Mini Dow Jones Futures Contract and Resistance Levels August 4th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

“The Current Uptrend is Strong”

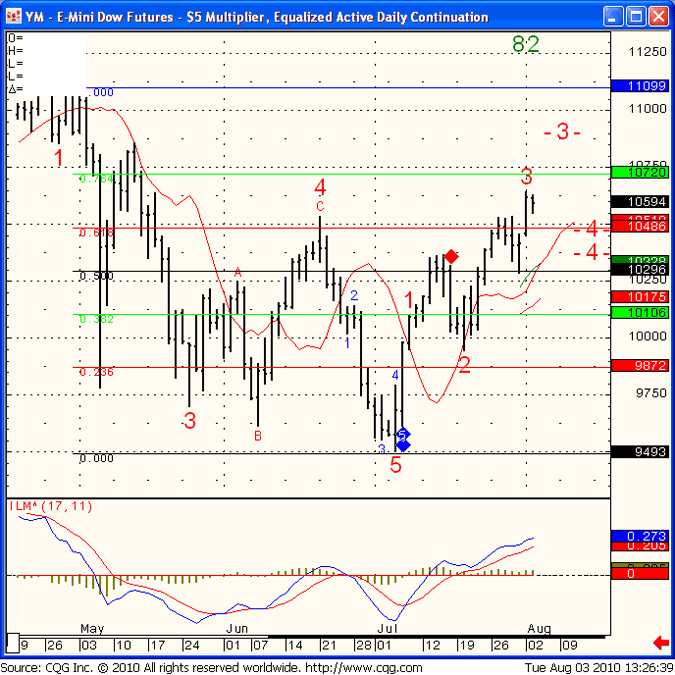

Daily chart of Mini Dow Jones futures contract for your review below with possible Elliot Wave scenarios. The 82 reading suggest the current uptrend is strong. If the 3rd wave we are in will continue than next target will be 10723. If the market pulls back first to possible 4th wave, support is at 10490. Of course, when its all said and done what matters most is price action and not what we want or hope the market will do.

YM – E-Mini Dow Futures – $5 Multiplier, Equalized Active Daily Continuation

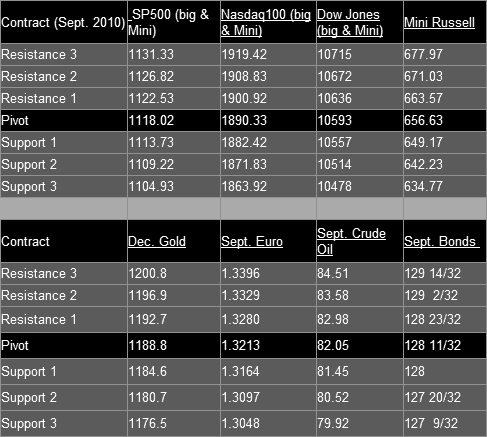

Futures & Commodity Trading Levels (Potential Support/Resistance):

Futures & Commodity Trading Levels (Potential Support/Resistance):

This Week’s Calendar from Econoday.Com

All reports are EST time

Friday August 6th – http://mam.econoday.com/byweek.asp?cust=mam

- Employment Situation – 8:30 AM ET

- Consumer Credit – 3:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!