When navigating the complex and fast-paced world of futures trading, choosing the right broker can be the difference between long-term success and costly missteps. The best futures brokers don’t just provide access to markets—they deliver performance, reliability, and client-focused service. In a market where traders need every edge, selecting the best futures brokerage is a strategic decision that goes beyond commissions and technology.

As a trader, whether you’re managing a diversified commodity portfolio or scalping market volatility, you’re likely looking for top rated futures brokers who can offer a blend of deep industry experience, regulatory credibility, advanced trading platforms, and client-centered service. This is where Cannon Trading Company shines—not just as a viable contender but as a top-rated commodities brokerage with nearly four decades of operational excellence.

A Legacy of Excellence Since 1988

Founded in 1988, Cannon Trading Company has become one of the most enduring and respected names among top rated futures brokers in the United States. With nearly 40 years of uninterrupted service, Cannon Trading has weathered market cycles, regulatory changes, technological revolutions, and the digital transformation of the financial services industry.

Their longevity is not by chance. It is rooted in a relentless pursuit of excellence and adaptability. While some firms operate in reaction to market conditions, Cannon Trading is proactive—constantly evaluating its services, expanding its platform offerings, and optimizing client experiences.

When traders research the best futures brokers, one of the key indicators they often seek is industry tenure. A firm like Cannon Trading, with decades of proven performance, assures traders of stability and expertise—an essential edge in an unpredictable market landscape.

Regulatory Reputation and Trust

Any claim to being among the top-rated commodity brokers is incomplete without impeccable regulatory standing. Cannon Trading Company boasts a pristine record with U.S. futures regulators, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This clean record is not merely a badge of honor—it is a testament to the company’s commitment to integrity, compliance, and transparency.

This kind of regulatory fidelity elevates Cannon Trading above many competitors who may offer flashy tools but lack the trustworthy foundation required for long-term engagement. For clients who take compliance and security seriously, choosing a top-rated futures brokerage like Cannon Trading ensures peace of mind.

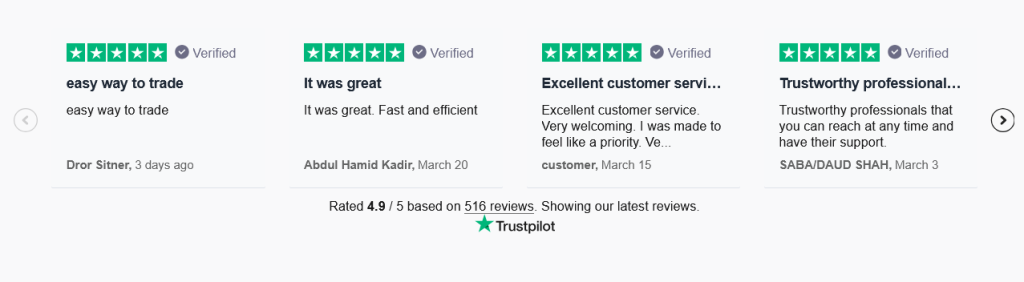

Client Satisfaction and 5-Star TrustPilot Ratings

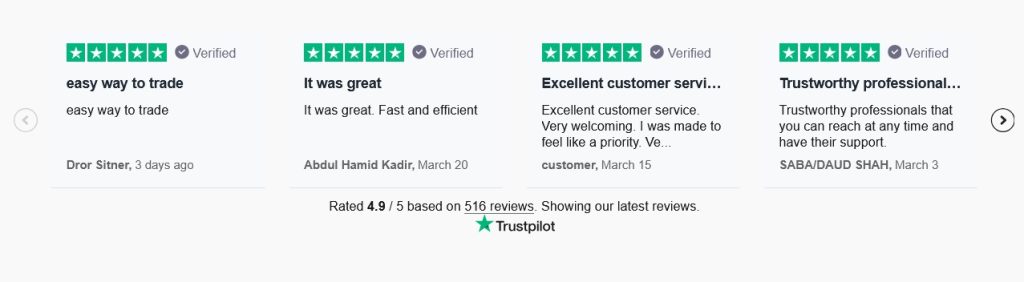

In today’s digital era, online reputation matters more than ever. Independent reviews are often more insightful than promotional materials. Cannon Trading Company has earned consistent 5 out of 5-star ratings on TrustPilot—a rare feat in the brokerage industry.

