Cannon Futures Weekly Newsletter Issue # 1041

Dear Traders,

Trading 101: Knowing What You Don’t Know in Trading Markets

From our friend Jim Wyckoff at JimWyckoff.com

The headline of this educational feature may be a bit confusing, but I will explain what I mean shortly. First, I want to reiterate that trading futures, stock and FOREX markets is not an easy undertaking. It disgusts me that there are a few unsavory people in our industry that portray trading as an easy, get-rich-quick scheme, or as some endeavor for which there are “secrets” to be learned from those who hold “trading secrets.”

Folks, the plain truth is that there are no trading secrets and no easy paths to quick success in trading markets. Beware of anyone who tries to tell (or sell) you such. One of the biggest obstacles to success in trading markets is a lack of knowledge and understanding of the process of trading. The “process of trading” includes understanding financial leverage, market behavior and trader psychology. Understanding the process of trading can be achieved with perseverance and a willingness to continue to learn.

It’s not coincidental that trading markets is similar to most other human endeavors: Hard work and experience are required to achieve notable success. A person who enjoys classic automobiles would not attempt to tear down and successfully rebuild an engine without having some previous experience, or without having learned about the workings of an automobile engine—including knowing about the tools involved in the operation.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

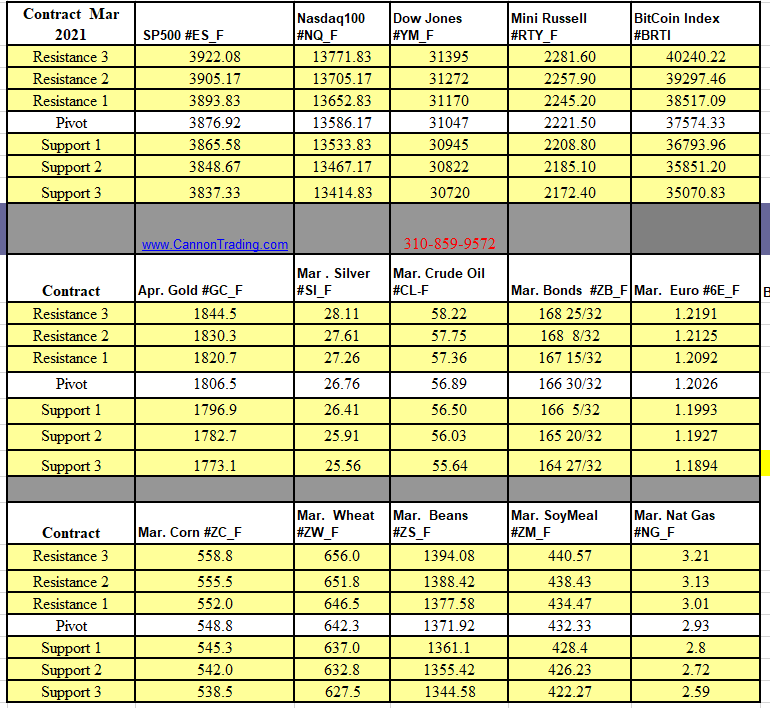

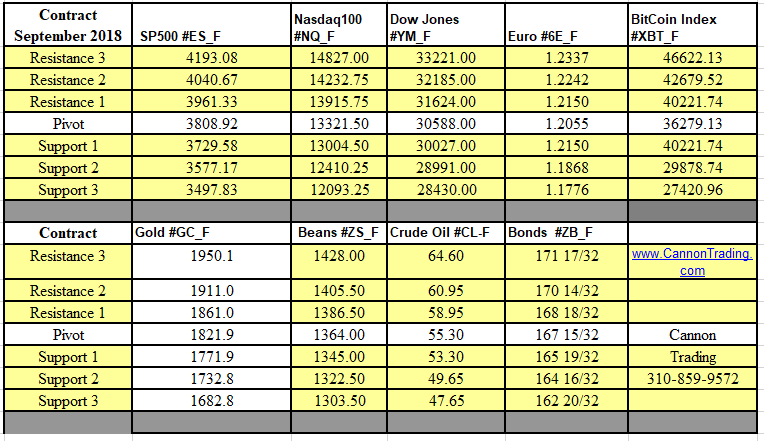

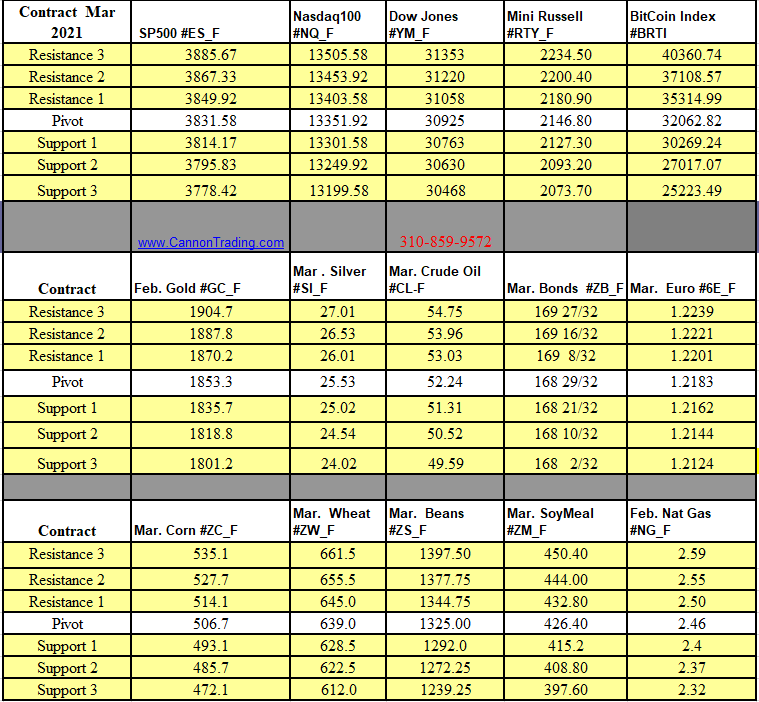

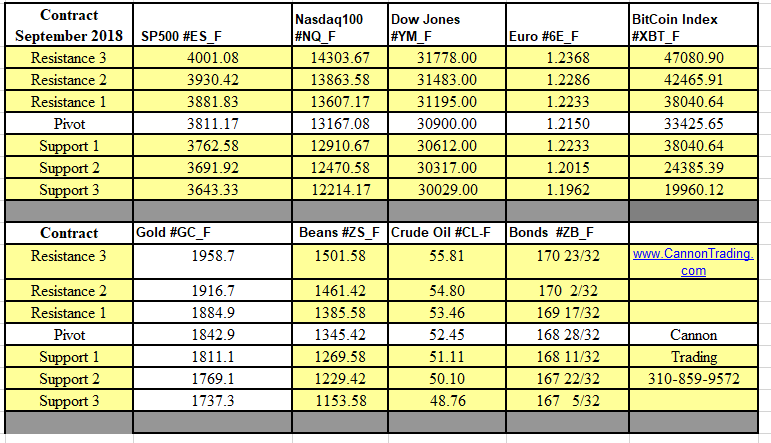

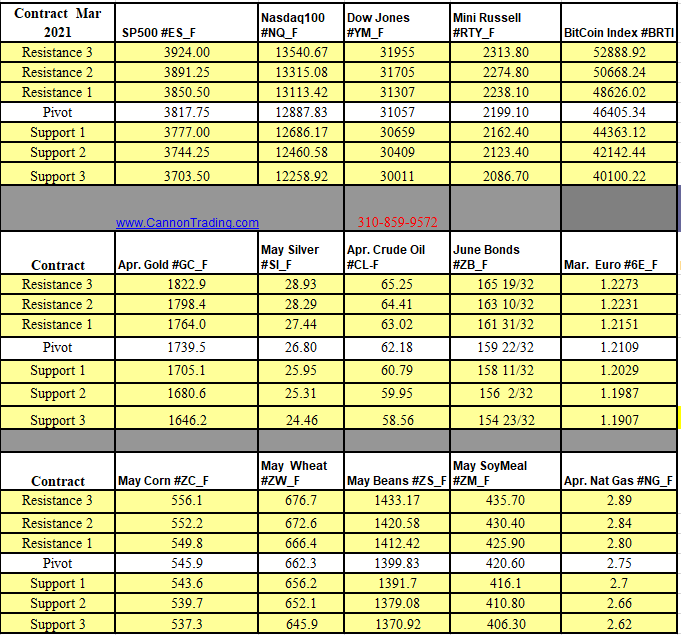

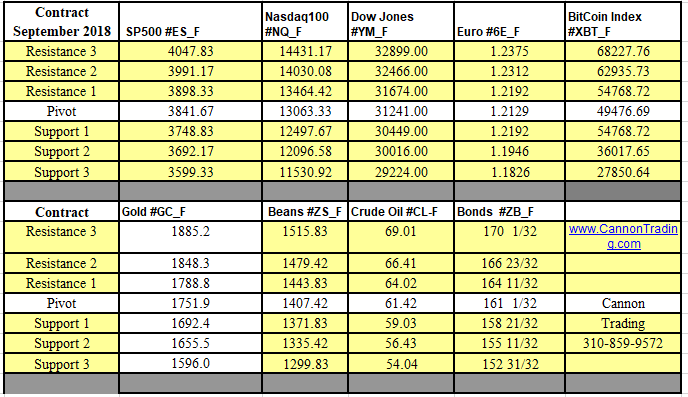

Futures Trading Levels

3-01-2021

Weekly Levels

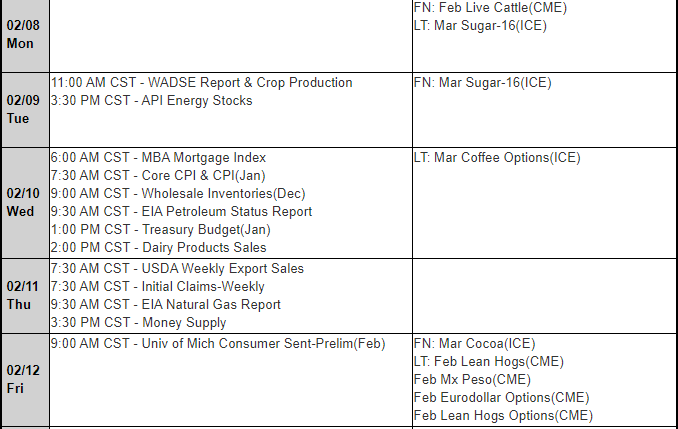

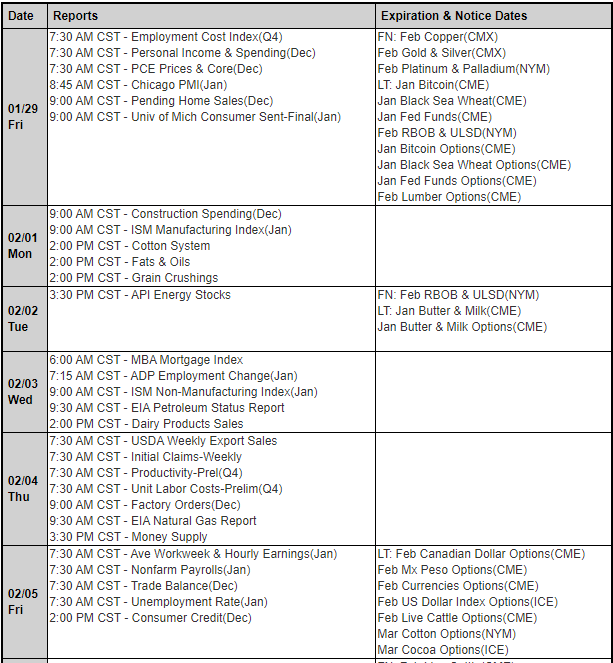

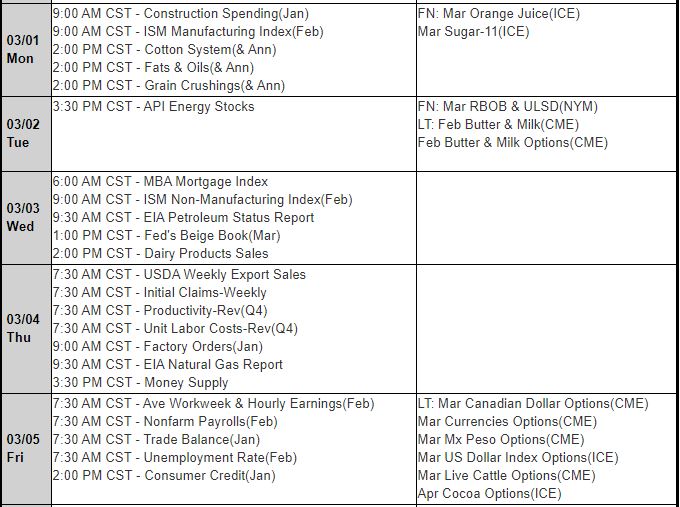

Reports, First Notice (FN), Last trading (LT) Days for the Week:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in tradin

_Weekly_Continuation.png)