Crude Oil Market Insights and Predictions

The Strategic Importance of Crude Oil Futures

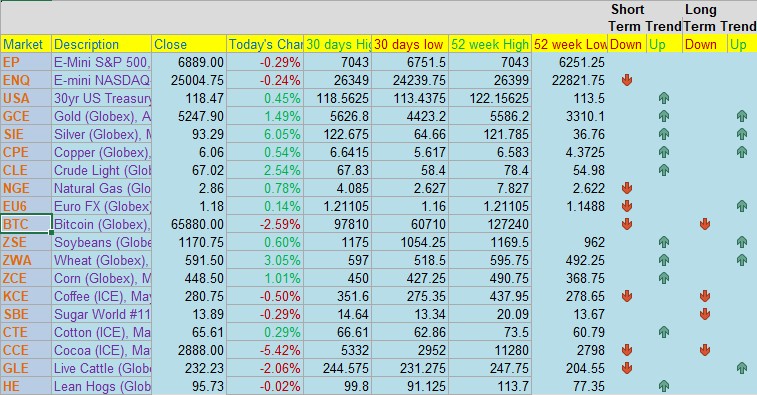

Crude oil remains one of the most actively traded commodities in global derivatives markets. Energy contracts shape economic expectations, influence inflation, and guide corporate hedging strategies. For traders seeking opportunity in volatile markets, crude oil futures provide liquidity, leverage, and clear price discovery.

Geopolitical instability significantly amplifies oil market volatility. Recent tensions involving the United States and Iran have reintroduced risk premiums into global crude supply chains. Events affecting the Strait of Hormuz, where nearly one-fifth of global oil passes daily, immediately influence futures pricing.

In these environments, experienced futures brokers help traders interpret market signals and execute trades efficiently. Understanding supply disruptions, shipping risks, and OPEC responses allows traders to act strategically rather than emotionally.

Professional commodities brokers also assist clients in identifying hedging opportunities during geopolitical crises. Energy producers, airlines, and hedge funds frequently turn to crude futures to offset risk when Middle East tensions escalate.

Modern commodity trading platforms enable real-time monitoring of energy contracts, allowing traders to react quickly to breaking geopolitical developments. Platforms integrated with market data, depth-of-market analytics, and algorithmic execution tools help traders maintain an advantage.

For decades, Cannon Trading Company has supported traders navigating complex markets like crude oil futures.

How U.S.–Iran Tensions Influence Oil Market Dynamics

The conflict between the United States and Iran historically drives immediate reactions in crude oil futures markets. Political statements, military movements, and sanctions policies can trigger rapid price spikes.

Energy traders track these developments because Iran controls strategic access to the Persian Gulf. Any disruption to oil shipping routes can tighten global supply expectations.

Key geopolitical triggers include:

- Sanctions and Export Restrictions

U.S. sanctions on Iranian oil exports reduce global supply expectations. Futures prices often rise as markets anticipate tighter inventories. - Military Activity Near the Strait of Hormuz

Naval deployments or threats to shipping lanes create immediate volatility in crude contracts. - OPEC Policy Adjustments

Other oil producers may increase output to offset potential shortages, moderating price spikes.

Experienced futures brokers analyze these factors daily. Their role includes helping traders interpret news events and translate them into actionable trading strategies.

Professional commodities brokers also provide insights into global inventory reports and refinery demand trends. This perspective allows traders to differentiate between temporary price reactions and long-term structural changes.

Many traders rely on advanced commodity trading platforms to track crude oil contracts listed on CME Group exchanges. These systems allow rapid execution when geopolitical headlines break.

Crude Oil Futures Mechanics and Trading Strategy

Crude oil futures contracts allow traders to speculate on or hedge against changes in oil prices. Contracts typically represent 1,000 barrels of crude and trade electronically through regulated exchanges.

Understanding contract mechanics is essential before entering the market.

Common crude oil trading strategies include:

- Directional Trading

Traders take long or short positions based on geopolitical expectations. - Calendar Spreads

This involves trading price differences between different delivery months. - Inventory Reaction Trades

U.S. Energy Information Administration reports frequently trigger short-term volatility. - Options Hedging

Combining futures with options can help limit downside exposure.

Working with experienced futures brokers ensures traders understand margin requirements, contract specifications, and risk exposure.

Similarly, knowledgeable commodities brokers guide clients through advanced strategies such as spread trading or volatility hedging.

Reliable commodity trading platforms provide tools such as order-flow analytics, time-and-sales tracking, and DOM trading. These features allow traders to detect institutional activity and liquidity levels in real time.

Cannon Trading Company provides access to several leading trading technologies designed specifically for futures traders.

How a Futures Broker Supports Crude Oil Traders During Geopolitical Crises

Geopolitical conflicts introduce extreme volatility into oil markets. Sudden news releases can cause price swings of several dollars per barrel within minutes.

In these conditions, the expertise of professional futures brokers becomes invaluable.

A broker assists traders in several ways:

- Market Interpretation

Brokers translate geopolitical developments into potential market scenarios. - Execution Support

Rapid order routing ensures trades are filled efficiently during volatile market conditions. - Risk Management Guidance

Brokers help traders determine position sizing and margin considerations. - Strategy Development

Traders receive insights into spread opportunities and volatility trades.