Clients praise the firm for personalized service, fast response times, and trading desk professionals who understand the nuances of both retail and institutional trading. These reviews are not marketing hyperbole—they are public testimonies from real users that back Cannon’s position among the best futures brokers in the country.

Whether you’re a beginner who needs handholding or a veteran seeking high-frequency trading solutions, Cannon Trading’s tailored approach to customer support ensures you’re not just a number in a CRM database—you’re a partner in success.

Platform Diversity: A Personalized Trading Experience

One of Cannon Trading’s most distinctive features as a top-rated futures brokerage is its vast selection of world-class trading platforms. Unlike many brokers that lock you into one or two interfaces, Cannon empowers you to choose from a broad spectrum, including:

- CannonX

- CQG

- RTrader Pro

- Bookmap

- MotiveWave

- Sierra Chart

- MultiCharts

- TradingView

- Firetip

- iBroker

- And more…

This flexibility enables traders to match their personal trading style with the tools they need. Whether you’re looking for advanced charting, market depth visualization, algorithmic trading support, or mobile-friendly execution, Cannon Trading delivers.

This breadth of choice alone elevates Cannon Trading to the upper echelon of top-rated commodity brokers. Personalized trading is no longer a luxury—it’s a necessity, and Cannon ensures you’re equipped.

Dedicated Support from Experienced Professionals

Cannon Trading’s support team isn’t composed of outsourced reps reading scripts. Instead, the company invests in experienced brokers and support staff who know the markets. Their team includes licensed professionals who can assist with strategy, risk management, platform configuration, and more.

This level of expertise is what separates Cannon from low-cost alternatives. Their team doesn’t just solve problems—they anticipate them. They don’t just process orders—they guide you through market dynamics, trading psychology, and system performance. It’s a hands-on approach that defines what the best futures brokerage should provide.

Competitive Pricing, Transparency, and No Gimmicks

Cannon Trading doesn’t lure clients with deceptive low pricing that later explodes with hidden fees. Instead, the firm maintains a transparent fee structure that caters to traders of all types—from high-volume intraday traders to hedgers and long-term position holders.

Account minimums are reasonable, margins are competitive, and the firm offers both self-directed and broker-assisted services without forcing traders into one-size-fits-all models.

This balanced approach makes Cannon Trading not only one of the top-rated futures brokers but also one of the most honest and accessible futures brokerages in the U.S.

Risk Management and Education

Risk is inherent in futures trading, but proper management is where traders gain the edge. Cannon Trading Company takes risk education seriously. From free webinars to comprehensive articles and one-on-one consultations, Cannon provides a robust educational infrastructure for clients.

Some of the key educational tools include:

