“The Futures Market is possibly over bought”

Monthly unemployment numbers tomorrow before the cash open will provide the futures market with some direction and may get us out of this ‘summer low volume’ type of trading.

Plan your trade, trade your plan. Stay focused and ONLY try to day-trade when you are focused. Remember to stay disciplined and know that no one trade or trading day will determine your trading fate. Even when day-trading (which is a short term action), the end results is of long term progress effort and the sum of many trades.

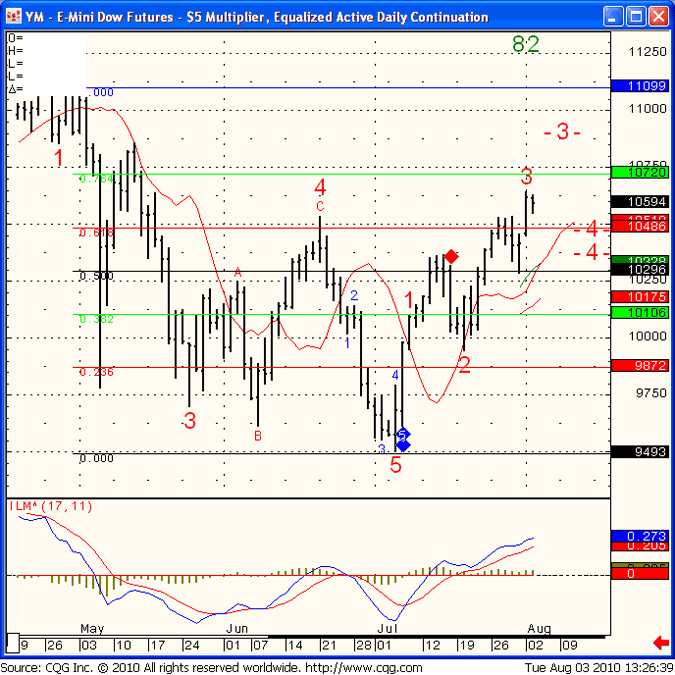

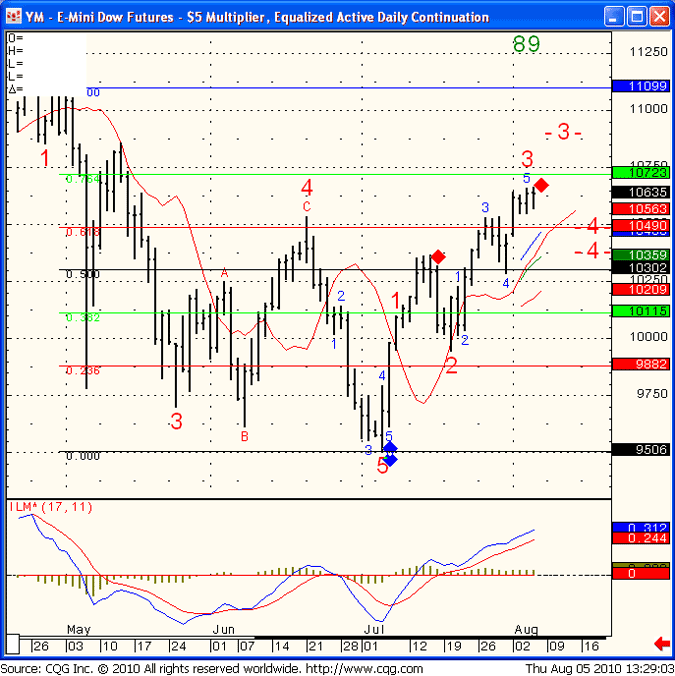

On a different note, below is a daily chart of the Mini Dow Jones. I got a red diamond ahead of tomorrows session. For me, that means that ‘the futures market is possibly over bought ‘. The way I like to play this set up is that if we break below 10550, we have a chance for a stronger move down. On the other hand, if we can keep above it, we may see 10720 soon.

YM – E-Mini Dow Futures – $5 Multiplier, Equalized Active Daily Continuation