One of the most overlooked Trading Ingredient: Learn to Lose!

Many different factors go into trading. Too many to discuss efficiently in one blog post. Some relate to trading techniques, other to money management, mental aspect, risk capital and much more.

But one that sticks in my eyes is the inability to accept a loss. I see many clients who can make money and have days where they make money but when they lose, they lose much more, sometimes even losing control and losing a big portion of their account.

I am not sure how a trader can embed this into their trading mind, BUT in my opinion if you train your brain to expect losses, understand losses and that losing days will happen, you will increase your chances of surviving in this business, which in return will actually give you a chance to succeed….

Losses are part of trading and as long as your losses are part of the plan and are quantified in advance and you can adhere to your rules, then you have a chance. I think it’s easy when traders are winning…making money etc. Much harder when you lose or down. your brain starts playing tricks on you…it tells you to double down, maybe reverse even though your analysis does not say so….all of a sudden you start pulling trades out of instinct, fear rather than a calculated plan that has solid risk/ reward.

If a trader learns how to lose, to accept losses, to have realistic expectations, then he/ she can avoid having one of those terrible days when traders can lose almost of all their account.

Also, while a bit easier in my mind, a day trader should also step away when he/she reached a predefined profit target for the trading day. In my humble opinion, the more you day trade, the more fatigued you become and larger chances for errors. Somewhat like a pro basketball player managing their playing minutes….

I went into this subject and detailed day-trading money management in an article I wrote a few years back for SFO magazine.

Click here to read the rest of the Article

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

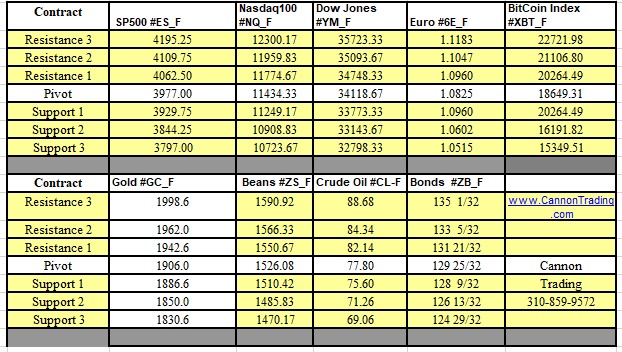

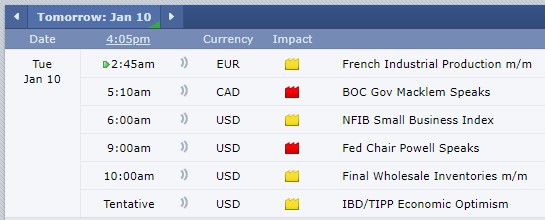

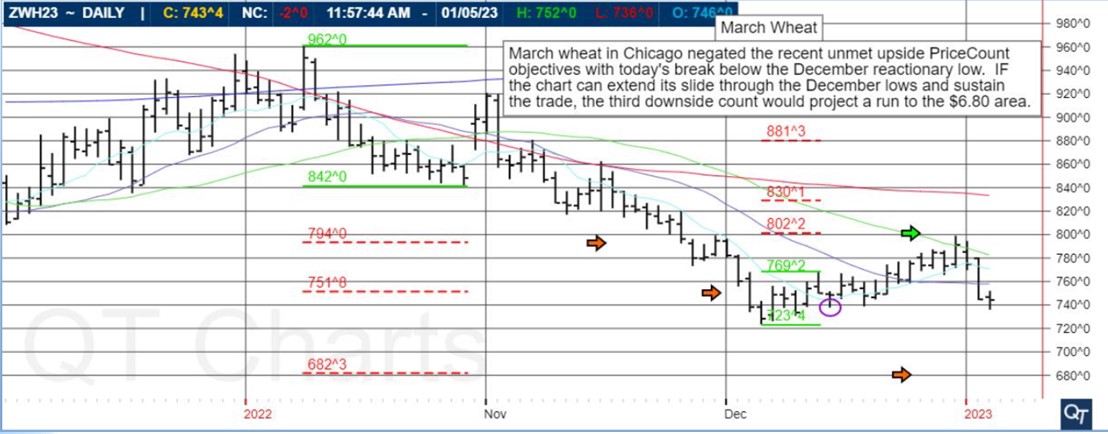

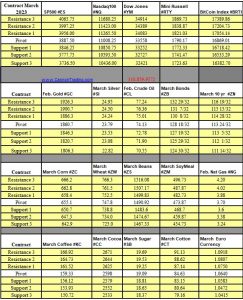

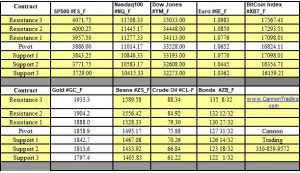

Futures Trading Levels

for 01-20-2023

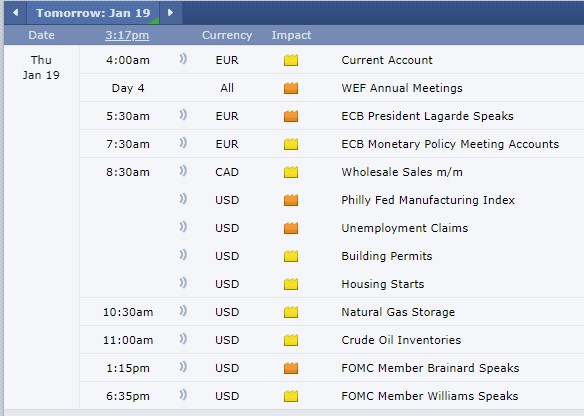

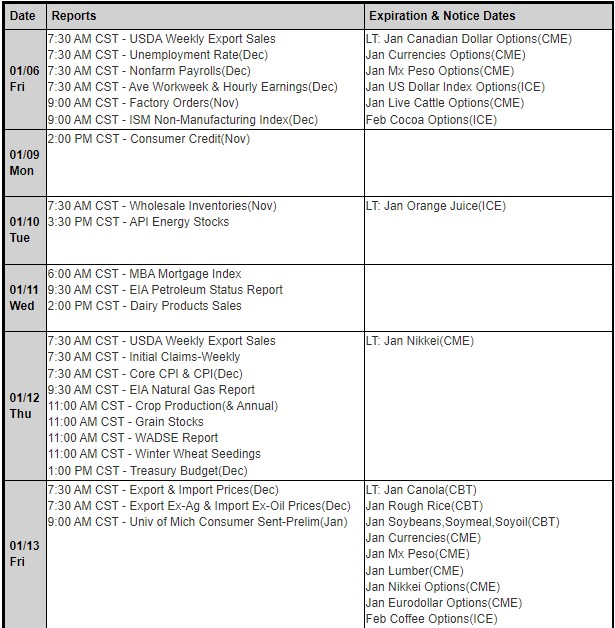

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.