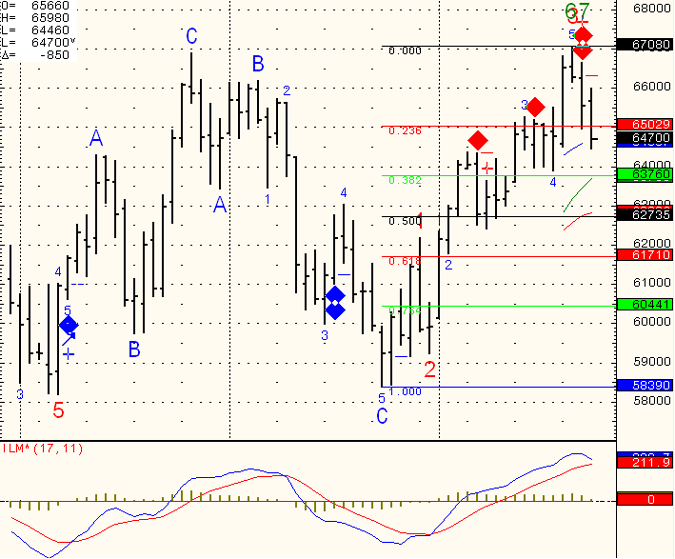

I got two “false” sell signals before this last one….I think the fact that we went through the first FIB level gives this short swing trade higher chances of being correct with initial target of 617.10.

Since NONE of us have a crystal ball, one always has to calculate the proper stop or risk allocated for the trade and see if it makes sense based on ones account size, risk tolerance etc.

For this specific one, I would conclude that my short trade is wrong if we trade above 660.

GOOD TRADING!

FUTURES TRADING LEVELS!

This Week’s Calendar from Econoday.Com

All reports are EST time

Another great source for economic reports around the globe with “report importance indicator” at: http://www.forexfactory.com/calendar.php

Friday, September 24th 2010 – http://mam.econoday.com/byweek.asp?cust=mam

- Durable Goods Orders

8:30 AM ET - New Home Sales

10:00 AM ET - Jeffrey Lacker Speaks

1:00 PM ET - Charles Plosser Speaks

2:00 PM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!