Get Real Time updates and more on our private FB group!

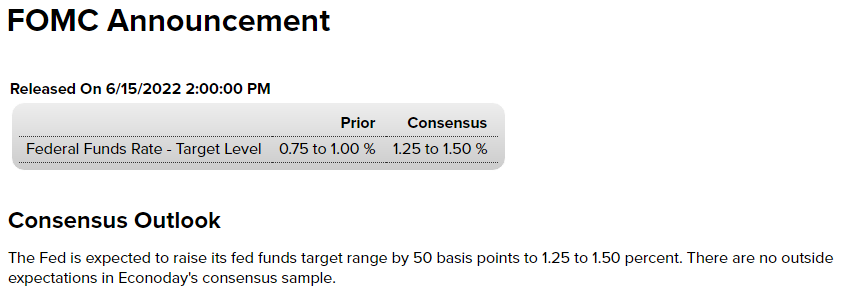

We heard FOMC decision and commentary LIVE while it was taking place!

Major news and much more are offered by TradeTheNews.com and

Cannon offers a free trial for this premium service utilized by trading professionals across the globe!

FREE TRIAL: TradeTheNews.com News and Out-Cry

SQUAWK BOX Channels, The equivalent of a financial police radio, TradeTheNews.com covers economic numbers, interest rate decisions, stock up/down grades, rumors, central banker speak, energy news, terrorism, geopolitical developments and natural disasters in real-time.

08:38 *(US) FED CHAIR POWELL: DOES NOT EXPECT 75BPS HIKES TO BE COMMON; EITHER 50BPS or 75BPS RAISE SEEMS MOST LIKELY AT NEXT MEETING – POST RATE DECISION COMMENTS – Next meeting could well be decision between 50bps and 75bps; Would take us to a more normal range and then we’d have optionality on speed of rates moving forward – SEP shows we want to see policy at modestly restrictive level at end of this year; That’s generally a range of 3-3.5% – Fed will try not to add uncertainty – Further surprises in inflation could be in store; Will need to be nimble – In current circumstances we think it’s helpful to provide more clarity than usual on policy; Markets show they understand the path we lay out – When I offered guidance of 50 bps hike at last meeting, I said that if data came in worse than expected, we would consider more aggressive move; CPI and inflation expectations data last week made us realize 75bps was way to go – Did not want to wait another six weeks for larger move; We thought strong action was needed at this meeting – We would like to see a series of declining inflation readings; Looking for ‘compelling evidence’ of inflation abating – We had expected to see inflation flattening out by now – Demand is still very hot; We would like to see demand moderating – We’d like to see labor market in better balance between supply and demand; Feels there is a role for Fed in moderating labor demand – Fed will not be completely model driven in our approach – Neutral rate is ‘pretty low’ these days; We will find out neutral rate empirically – Data shows inflation expectations are still in place where short-term inflation high but comes down sharply over the medium term; Last week’s Univ of Michigan inflation reading was ‘quite eye-catching’ – This was a very unusual situation where we got new inflation data that affected the outcome of the decision late, during the blackout period – What we want to see is a series of declining monthly inflation readings; We will not declare victory until we see compelling data that inflation is coming down – Clearly our goals are getting inflation to 2% while keeping the labor market strong; The pathways to achieving this have become more challenging due to factors outside of our control (like the Ukraine war) – Expectations are at risk due to high headline inflation – Consumer spending overall remains strong; No signs of a broader slowdown in the economy; People are talking about a slowdown a lot due to higher gas prices and lower stock prices, but not seeing signs of broader slowdown – On rates there is always the risk of going too far or not far enough; Worst mistake we could make would be to fail on inflation and restoring price stability, that is the bedrock of the economy – We don’t think we are seeing a wage/price spiral – I think the projections in the SEP would meet the test of a ‘softish’ landing; I do think it is possible, but the events of the last few months have created a greater degree of difficulty – We will have the Fed funds rate somewhere in the 2%’s by the end of the summer; We will also have more data by then – This is a highly uncertain environment; We will be determined but flexible – Have no reason to think that QT will lead to liquidity issues in the market- Carefully watching how much policy will affect housing market and residential investments – Source

TradeTheNews.com

June stock index futures will settle into cash on Friday morning right around the open.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

