Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday July 15, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

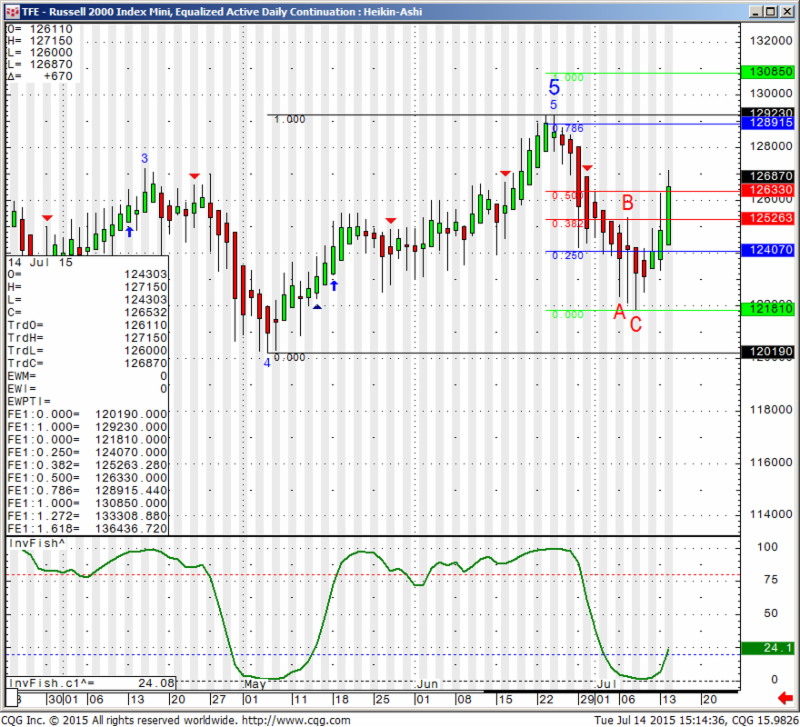

Mini Russell 2000 Testing Key Support Levels

I believe that as of late, the Russell 2000 index and it’s future contract, the mini Russell 2000 are the leaders in stock market behavior. With the recent sell off in equities, the big drop in China’s index, and the 4% drop in the Nikkei this morning, I wanted to get more clues about what may lay ahead for our equities and I opened my daily Heiken-Ashi chart for mini Russell 2000.

What I see is a market that has tested key support areas right around the 1224 ( September contract) three times! I also measured the move down that we had between April 27th and May 6th, and the move down we currently have is almost the EXACT magnitude.

While I believe that medium to longer term we should see a more meaningful correction for the short term, (i.e. the next few days) I think we will see a bounce from this levels as long as we can hold, and not close below 1224.

A Number of Options

There are more than a few ways to play this, the first is to try and go long around 1230 and place a stop below the recent lows. Another is to wait for a close below this level and establish longer term short positions. In between the volatility, intraday provides MUCH range, opportunities and risk….

– See more at: http://www.equities.com/editors-desk/investing-strategies/trading/mini-russell-2000-testing-key-support-levels#sthash.sl00KgAA.dpuf

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Sept. 2015 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2123.67 | 4582.25 | 18134 | 1284.83 | 98.17 |

| Resistance 2 | 2114.58 | 4556.00 | 18060 | 1278.17 | 97.69 |

| Resistance 1 | 2108.67 | 4537.00 | 18013 | 1273.33 | 97.25 |

| Pivot | 2099.58 | 4510.75 | 17939 | 1266.67 | 96.77 |

| Support 1 | 2093.67 | 4491.75 | 17892 | 1261.83 | 96.33 |

| Support 2 | 2084.58 | 4465.50 | 17818 | 1255.17 | 95.85 |

| Support 3 | 2078.67 | 4446.50 | 17771 | 1250.33 | 95.41 |

| Contract | Aug. Gold | Sept. Silver | Aug. Crude Oil | Sept. Bonds | Sept. Euro |

| Resistance 3 | 1165.5 | 15.71 | 56.31 | 150 14/32 | 1.1207 |

| Resistance 2 | 1162.3 | 15.60 | 54.82 | 150 1/32 | 1.1152 |

| Resistance 1 | 1158.2 | 15.47 | 53.86 | 149 22/32 | 1.1084 |

| Pivot | 1155.0 | 15.35 | 52.37 | 149 9/32 | 1.1029 |

| Support 1 | 1150.9 | 15.22 | 51.41 | 148 30/32 | 1.0961 |

| Support 2 | 1147.7 | 15.11 | 49.92 | 148 17/32 | 1.0906 |

| Support 3 | 1143.6 | 14.98 | 48.96 | 148 6/32 | 1.0838 |

| Contract | Dec. Corn | Sept. Wheat | Nov Beans | Dec. SoyMeal | Aug Nat Gas |

| Resistance 3 | 464.6 | 592.5 | 1047.50 | 359.20 | 3.02 |

| Resistance 2 | 459.4 | 587.5 | 1042.00 | 356.90 | 2.98 |

| Resistance 1 | 449.1 | 579.3 | 1033.50 | 352.60 | 2.90 |

| Pivot | 443.9 | 574.3 | 1028.00 | 350.30 | 2.86 |

| Support 1 | 433.6 | 566.0 | 1019.5 | 346.0 | 2.8 |

| Support 2 | 428.4 | 561.0 | 1014.00 | 343.70 | 2.75 |

| Support 3 | 418.1 | 552.8 | 1005.50 | 339.40 | 2.68 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:17pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedJul 15 | 2:45am | EUR | French CPI m/m | 0.1% | 0.2% | ||||

| Tentative | EUR | German 10-y Bond Auction | 0.81|1.7 | ||||||

| All Day | EUR | Eurogroup Meetings | |||||||

| 8:30am | USD | PPI m/m | 0.2% | 0.5% | |||||

| USD | Core PPI m/m | 0.1% | 0.1% | ||||||

| USD | Empire State Manufacturing Index | 3.4 | -2.0 | ||||||

| 9:15am | USD | Capacity Utilization Rate | 78.1% | 78.1% | |||||

| USD | Industrial Production m/m | 0.2% | -0.2% | ||||||

| 10:00am | USD | Fed Chair Yellen Testifies | |||||||

| 10:30am | USD | Crude Oil Inventories | -2.0M | 0.4M | |||||

| 2:00pm | USD | Beige Book | |||||||

| 3:00pm | USD | FOMC Member Williams Speaks |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.