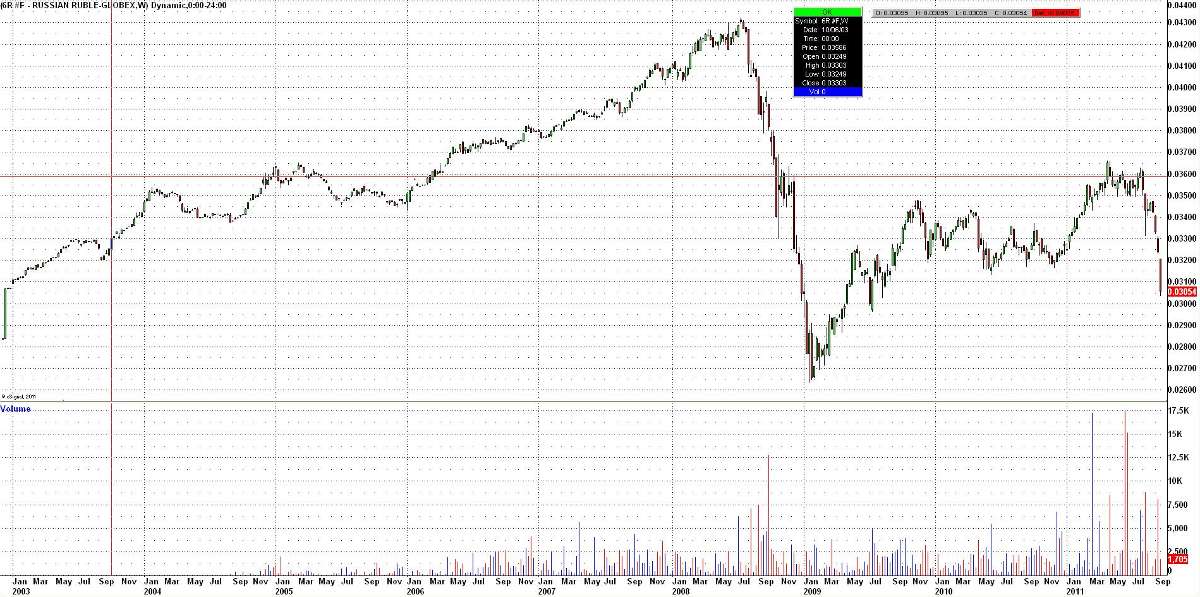

Chart of Russian Ruble Currency futures updated September 22, 2011. Click the chart to enlarge. Press ESC to close.

Disclaimer: This material is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

![]()

|

|

| Product Symbol | R6 |

|

|

| Contract Size | The unit of trading shall be 2,500,000 Russian rubles. |

|

|

| Venue | CME Globex, CME ClearPort |

|

|

| CME Globex Hours (EST) | Sundays: 5:00 p.m. – 4:00 p.m. Central Time (CT) next day. Monday – Friday: 5:00 p.m. – 4:00 p.m. CT the next day, except on Friday - closes at 4:00 p.m. and reopens Sunday at 5:00 p.m. CT. |

|

|

| CME ClearPort Hours (EST) | Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45–minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) |

|

|

| Minimum Fluctuation | Minimum price fluctuations shall be in multiples of $.00001 per Russian ruble (equivalent to $25.00) per contract. |

|

|

| Block Trade Eligibility & Minimum | Yes, 50 contracts minimum |

|

|

| Position Limits | A person shall not own or control more than 10,000 contracts net long or net short in all contract months combined except that in no event shall he own or control more than 2000 contracts in the lead month on or after the day one week prior to the termination of trading day. For positions involving options on the CME Russian ruble currency futures, this rule is superseded by the option speculative position limit rule. |

|

|

| Exemptions | The foregoing position limits shall not apply to bona fide hedge positions meeting the requirements of Regulation 1.3(z)(1) of the CFTC and the rules of the Exchange, and shall not apply to other positions exempted pursuant to Rule 559. |

|

|

| Termination of Trading | Futures trading shall terminate at 11:00 AM (Moscow Time) on the 15th calendar day of the contract month. If the foregoing date for termination is not a business day for the Moscow interbank foreign exchange market, futures trading shall terminate at the same time on the next business day for the Moscow interbank foreign exchange market. |

|

|

| Listed Contracts | Twelve consecutive (serial) contract months for the 1st year of maturity (includes 4 March, June, September and December quarterly contract months) plus 16 additional March quarterly months covering a total maturity range of 5 years (total of 20 March quarterly contract months plus 8 nearby non-March quarterly cycle serial contract months for a total of 28 contract months listed). |

