Jump to a section in this post:

1. Market Commentary

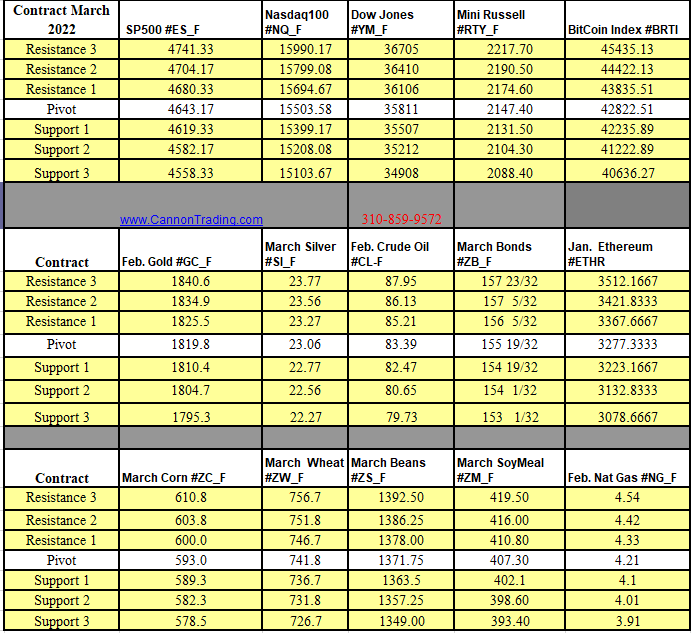

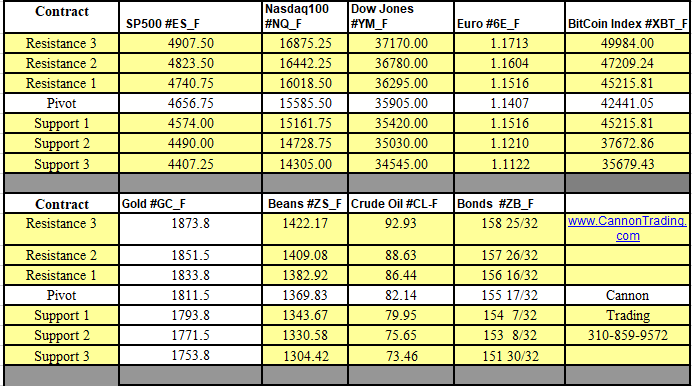

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Economic Reports for Tuesday, November 29, 2011

Hope everyone had a great Thanksgiving holiday/ long weekend and are ready for the final stretch of 2011.

Good reading material for your review below:

A LITTLE BIRD TOLD ME

Janice Dorn, M.D., Ph.D.

www.thetradingdoctor.com

Janice Dorn, M.D., Ph.D. is a Financial Psychiatrist and Financial Futurist. Dr. Janice Dorn is believed to be the only Ph.D. (Brain Anatomist) and M.D. (Board-Certified Psychiatrist and Addiction Psychiatrist) in the world who actively trades, writes commentary on the financial markets and coaches fellow traders. Dr. Dorn has been trading the gold futures markets full time since 1993. She has written over 2000 articles on trader and investor psychology, and coached over 600 traders. Her website is www.thetradingdoctor.com and you can sign up to receive all new postings at this link: http://www.thetradingdoctor.com/joinfreemailinglist.html

Knowing yourself is the beginning of all wisdom…Aristotle

Bobby was a lonely trader who bought a talking bird to keep him company. Little did he know what he was getting himself into, since the minute Bobby tried to put it into a cage, the bird began speaking rapidly:

“Don’t put me in a cage, please. Let me free and I will tell you the three secrets of successful trading? I will, I promise you. Just let me go!”

Bobby was tired, his resistance was low from not working out and eating junk food plus he was on a three-month losing streak. This combination made the bird’s offer irresistible.

“Tell me, bird, what are the secrets?”

“Promise me you’ll pay close attention, Bobby?”

“Yep.”

” OK. Here they are:”

Ignore the hype. If something seems too good to be true, it probably is!

Know yourself and what you are capable of doing. Know your strengths and your limitations

Always strive to do good things and don’t forget the good you have done. It comes back to you in ways that you may never suspect.

Bobby was not particularly impressed, especially with the “do good” part, but he let the bird go anyway. Flying away quickly, the bird rested on a tree branch and immediately started touting the trader.

“Hey, trader guy-Guess what? Just before you bought me and brought me home to put me in some miserable cage, I swallowed a rare, authentic alexandrite gemstone. If you had kept me, I might have told you about it— but I might not have because you would want to kill me, find the precious stone, sell it and get rich. ”

Bobby was furious, and regretted the instant he let the bird fly away. He lunged toward the tree and tried to climb it to get at the bird. Sadly, he was so out of shape and full of rage he couldn’t make it half-way up without falling down to the ground.

The bird watched this and then started lecturing to Bobby:

“You silly trader! You heard what I said but you didn’t listen one bit!

You did exactly what I told you not to do!

You believed the hype. What’s the chance that a bird would swallow a rare and precious gem and then tell you about it? Do you think I am such a stupid bird with a little brain that would risk being killed by you so you could get the stone out of my belly?”

Before Bobby could utter one word, the bird continued:

“You have no idea what your abilities are. You tried to climb the tree to capture me, and couldn’t even make it half-way up because you are so out of shape.

Finally, you forgot your good deed and did not keep your promise. You let me free then changed your mind and tried to get me back.

You failed in every respect. You did not keep your promises to me or to yourself.”

Bird 3: Bobby 0.

What lessons can you learn about trading and living from this story?

We are drowning in information overload. It’s especially bad because there is so much misinformation, disinformation and garbage competing for and assaulting our senses every day. As a trader, it is critical to filter out the signal from the noise. There is way too much hype and too many people trying to sell you something that is not real or true.

The instruction is to look beyond the noise, the hype and the predictions. If something sounds too good to be true, it probably is. There is no holy grail and there is no magical system that wins 100% of the time.

How many legs does a dog have if you call the tail a leg? Four— calling a tail a leg doesn’t make it a leg… Abraham Lincoln Read the rest of this entry »