Skilled commodities brokers also maintain relationships with institutional research providers. This enables them to provide clients with deeper insight into energy supply forecasts and macroeconomic influences.

Additionally, modern commodity trading platforms enable traders to automate strategies that react to market volatility. Algorithmic tools can adjust stop levels, manage risk thresholds, and capture price momentum.

Cannon Trading Company’s brokerage services combine technology, human expertise, and decades of market experience.

The Role of Technology in Modern Oil Trading

Technology has transformed how traders interact with energy markets.

Today’s commodity trading platforms integrate advanced analytics, real-time news feeds, and customizable charting tools. These features allow traders to respond instantly to geopolitical developments.

Key technological advantages include:

- Depth-of-Market Visualization

Shows real-time liquidity across price levels. - Algorithmic Trading Tools

Allows automated strategy execution. - Risk Management Dashboards

Displays margin usage and exposure in real time. - Multi-Asset Integration

Energy contracts can be analyzed alongside currencies, equities, and bonds.

Professional futures brokers help traders select the most suitable platform for their trading style. Some traders prefer DOM-based scalping interfaces, while others rely on advanced charting environments.

Experienced commodities brokers also assist clients in configuring data feeds and optimizing order routing.

Cannon Trading Company provides access to several industry-leading technologies through its brokerage infrastructure.

These advanced commodity trading platforms help traders maintain speed and precision in volatile oil markets.

Risk Management Strategies for Crude Oil Traders

Crude oil trading carries significant opportunity but also considerable risk.

Geopolitical developments can cause rapid price movements that exceed typical volatility ranges.

Traders should implement disciplined risk management strategies such as:

- Stop-Loss Orders

Automatic exits limit downside exposure. - Position Sizing

Traders should limit risk per trade relative to account size. - Diversification

Combining energy contracts with other commodities reduces concentration risk. - Spread Strategies

Calendar spreads often carry lower volatility than outright positions.

Experienced futures brokers play a crucial role in guiding traders through these risk management techniques.

Professional commodities brokers also help clients interpret inventory reports, seasonal demand patterns, and refinery utilization rates.

Advanced commodity trading platforms support these strategies by allowing automated risk controls and conditional orders.

By combining broker expertise with sophisticated technology, traders can navigate oil market volatility more effectively.

Why Cannon Trading Company Is a Leading Choice for Futures Traders

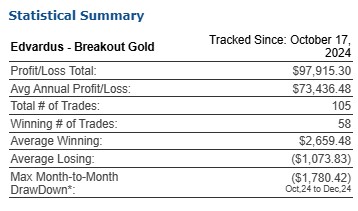

Cannon Trading Company has served futures traders for decades. Its reputation stems from transparent service, technological access, and personalized brokerage support.

The company has built strong relationships with both institutional and independent traders.

Reasons traders choose Cannon Trading include:

- Experienced Brokerage Team

Knowledgeable futures brokers provide personalized guidance. - Access to Global Markets

Traders can access major energy, metals, and agricultural futures. - Advanced Technology

Multiple professional commodity trading platforms are available. - Responsive Customer Support

Traders receive direct assistance from experienced professionals. - Trusted Reputation

Client reviews on Trustpilot reflect strong service quality.

Cannon’s team of commodities brokers understands the unique challenges of energy trading. Their expertise helps traders navigate volatile conditions caused by geopolitical developments.

This combination of experience, technology, and service has positioned Cannon Trading Company among the most respected brokerage firms in the futures industry.

Crude Oil Market Outlook and Predictions

Looking ahead, crude oil markets are likely to remain influenced by geopolitical developments.

Several factors will shape oil prices in the coming months.

- Middle East Security Risks

Continued tensions involving Iran may maintain a geopolitical risk premium. - Global Economic Growth

Demand from major economies influences long-term price trends. - OPEC Production Decisions

Output adjustments can stabilize or amplify price movements. - Energy Transition Policies

Long-term shifts toward renewable energy could influence future demand expectations.

Traders who remain informed and disciplined will be best positioned to navigate these changes.

Working with experienced futures brokers helps traders stay ahead of market developments.

Professional commodities brokers provide valuable insights into supply disruptions, production forecasts, and inventory changes.

Reliable commodity trading platforms ensure traders can react instantly to breaking news events.

Cannon Trading Company continues to support traders seeking opportunities in the global energy markets.

FAQ: Crude Oil Futures Trading

What are crude oil futures?

Crude oil futures are standardized contracts that allow traders to buy or sell oil at a predetermined price for future delivery. They are widely used for speculation and hedging in energy markets.

Why do geopolitical tensions affect oil prices?

Oil supply chains depend heavily on politically sensitive regions. Events affecting production or transportation routes can reduce supply expectations, driving prices higher.

How can futures brokers help oil traders?

Professional brokers assist traders with market analysis, order execution, and risk management strategies during volatile market conditions.

What role do commodities brokers play?

They provide specialized expertise in physical supply trends, inventory data, and seasonal demand patterns that influence commodity pricing.

Why are commodity trading platforms important?

Modern trading platforms provide real-time market data, charting tools, and automated order execution that allow traders to react quickly to price movements.

Why choose Cannon Trading Company?

Cannon Trading Company offers decades of experience, advanced trading technology, personalized brokerage support, and access to global futures markets.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading