Cannon Trading / E-Futures.com

Another strong volume day on the SP 500, with price action going both ways intraday but still finishing lower for the day.

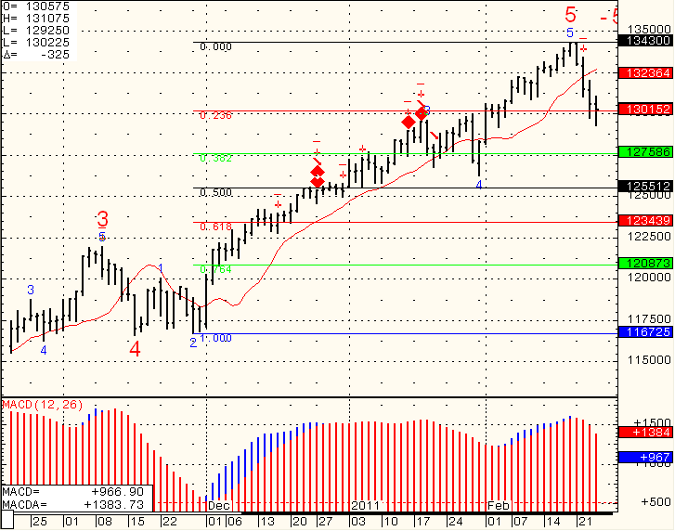

Some longer term FIB levels below to watch for. Middle East and crude oil will lead the way as we head into the weekend.

As volatility rises, so does risk…..as well as intraday opportunities. make sure you understand the change in the day trading environment we are noticing the last few days and incorporate into your trading decisions and money management.

Daily E-Mini S&P 500 Futures Trading Chart

GOOD TRADING!

TRADING LEVELS!

Economics Report Source: http://www.forexfactory.com/calendar.php

Friday, February 25, 2011

Prelim GDP q/q

8:30am USD

Prelim GDP Price Index q/q

8:30am USD

Revised UoM Consumer Sentiment

9:55am USD

FOMC Member Yellen Speaks

1:30pm USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!