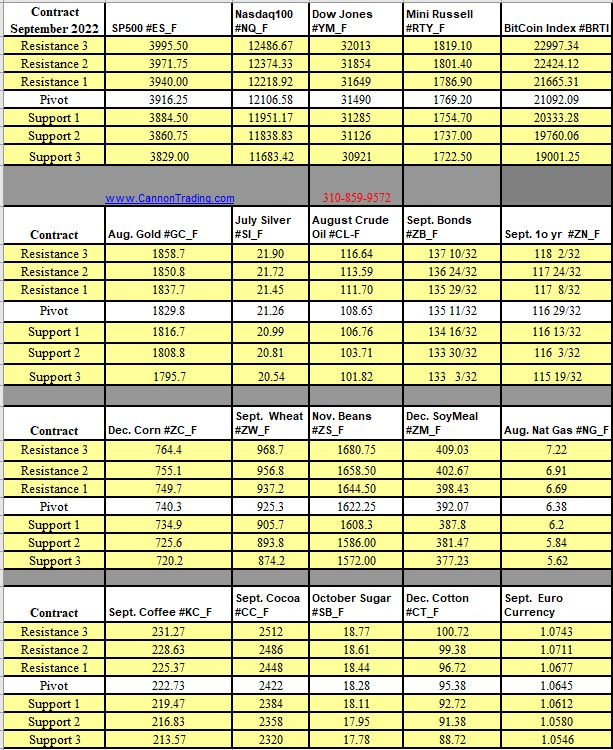

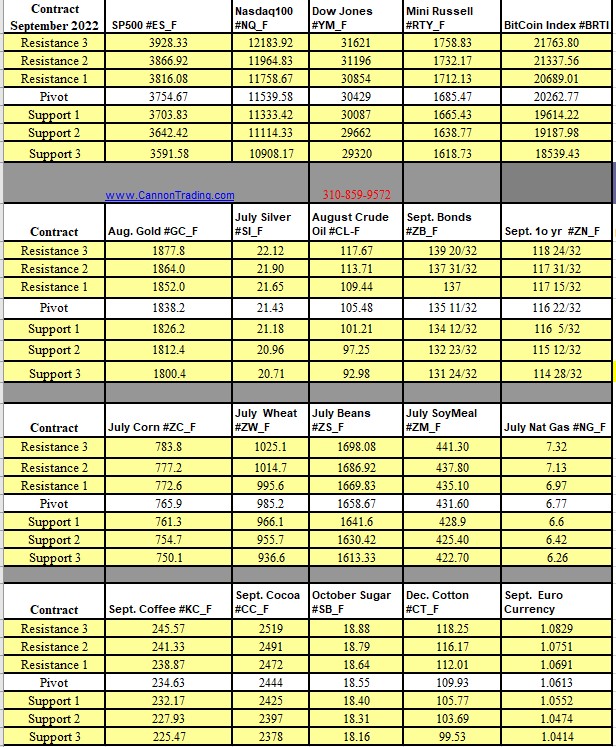

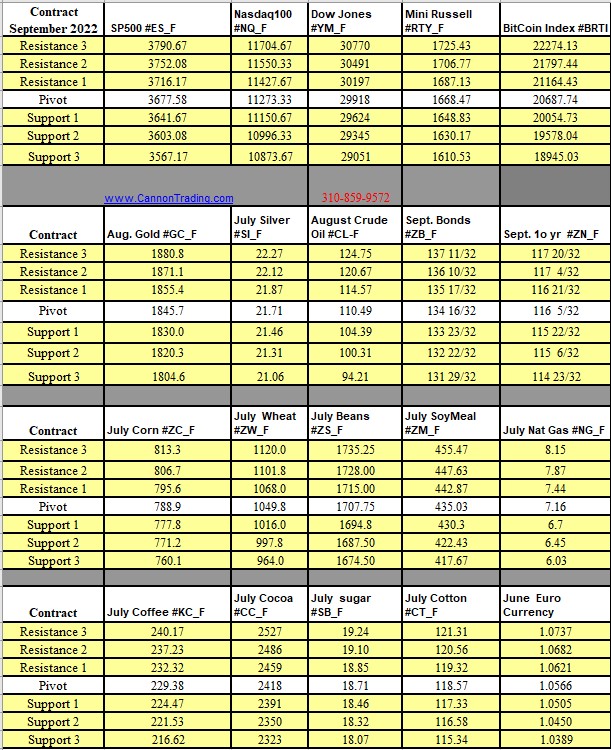

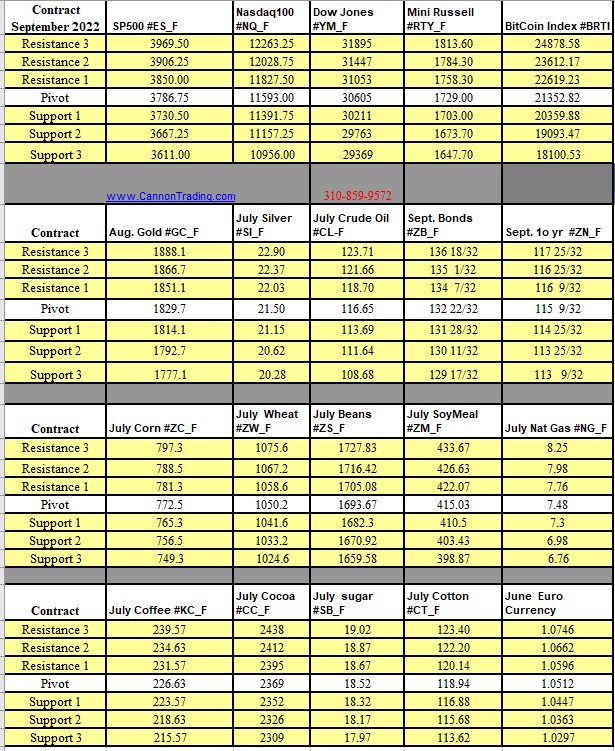

