This Week Free offer

1. Trading 102: IdentifyingTrend Days (Bullish/Bearish)

This article was contrbuted by 3rd party. The logic behind the article is valuable in our opinion and provides you, the trader, another possible trading tool to explore.

By: David Dube of Polaris Trading Group

For a free 30 day pass to David's trading room, fill out the short information at the bottom of this page

Trend days often begin as strong upside (gap) breakouts that never get filled. Typically volatility and volume expand suggesting the move has significant participation from large (Other Time Frame) traders. Once the move is initiated price continues to trade above the market’s Volume Weighted Average Price (VWAP) and itself trends in direction of breakout. Since VWAP is trending this implies that traders are accepting “expanding value”.

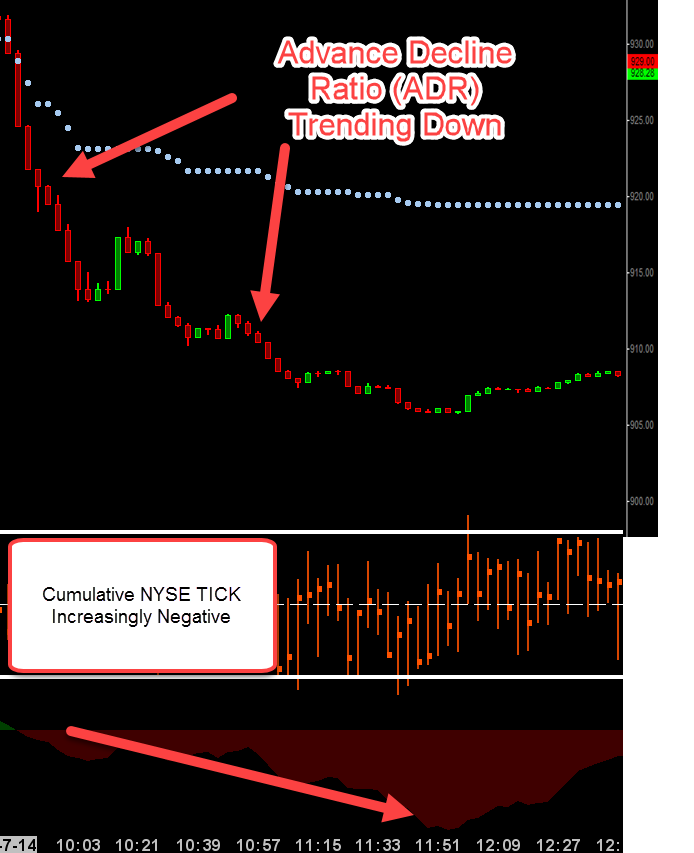

Momentum and breadth Indicators will be skewed…Downside breakouts will be associated with high Cumulative NYSE Tick reading maintaining below zero-line with shallow pullbacks during the session. This tells us that, on balance, more stocks are trading on downticks versus upticks: (bearish case…sellers are in control). Additional breadth indicators to consider are Advance/Decline Ratio and Cumulative Volume Delta.

....Finish reading rest of the article ( along with optional free pass to David's trading Room)

Identifying Trend Days

Cannon Trading respects your privacy and will never give this information to a 3rd party.

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!