|

|

| Settlement Type | Cash |

|

|

| Cash Settlement | Applicable for the June 2005 through March 2006 contract months. All Russian ruble futures contracts remaining open after the close of trading on the termination of trading day shall be liquidated by cash settlement at a price equal to the Final Settlement Price. The CME Russian ruble futures contract Final Settlement Price shall be equal to the reciprocal of the result of Chicago Mercantile Exchange Inc. ("CME") / EMTA, Inc. (previously the Emerging Markets Traders Association) ("EMTA") Russian Ruble per U.S. Dollar Reference Rate survey procedure as described in sections 1 and 2 below, rounded to six decimal places. 1. CME/EMTA Survey Procedure The Exchange shall determine the CME/EMTA Russian Ruble per U.S. Dollar Reference Rate by conducting two surveys of financial institutions inside the Russian Federation that are active participants in the Russian Ruble per U.S. Dollar spot and/or non-deliverable forward ("NDF") markets. For each survey, the Clearing House shall select at random 8 reference institutions from a list of no less than 12 institutions who are active participants in the market for spot and/or NDF Russian Rubles. During the regular SELT1 session for foreign exchange trading between commercial banks, two surveys at unannounced randomly selected times will be conducted. Each participant shall be requested to provide the bid and offer at which the participant could currently execute a transaction of at least US$100,000 for same-day value ("TOD") and for next-day value ("TOM") Russian Ruble per U.S. dollar spot transactions in the Moscow marketplace and the current bid and offer of the overnight Russian ruble money-market rate. Before a quote is officially accepted, it must be confirmed either by telex, facsimile, or other hard-copy confirmation, or by recorded telephone message. A participant's survey response will be deemed usable if either a TOD rate (bid and offer) is provided or a TOM rate (bid and offer) and an overnight Russian ruble money-market rate (bid and offer) is provided, or both. For each participant, the TOD rate will be used if provided, otherwise, the TOM rate will be adjusted to a synthetic TOD rate using an average bid and offer of the overnight Russian ruble money-market rate provided by all participants and the overnight Fed Funds Effective Rate from Telerate page 118 or Reuters page "FEDM" or a successor page. For each of the two surveys, the midpoint of each bid-offer pair shall be determined, and the two lowest and two highest such midpoints shall be eliminated. The Clearing House shall then compute the arithmetic mean of the remaining 4 midpoints for each survey and average the means of the two surveys to determine the CME/EMTA Reference Rate. In the event that the CME/EMTA survey procedures result in less than eight but at least five responses for either of the two surveys, the CME Clearing House shall select at random as appropriate five, six, or seven reference institutions from a list of no less than 12 institutions who are active participants in the market for spot and/or NDF Russian rubles. The midpoint of each bid-offer pair shall be determined, and the lowest and highest of such midpoints shall be eliminated. The Clearing House shall then compute the arithmetic mean of the remaining 3, 4, or 5 midpoints as appropriate. Any survey with at least 5 usable responses shall be deemed complete. If both surveys on the termination day are complete, the arithmetic average of the two shall be the CME/EMTA Russian ruble per U.S. Dollar Reference Rate. On the termination of trading day the reciprocal of this arithmetic mean of the Russian ruble per U.S. dollar spot exchange rate will then be calculated and rounded to the nearest $.000001 per Russian Ruble. This number shall become the Final Settlement Price for the termination of trading day. If for any reason there is difficulty in obtaining a quote within a reasonable time interval from one of the participants in the sample, that participant shall be dropped from the sample, and another shall be randomly selected to replace it. If only one survey is complete, the result of that survey shall be the CME/EMTA Russian Ruble per U.S. Dollar Reference Rate for that day. In that instance the Final Settlement Price shall be determined by the procedures in section 2. In the event the CME/EMTA survey procedures result in less than five responses for each of the two surveys, a substitute for the CME/EMTA Reference Rate may be published for information purposes only along with an explanatory note. 2. Futures Final Settlement Price When Both Surveys Cannot Be Completed For A Given Day In the event that two surveys cannot be completed, the Clearing House shall conduct the survey on the following business day. Provided two surveys can be completed on that day as described in section 1 above, the results shall be used to determine the Final Settlement Price as so described. In the event that two surveys cannot be completed on the following business day either, then the results from the most recent day when two complete surveys were conducted shall be used to determine the Final Settlement Price. In this instance, TOM rates will be used if provided to get the nearest value date to the termination of trading, or in the absence of TOM rates, TOD rates would be adjusted to synthetic TOM rates. 3. When No Survey Can Be Done However, in the event that the Exchange President determines that the Clearing House is not able to determine a Final Settlement Price pursuant to any of the preceding sections, then Rule 26003 shall apply to determine the Final Settlement Price. Applicable for the June 2006 and subsequently listed contracts All Russian ruble futures contracts remaining open after the close of trading on the termination of trading day shall be liquidated by cash settlement at a price equal to the Final Settlement Price. The CME Russian ruble futures contract Final Settlement Price shall be equal to the reciprocal of the result of Chicago Mercantile Exchange Inc. ("CME") / EMTA, Inc. (previously, the “Emerging Markets Traders Association”) Russian Ruble per U.S. Dollar Reference Rate survey procedure as described in sections 1, 2, 3 and 4 below, rounded to six decimal places. 