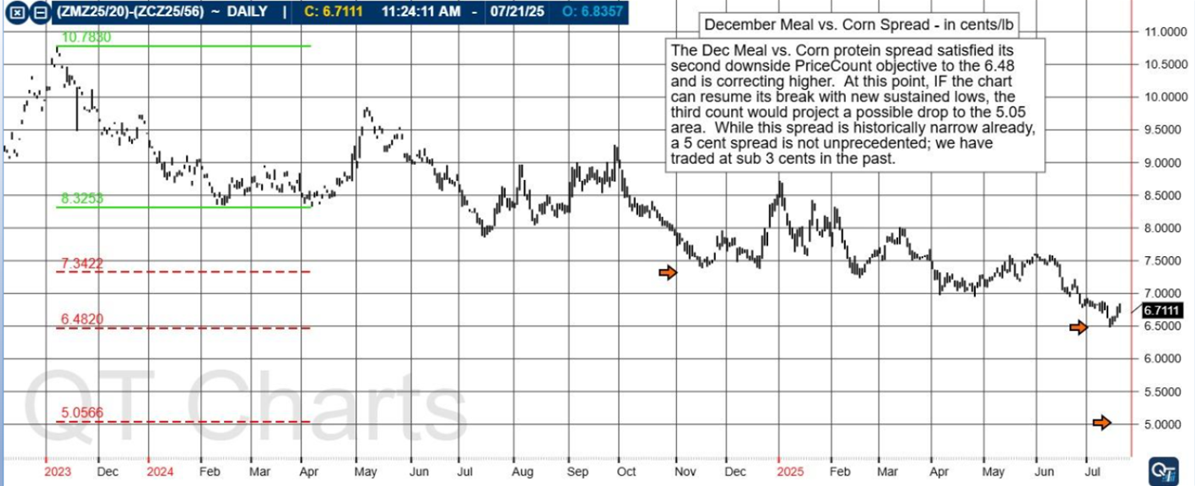

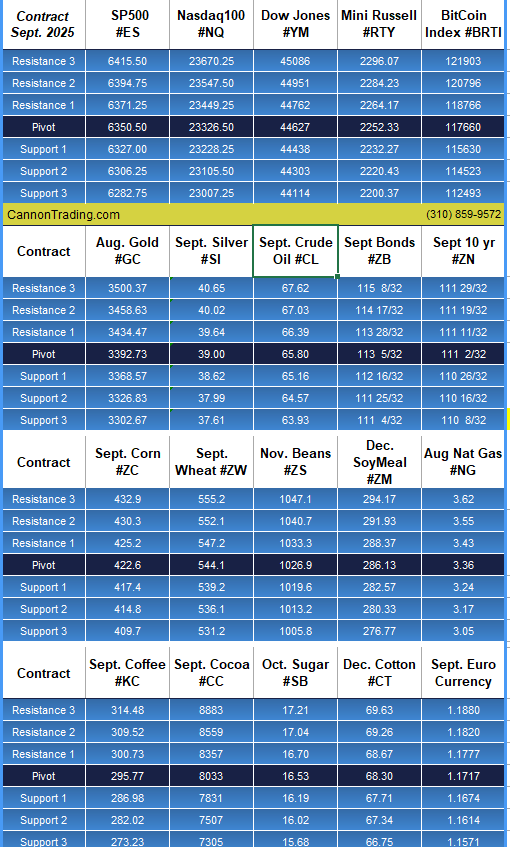

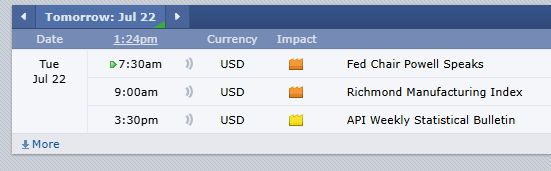

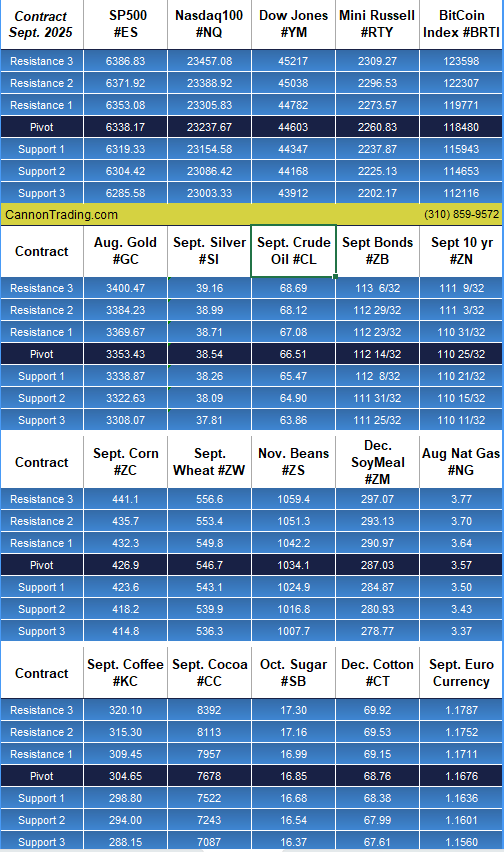

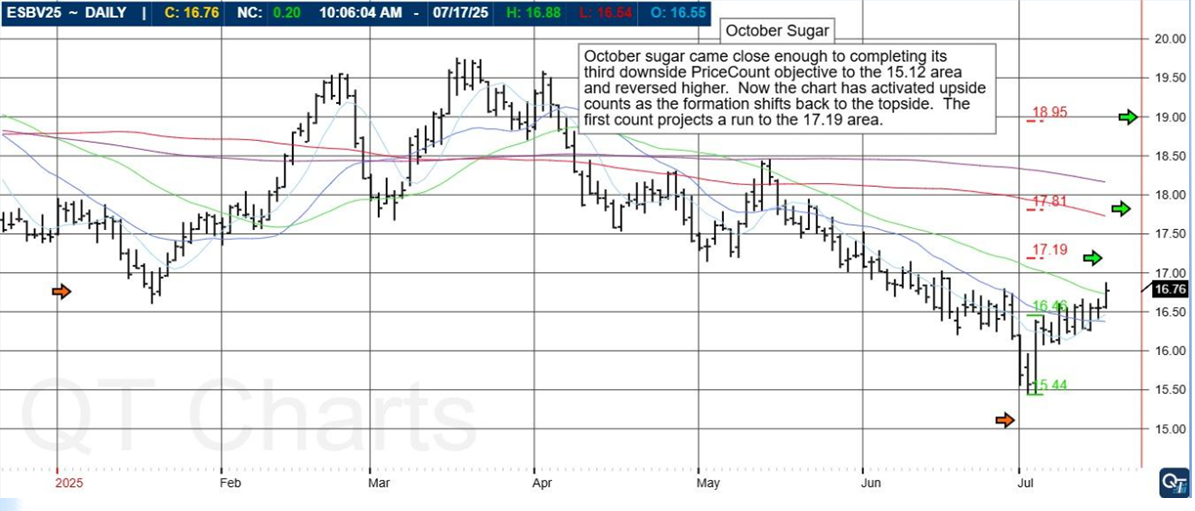

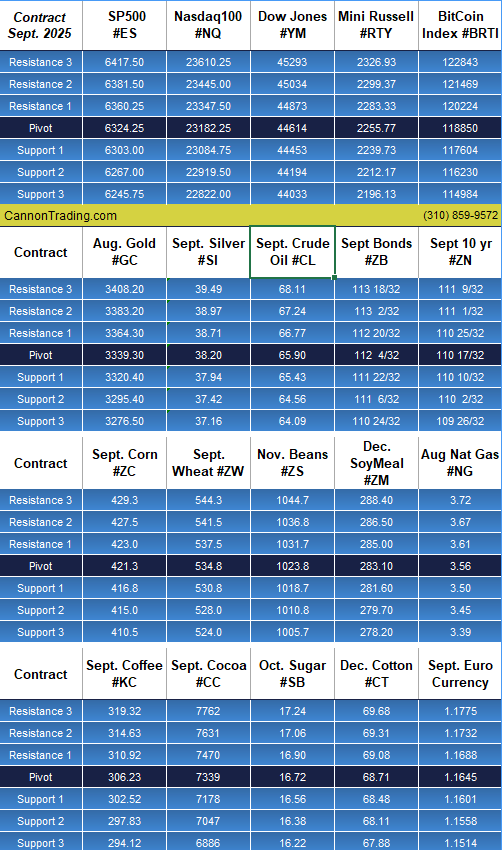

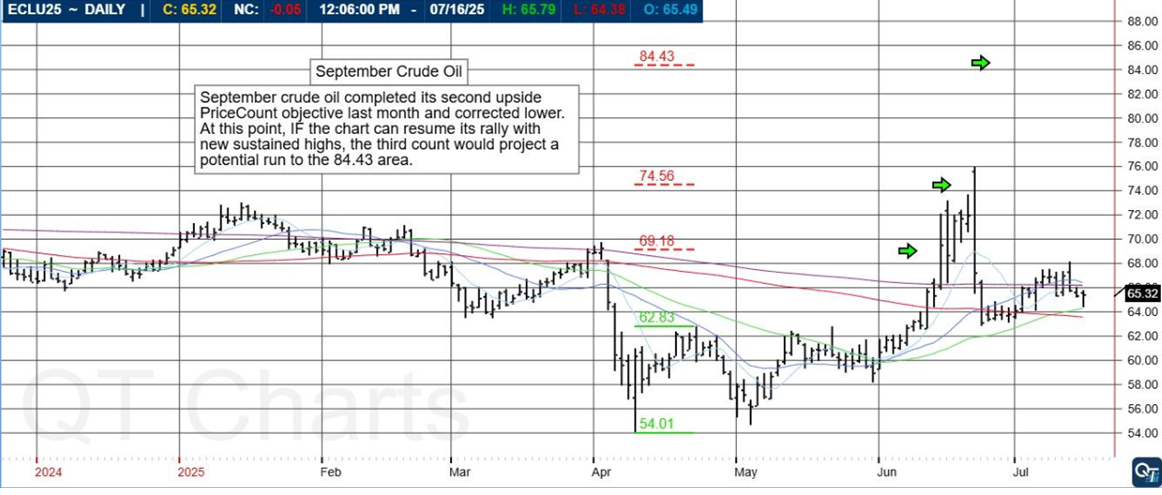

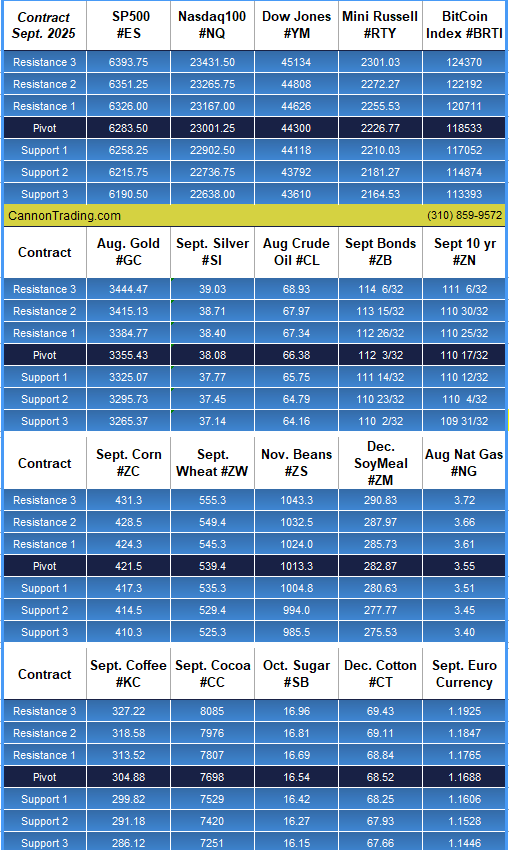

- Daily support & resistance levels

- Market commentary

- Trading tutorials

- Platform-specific guidance

- Broker insights based on current market activity

Cannon’s emphasis on education demonstrates a client-first mentality—another trait that places it high on the list of best futures brokers available to U.S.-based traders.

Custom Brokerage Solutions for Every Trader Type

Whether you’re a day trader seeking tight spreads and rapid execution, or a commodity hedger managing physical positions, Cannon Trading can customize a brokerage solution to fit your needs.

This bespoke brokerage model is what sets Cannon apart from most top-rated commodities brokerages, many of which cater exclusively to either the institutional or retail segment. Cannon manages to serve both ends of the spectrum without compromising quality.

High-Speed Execution and Advanced Order Types

In today’s algorithmic trading environment, execution speed can make or break profitability. Cannon Trading offers:

- Low-latency order routing

- Colocated servers with exchanges

- Access to advanced order types (OCO, brackets, trailing stops)

- Integration with algorithmic systems and APIs

These features aren’t just for show—they represent real competitive advantages that place Cannon Trading among the best futures brokers for speed, precision, and strategy execution.

Recognized Leadership in the Futures Industry

Over the years, Cannon Trading has earned accolades from clients, regulators, and industry peers alike. The firm has been invited to participate in trading expos, industry panels, and educational summits, further cementing its position as a top-rated futures brokerage and thought leader.

Their content is frequently cited in futures forums, educational blogs, and trading academies—another validation of the trust and authority Cannon Trading has cultivated in its nearly 40 years of operation.

Comparing Cannon to Other U.S. Futures Brokers

While many brokers offer competitive rates or sleek platforms, very few combine the full suite of advantages that Cannon does:

| Feature | Cannon Trading Company | Average U.S. Futures Broker |

| Years in Business | ~40 | 10–15 |

| Platform Options | 10+ | 1–3 |

| TrustPilot Rating | 5.0 (multiple ratings) | 3.5–4.5 |

| Regulatory Standing | Clean record with CFTC/NFA | Mixed |

| Broker-Assisted Trading | Available | Often unavailable |

| Custom Solutions | Yes | Limited |

| Education & Risk Tools | Extensive | Minimal |

As this comparison illustrates, Cannon doesn’t just match its competitors—it exceeds them across nearly every meaningful metric.

A Legacy Built for the Future

The title of best futures brokerage isn’t one that can be self-proclaimed—it must be earned through decades of diligence, innovation, client satisfaction, and transparency. Cannon Trading Company exemplifies all of these values. Its nearly 40-year legacy, stellar regulatory history, highly rated client reviews, and unparalleled platform diversity set it apart as a consistent leader.

For any trader looking for the best futures brokers in the U.S., Cannon Trading deserves a place at the top of the list—not just because of what they’ve done, but because of what they continue to do for their clients every day.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading