The world of futures trading continues to evolve rapidly. Technological innovation and the need for robust reliable tools are at the center of needs for industrial and retail traders. One of the leading solutions to emerge in recent years is the Quantower trading platform. Quantower is a dynamic, multi-asset interface that has positioned itself as a top-tier futures trading platform. From its intuitive design and advanced charting capabilities to its seamless integrations with data feeds and brokers, Quantower is redefining how futures traders approach the markets.

Origins and Availability of the Quantower Trading Platform

Launched in 2017, the Quantower trading platform was conceived to address the limitations and pain points found in many legacy futures platforms. Developed by a team of experienced software engineers and market professionals, Quantower’s mission was clear: create a modern, flexible, and powerful trading interface capable of catering to a broad range of traders, from beginners to institutional investors.

Since its inception, the quantower futures platform has been accessible to brokers and traders worldwide. Its rapid adoption across various financial markets is a testament to its innovative features, reliability, and user-centric design. Over the years, Quantower has established partnerships with numerous data vendors, brokers, and execution providers, making it one of the most versatile futures trading tools in the industry today.

What Sets Quantower Apart from Other Futures Trading Platforms?

The Quantower trading platform distinguishes itself through a combination of high-end professional features, remarkable modularity, and a commitment to continuous development. Unlike many traditional futures platforms, which often lock traders into rigid layouts or proprietary brokerage ecosystems, Quantower embraces customization and openness.

- Multi-Asset Support & Modular Design

Quantower supports not only futures trading but also forex, options, and cryptocurrencies. This allows traders to manage all asset classes from a single dashboard—a critical benefit for diversified and institutional traders. The platform’s modular structure means users can add or remove panels and components to suit their workflows. Whether you are trading futures or managing options strategies, the platform scales with your needs.

- Advanced Charting and Analytical Tools

One of the most powerful aspects of the Quantower futures platform is its rich charting environment. Traders can utilize hundreds of technical indicators, multiple chart types, drawing tools, and the ability to build custom studies through C#. This flexibility empowers users to conduct in-depth analysis and implement sophisticated futures trading strategies with confidence.

- Order Flow and Volume Analysis Tools

Quantower offers features typically found only in high-end institutional trading platforms, such as DOM Surface, Volume Profiles, TPO Charts, and Cluster Charts. These tools provide granular market insight, helping traders read order book dynamics and identify hard to find levels of support and resistance—key elements in successful futures trading.

- Broker and Data Feed Flexibility

With native integrations to leading futures brokers and data feeds such as Rithmic, and CQG, the quantower futures platform gives traders choice and flexibility. This eliminates the “vendor lock-in” problem found in many futures platforms, enabling users to shop for the best execution and data rates.

- Scripting and Automation

Quantower’s API and strategy scripting environment allow traders to build and test custom indicators, automated trading algorithms, and integrations. This level of openness is ideal for prop firms, quant traders, and others seeking a true institutional trading platform experience.

Streamlined Trade Execution With Quantower

Efficient trade execution is a cornerstone of success in futures trading. Quantower excels in this domain with features designed to eliminate latency, maximize precision, and streamline the user experience.

- One-Click Trading and Hotkeys

Speed is vital in trading futures, especially in fast-moving futures markets. Quantower offers one-click order entry and customizable hotkeys to execute trades instantly from charts, the order book, or watchlists. Traders can also set predefined order parameters such as quantity, order type, and slippage tolerances.

- Multi-Account and Multi-Broker Management

The Quantower trading platform allows users to connect and manage multiple brokerage accounts simultaneously. This is particularly valuable for traders running multi-strategy portfolios or institutional desks that need to allocate orders across various accounts in real-time.

- Trade from Charts and DOM

Chart-based trading and a depth-of-market (DOM) interface are standard on the Quantower futures platform, enabling traders to analyze price action and execute trades without switching views. The DOM Surface adds a visual layerover to market depth, making it easier to understand large order concentrations and market sentiment.

- Risk Management Tools

Built-in risk management tools features help traders protect the downside risk. Traders can set global stop-loss levels, monitor margin usage, and receive alerts for abnormal market behavior—core aspects of a dependable futures trading platform.

Why Cannon Trading Company Is the Ideal Brokerage Partner

While the Quantower trading platform offers cutting-edge technology, partnering with the right broker is crucial for unlocking its full potential. Cannon Trading Company stands out as a premier partner for those seeking excellence in futures trading.

- Trusted Reputation and Regulatory Excellence

With over three decades in the industry, Cannon Trading has built a reputation for integrity, transparency, and superior client service. The firm maintains a positive record with federal regulatory bodies such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). This ensures traders operate within a secure and compliant environment while trading futures.

- 5-Star TrustPilot Ratings

Customer satisfaction is a cornerstone of Cannon Trading’s mission. Numerous 5 out of 5-star reviews on TrustPilot speak volumes about the firm’s dedication to responsive support, platform education, and client success. Whether you’re a novice or professional, Cannon Trading delivers personalized service tailored to your goals.

- Access to Top-Tier Trading Platforms

Cannon Trading offers access to a wide selection of high-performance futures trading platforms, including RTrader Pro, CQG, Bookmap, MotiveWave, and of course, the Quantower futures platform. This gives traders unmatched flexibility to choose the platform that best aligns with their trading style and strategy.

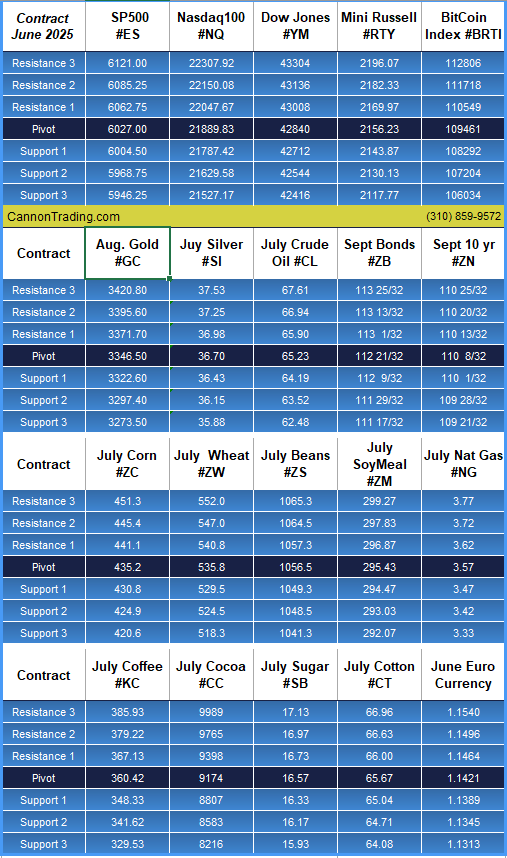

- Competitive Commission Structures and Margins

Cost is a significant factor in trading futures. Cannon Trading delivers competitive commission schedules and low day-trading margins, helping traders save costs and have increased leverage. When paired with the feature-rich Quantower trading platform, this can create a winning formula for serious traders.

- Dedicated Support and Education

Unlike many brokers that rely on impersonal support, Cannon Trading provides clients with access to licensed brokers, platform training sessions, and real-time troubleshooting. Their commitment to education ensures that users can fully harness the advanced capabilities of the Quantower futures platform.

A Future-Ready Trading Solution

The demands of modern futures trading require a combination of sophisticated technology and reliable brokerage support. The Quantower trading platform meets this challenge with flying colors, offering a best-in-class solution that competes with legacy institutional trading platforms. When combined with Cannon Trading Company’s proven track record, regulatory reliability, and exceptional client service, traders are equipped with everything they need to navigate the futures markets with confidence. The synergy between Quantower’s powerful toolset and Cannon’s robust brokerage infrastructure creates a future-ready solution that excels in execution, analytics, and risk control.

Whether you’re a retail trader exploring new strategies or a professional trading desk seeking powerful tools, the combination of the Quantower trading platform and Cannon Trading Company represents one of the best opportunities available in the futures space today.

In an increasingly competitive landscape, traders need platforms and partners that empower rather than limit. The Quantower futures platform delivers the performance, flexibility, and analytics expected from a modern futures trading platform, while Cannon Trading Company brings decades of trust, customization, and client focus. Together, they offer a powerful pathway for succeeding in Trading Futures.- NICE ONE!

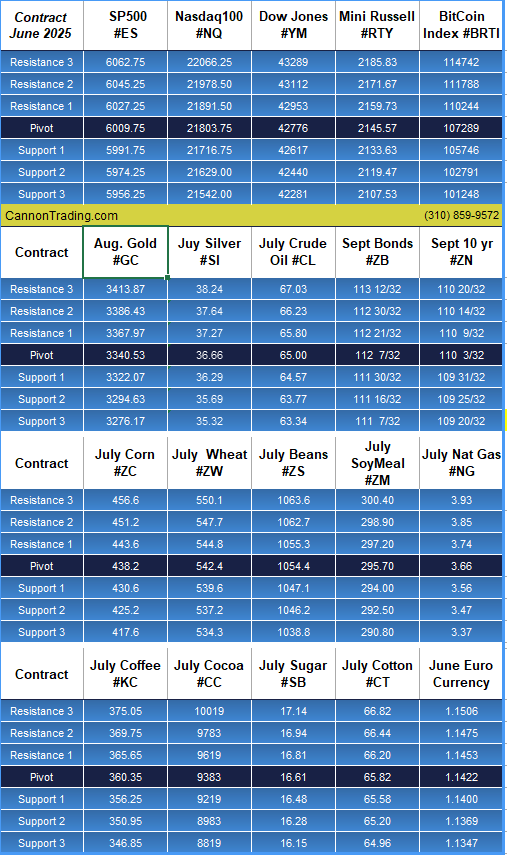

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading