Cannon Futures Weekly Letter Issue # 1078

Dear Traders,

Trading 201: Trading During Rollover

- Currencies are DELIVERABLE and you must be out and trading March as of today, Friday Dec. 10th

- Stock index futures are cash settled on Friday Dec. 17th at 9:30 AM Eastern Time.

- During the rollover period, especially with stock index futures, I noticed that the first few days will have two sided, volatile action. Think about it, you have large traders and institutions who are NOT day traders and carry large positions as speculation or a hedge and now they need to rollover from Dec. to March.

- In my opinion, counter trend methods, mean reversion techniques can work better during rollover period but one must be very aware as past performance is not indicative of futures results.

- Keep in mind, back in the days, many floor traders would “trade the spread” specifically with different techniques. I believe some traders still do using the screen.

- Bottom line is know that this is rollover period, do research on past rollover periods, start trading the March contract and good trading and happy holidays!

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

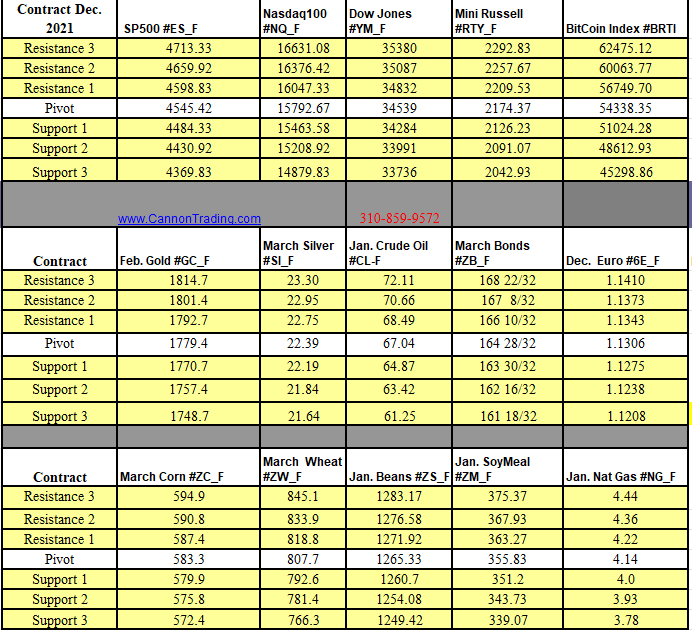

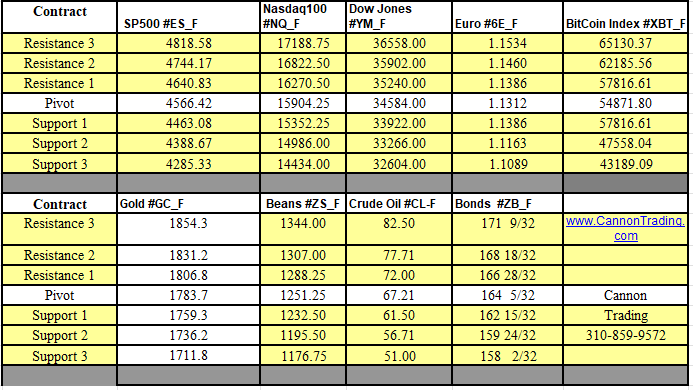

Futures Trading Levels

12.13.2021

Weekly Levels

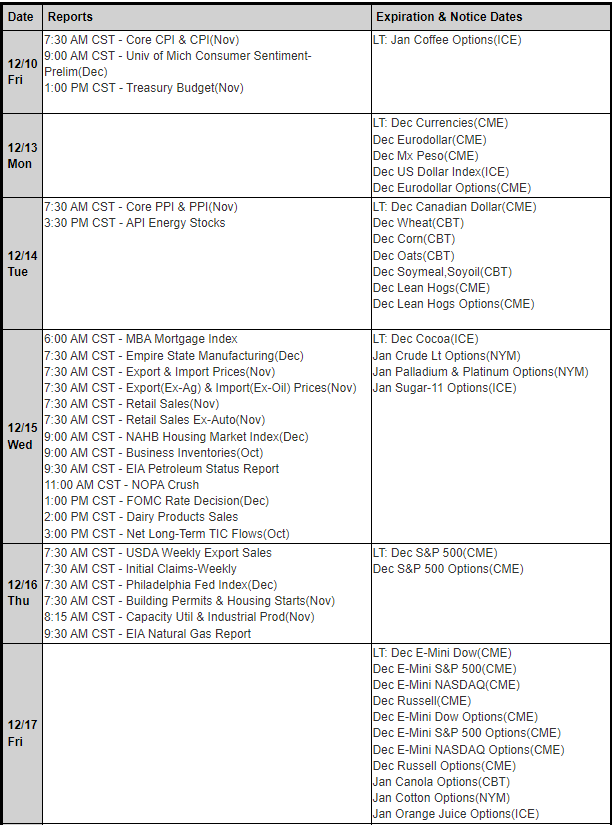

Reports, First Notice (FN), Last trading (LT) Days for the Week:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading