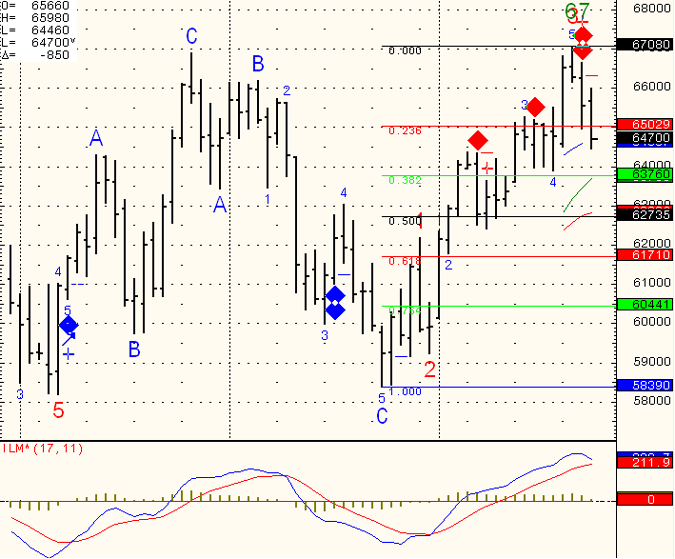

I got two “false” sell signals before this last one….I think the fact that we went through the first FIB level gives this short swing trade higher chances of being correct with initial target of 617.10.

Since NONE of us have a crystal ball, one always has to calculate the proper stop or risk allocated for the trade and see if it makes sense based on ones account size, risk tolerance etc.

For this specific one, I would conclude that my short trade is wrong if we trade above 660.

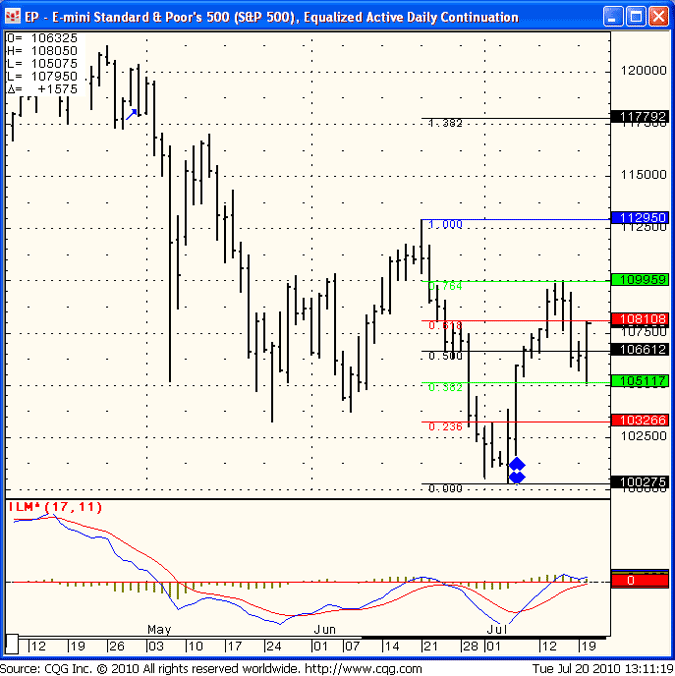

SP 500 Day Trading