The Rest of the Trading Week Ahead:

By Mark O’Brien, Senior Broker

General:

This week more than most (and just wait ‘til next week), Washington D.C. holds the key to price action in the futures markets and more broadly, global economic sentiment. As of this writing, there are still no signs that negotiations regarding the raising of the U.S. borrowing level are approaching a breakthrough. Futures markets – particularly ones in the financial sector such as interest rate instruments, equity indexes and currencies are justified in their unease. If the U.S. government misses an interest payment and defaults on its debt, even for just a few hours next week, its creditworthiness could suffer long-lasting consequences. For proof, just examine the plans being made by this country’s three major ratings companies — S&P Global Ratings, Moody’s and Fitch Ratings. All three are prepared to lower the rating of the United States as a borrower and not just temporarily if lawmakers come to a late agreement. More proof: in 2011, even though a debt-limit deal was reached, the U.S. lost its S&P AAA credit rating – lowered to AA+ – and has not recovered since.

Metals:

Copper, ever eyeing the economic conditions within the world’s biggest consumer: China, continued to be disappointed in that country’s flagging recovery and slid to lows not seen since last November. The July contract lost over 10 cents today, intraday, a ±55-cent / $13,500 slide since the beginning of April.

Softs:

Today’s intraday high of $2.9590 per pound in July orange juice marks a new all-time high for this famed commodity (remember Eddie Murphy in Trading Places) reestablishing a significant price increase from ±$2.00 at the beginning of the year. The latest surge – a mere eight trading sessions – elevated prices ±55 cents – a ±$8,250 move.

Currency:

More often observed for guidance on other markets’ direction, the U.S. Dollar Index has cautiously moved up ±370 points / $3,700 off its lows near 100.00, a level down through which it has unsuccessfully tried to puncture three times this year, most recently at the beginning of the month.

It can’t be understated as we approach the date an agreement would need to be in place to deal with our federal government’s debt limit (approximately June 1) that traders across the commodities spectrum – including the aforementioned as well as metals, energies, even agricultural products – need to take heed when entering the markets. As we approach that point in time, markets may be more and more on a knife-edge and quick to react. While it’s more fortunate that the situation is “local,” as opposed to being influenced by international affairs and any developments tend to reported at a fast pace, trade with caution and alertness.

Plan your trade and trade your plan.

Memorial Day 2023 Futures Trading Schedule

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

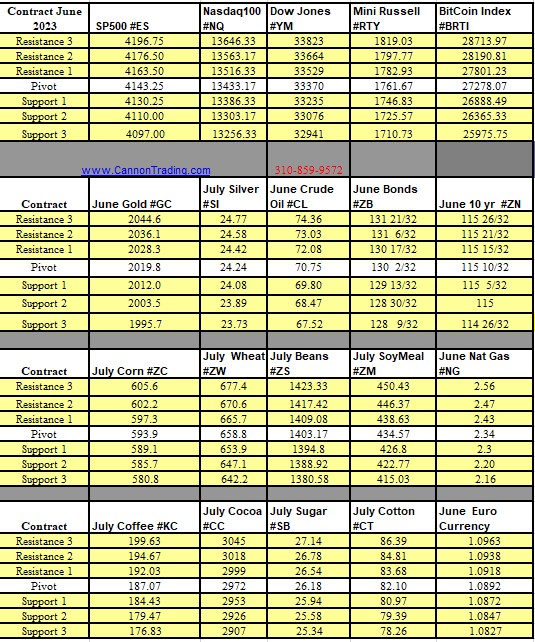

Futures Trading Levels

for 05-25-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.