Helpful Tips to Trade on the E-Futures Platform 4.12.2016

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday April 12, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

Making the most of your trading DOM with E-futures Int’l trading software:

Down below you will find helpful tips and setups I use when I trade on the E-Futures platform. In today’s e-mail, I share some tips that assist me in making the most of the trading DOM. I have used the platform for the past ten years and finds the platform to be the whole package for day traders, option traders, swing traders and all other traders in between.

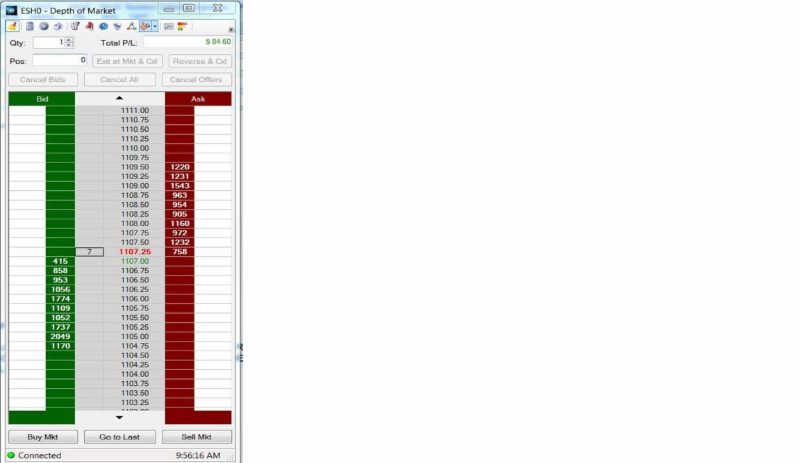

The default Dom comes up like shown below:

By clicking on the third icon from top left, you can now open the DOM options menu:

What I like to do is the following:

I check Auto sum bid/ask (will show me the total bid/ask waiting on both sides, look at next screen shot, on bottom of DOM)

I also like to have highlighted last price

Browse and use our FREE Trading Resources for Futures and Commodities

Featured System of the Month ( including real-time performance): Axiom Index II WFO NQ Trading System

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract June 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2073.67 | 4553.58 | 17842 | 1122.20 | 94.92 |

| Resistance 2 | 2065.08 | 4531.67 | 17745 | 1115.30 | 94.63 |

| Resistance 1 | 2049.67 | 4490.33 | 17607 | 1101.80 | 94.31 |

| Pivot | 2041.08 | 4468.42 | 17510 | 1094.90 | 94.03 |

| Support 1 | 2025.67 | 4427.08 | 17372 | 1081.40 | 93.71 |

| Support 2 | 2017.08 | 4405.17 | 17275 | 1074.50 | 93.42 |

| Support 3 | 2001.67 | 4363.83 | 17137 | 1061.00 | 93.10 |

| Contract | June Gold | May Silver | May Crude Oil | June Bonds | June Euro |

| Resistance 3 | 1284.6 | 16.76 | 42.50 | 168 10/32 | 1.1542 |

| Resistance 2 | 1272.8 | 16.37 | 41.63 | 167 17/32 | 1.1506 |

| Resistance 1 | 1265.3 | 16.14 | 41.00 | 166 28/32 | 1.1466 |

| Pivot | 1253.5 | 15.76 | 40.13 | 166 3/32 | 1.1429 |

| Support 1 | 1246.0 | 15.53 | 39.50 | 165 14/32 | 1.1389 |

| Support 2 | 1234.2 | 15.14 | 38.63 | 164 21/32 | 1.1353 |

| Support 3 | 1226.7 | 14.91 | 38.00 | 164 | 1.1313 |

| Contract | May Corn | May Wheat | May Beans | May SoyMeal | May Nat Gas |

| Resistance 3 | 366.9 | 468.1 | 942.33 | 290.03 | 2.00 |

| Resistance 2 | 364.6 | 463.4 | 935.92 | 285.37 | 1.97 |

| Resistance 1 | 360.7 | 455.3 | 932.08 | 282.73 | 1.95 |

| Pivot | 358.3 | 450.7 | 925.67 | 278.07 | 1.93 |

| Support 1 | 354.4 | 442.6 | 921.8 | 275.4 | 1.9 |

| Support 2 | 352.1 | 437.9 | 915.42 | 270.77 | 1.89 |

| Support 3 | 348.2 | 429.8 | 911.58 | 268.13 | 1.86 |

Economic Reports

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:09pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueApr 12 | 2:00am | EUR | German Final CPI m/m | 0.8% | 0.8% | ||||

| EUR | German WPI m/m | 0.3% | -0.5% | ||||||

| 6:00am | USD | NFIB Small Business Index | 93.9 | 92.9 | |||||

| 8:30am | USD | Import Prices m/m | 1.0% | -0.3% | |||||

| 2:00pm | USD | Federal Budget Balance | -97.5B | -192.6B |