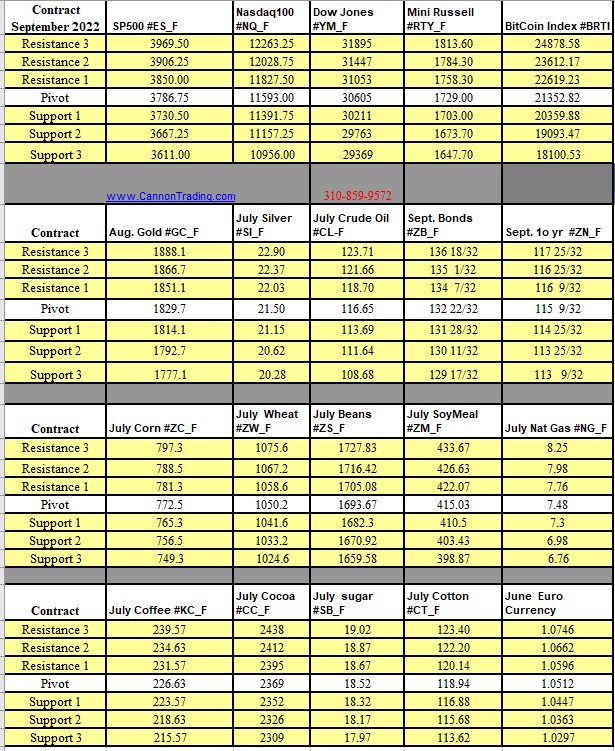

Futures Trading Levels

06-16-2022

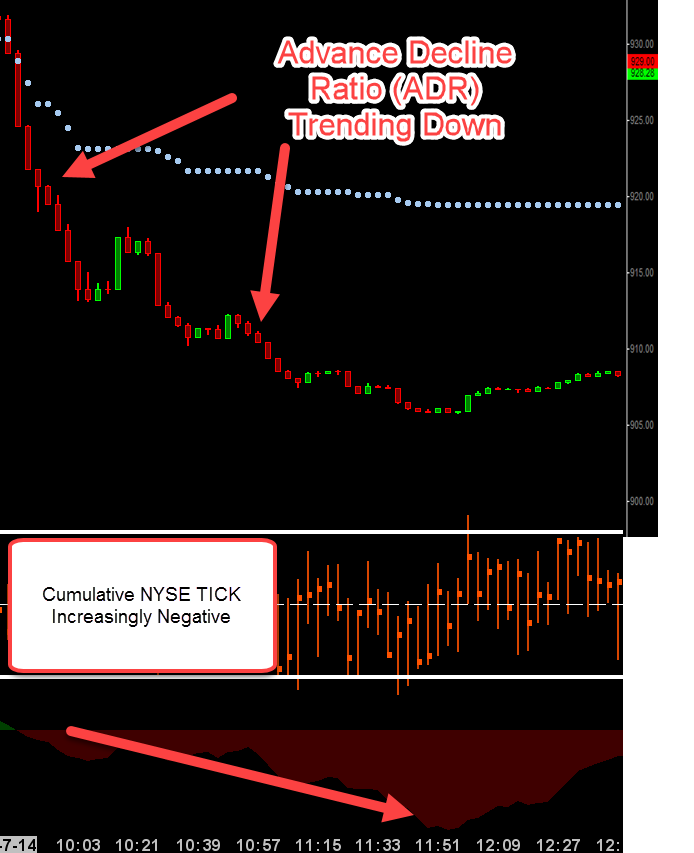

Improve Your Trading Skills

