Futures Market & Commodity Trading Daily Levels August 6th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

“The Futures Market is possibly over bought”

Monthly unemployment numbers tomorrow before the cash open will provide the futures market with some direction and may get us out of this ‘summer low volume’ type of trading.

Plan your trade, trade your plan. Stay focused and ONLY try to day-trade when you are focused. Remember to stay disciplined and know that no one trade or trading day will determine your trading fate. Even when day-trading (which is a short term action), the end results is of long term progress effort and the sum of many trades.

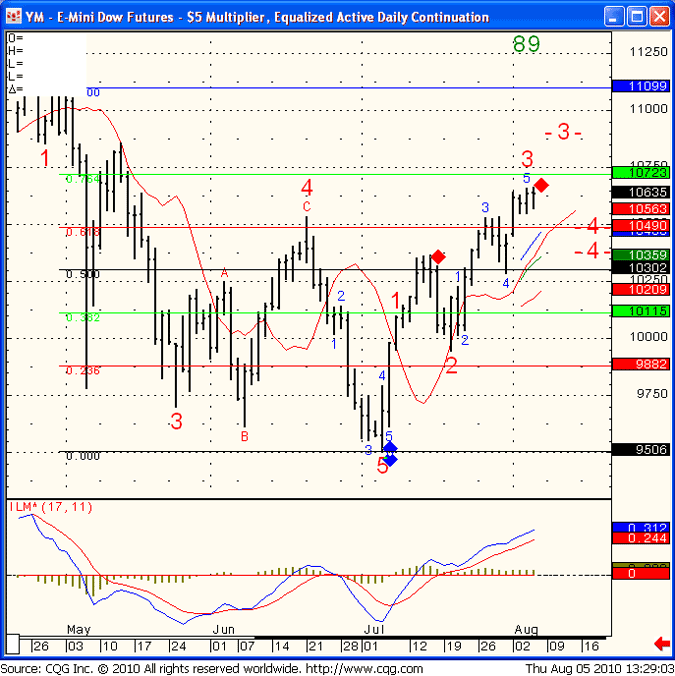

On a different note, below is a daily chart of the Mini Dow Jones. I got a red diamond ahead of tomorrows session. For me, that means that ‘the futures market is possibly over bought ‘. The way I like to play this set up is that if we break below 10550, we have a chance for a stronger move down. On the other hand, if we can keep above it, we may see 10720 soon.

YM – E-Mini Dow Futures – $5 Multiplier, Equalized Active Daily Continuation

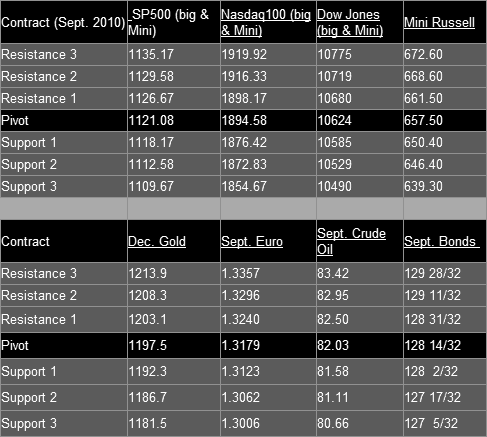

Futures & Commodity Trading Levels (Potential Support/Resistance):

Futures & Commodity Trading Levels (Potential Support/Resistance)

This Week’s Calendar from Econoday.Com

All reports are EST time

Friday August 6th – http://mam.econoday.com/byweek.asp?cust=mam

- Employment Situation – 8:30 AM ET

- Consumer Credit – 3:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!