1. CME/EMTA Survey Procedure CME shall determine the CME/EMTA Russian Ruble per U.S. Dollar Reference Rate by conducting a survey of financial institutions inside the Russian Federation that are active participants in the Russian Ruble per U.S. Dollar spot and/or non-deliverable forward ("NDF") markets. For such survey, CME shall poll no less than 15 such institutions at an unannounced, randomly selected time between 12:00 noon and 12:30 p.m. Moscow time.2 Each participant shall be requested to provide the bid and offer at which the participant could currently execute a transaction of at least US$100,000 for next-day value ("TOM") Russian Ruble per U.S. dollar spot transactions in the Moscow marketplace. Before a quote is officially accepted, it must be confirmed either by telex, facsimile, or other hard-copy confirmation, or by recorded telephone message or secure electronic confirmation. If ten or more responses are received to the survey, CME shall randomly select ten of such responses. CME shall calculate the midpoint of each bid-offer pair and shall eliminate the two lowest and two highest midpoints. CME shall then compute the arithmetic mean of the remaining 6 midpoints for the survey to determine the CME/EMTA Reference Rate. In the event that the CME/EMTA survey procedures result in less than ten but at least five responses for the survey, using all responses received, CME shall determine the midpoint of each bid-offer pair and the lowest and highest of such midpoints shall be eliminated. CME shall then compute the arithmetic mean of the remaining 7, 6, 5, 4 or 3 midpoints for the survey as appropriate to determine the CME/EMTA Reference Rate. A survey with at least 5 usable responses shall be deemed complete. If such survey on the termination day is complete, the arithmetic average of the survey results shall be the CME/EMTA Russian ruble per U.S. dollar Reference Rate. On the termination of trading day the reciprocal of the CME/EMTA Russian ruble per U.S. dollar Reference Rate (spot exchange rate) will then be calculated and rounded to the nearest $.000001 per Russian Ruble. This number shall become the Final Settlement Price for the Termination of Trading day. In the event the CME/EMTA survey procedures result in less than five responses for the survey, then such survey shall be deemed incomplete and no CME/EMTA Reference Rate shall be calculated and published for that day. A notice that no rate is available for that day shall be posted by CME by approximately 1:30 p.m. Moscow time. In order to contribute to transparency in the survey process, by not later than the next Polling Day from each survey, CME shall publish on the CME Web site as well as on the EMTA Web site the results of each day’s CME/EMTA Russian Ruble Reference Rate Survey, including the names of respondents to the survey and each respondent’s corresponding bid and offer quotes provided in each day’s survey. 2. Futures Final Settlement Price When the Survey Cannot Be Completed For A Given Day In the event that the survey cannot be completed on the CME Russian ruble futures contract Termination of Trading day, and therefore, CME cannot determine the CME/EMTA Russian Ruble Reference Rate used to calculate the Final Settlement Price, then final settlement of the CME Russian ruble futures contract may be deferred or postponed for up to (but not more than) 14 consecutive calendar days. This procedure is intended to correspond to the deferral or postponement procedure followed by the NDF market pursuant to recognized market practices as published by EMTA, Inc. Upon the publication of the CME/EMTA Reference Rate prior to the lapse of such 14-day period, CME shall determine the Final Settlement Price using the reciprocal of such Rate and the CME Russian ruble futures contract shall be settled on such day. If however, 14 consecutive calendar days pass without publication of the CME/EMTA Reference Rate, CME shall otherwise determine the Final Settlement Price. See section 3. 3. Deferring or Postponing Valuation and the EMTA RUB Indicative Survey Rate After the lapse of 14 consecutive calendar days without publication of the CME/EMTA Reference Rate, the Final Settlement Price may be calculated and published by CME on the next business day using the EMTA RUB Indicative Survey Rate, if available. The EMTA RUB Indicative Rate is a rate proposed to be published by EMTA, Inc. (or its designee) and posted on the public portion of EMTA’s website following the continuous unavailability of the CME/EMTA Reference Rate for 14 calendar days in order to provide the NDF market with a back-up rate source for valuation of certain outstanding non-deliverable foreign exchange transactions if the CME/EMTA Reference Rate cannot be published for an extended period of time. The procedures for the EMTA RUB Indicative Survey are defined in the Interpretation to this chapter. However, if EMTA fails to publish the EMTA RUB Indicative Rate following the lapse of the valuation postponement or deferral period described above, and the CME/EMTA Reference Rate is also not available, then Rule 26003 shall apply to determine the Final Settlement Price. See section 4. 4. When No Survey Can Be Done and the EMTA RUB Indicative Survey Does Not Provide a Rate However, in the event that the Exchange President determines that the Clearing House is not able to determine a Final Settlement Price pursuant to any of the preceding sections and the Interpretation to this chapter, then Rule 26003 shall apply to determine the Final Settlement Price.3 |

|

|

| Grade and Quality Specifications | Please see rulebook chapter 260. |

|

|

| Exchange Rule | These contracts are listed with, and subject to, the rules and regulations of CME. |

![]()