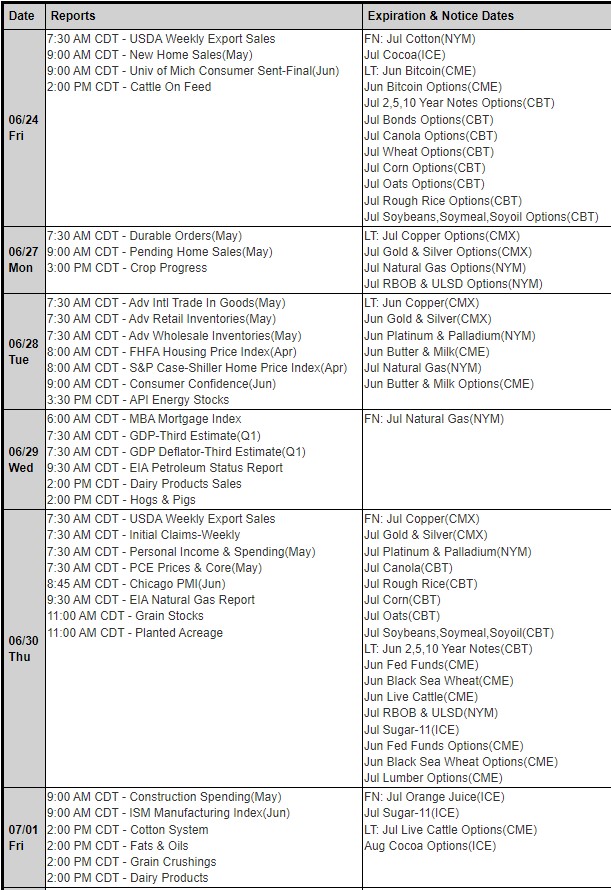

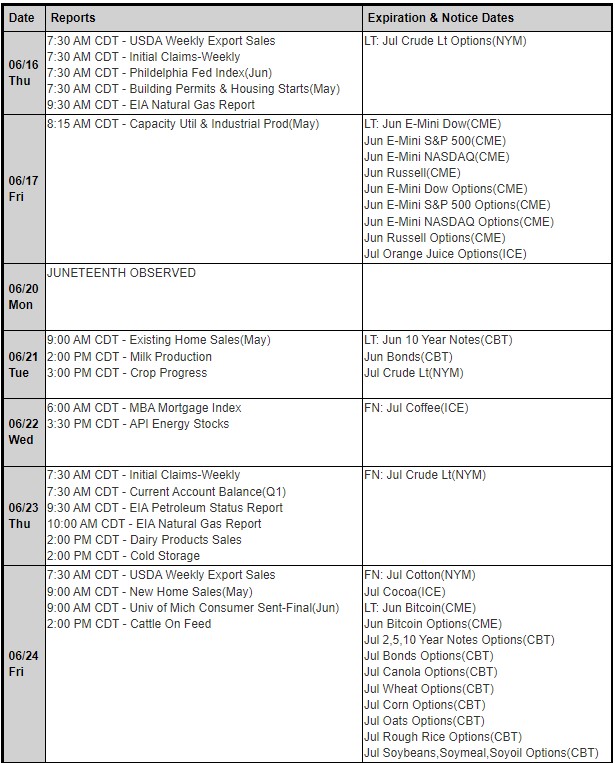

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.