Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday March 22, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

Hedge Fund Manager Shares Current market Outlook, Trading Methodology, Money Management and More!

Join us for a webinar on Mar 23, 2016 at 1:00 PM PDT.

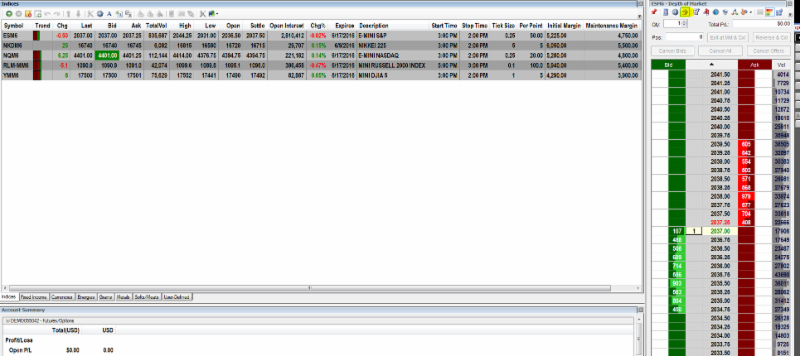

Today I would like to share a tip on our E-futures Int’l platform.

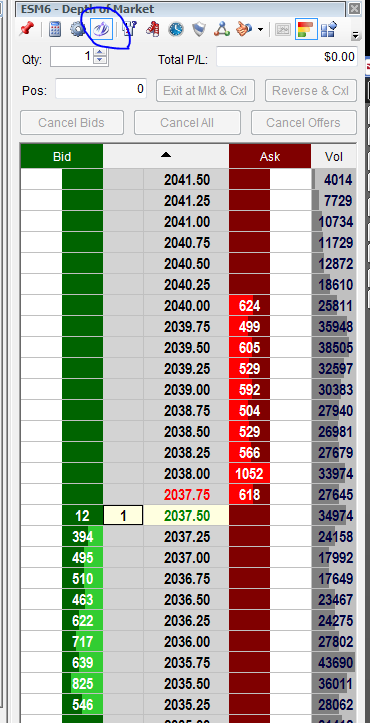

How to link the DOM to the quote-board so if you select different markets on your quotes, it will change the DOM you are using to the market quote you are viewing:

In screenshot below, you will see a little icon highlighted on the top of the DOM. It is the icon one can use if you would like to link your DOM to your quote-board.

if you do NOT see this icon ( larger screen shot below)

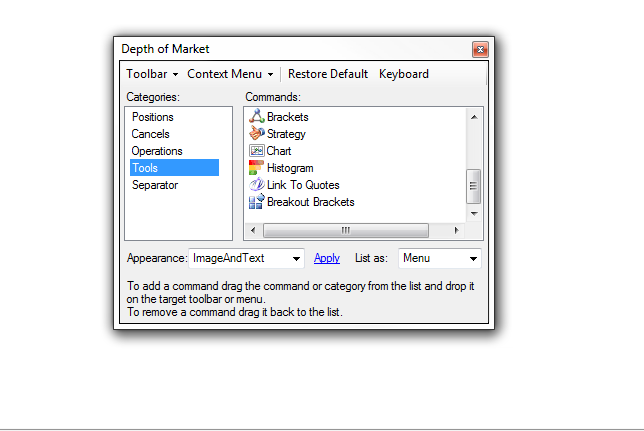

RIGHT click on the border of the DOM and select configure.

Than from the menu, select tools, scroll down on the right side and select the “link to quotes” command.

Have you checked out iSystems?? This cutting edge technology allows you to select, activate, change and view in real time professionally designed trading systems! Check out live data at: https://cannon.isystems.com

TRADE SMART / TRADE SYSTEMS — for the current rankings as well as actual performance of trading systems traded at Striker, click here.

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

| Contract June 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2060.67 | 4476.08 | 17678 | 1108.53 | 95.90 |

| Resistance 2 | 2052.58 | 4448.67 | 17615 | 1104.07 | 95.65 |

| Resistance 1 | 2047.17 | 4431.58 | 17567 | 1098.73 | 95.51 |

| Pivot | 2039.08 | 4404.17 | 17504 | 1094.27 | 95.27 |

| Support 1 | 2033.67 | 4387.08 | 17456 | 1088.93 | 95.13 |

| Support 2 | 2025.58 | 4359.67 | 17393 | 1084.47 | 94.88 |

| Support 3 | 2020.17 | 4342.58 | 17345 | 1079.13 | 94.74 |

| Contract | Apr. Gold | May Silver | May Crude Oil | June Bonds | June Euro |

| Resistance 3 | 1268.6 | 16.15 | 43.55 | 164 22/32 | 1.1353 |

| Resistance 2 | 1262.7 | 16.04 | 42.68 | 164 1/32 | 1.1333 |

| Resistance 1 | 1253.1 | 15.95 | 42.16 | 162 30/32 | 1.1302 |

| Pivot | 1247.2 | 15.84 | 41.29 | 162 9/32 | 1.1282 |

| Support 1 | 1237.6 | 15.75 | 40.77 | 161 6/32 | 1.1251 |

| Support 2 | 1231.7 | 15.64 | 39.90 | 160 17/32 | 1.1231 |

| Support 3 | 1222.1 | 15.55 | 39.38 | 159 14/32 | 1.1200 |

| Contract | May Corn | May Wheat | May Beans | May SoyMeal | April Nat Gas |

| Resistance 3 | 375.3 | 479.3 | 915.33 | 274.03 | 1.98 |

| Resistance 2 | 372.7 | 475.7 | 910.17 | 271.87 | 1.94 |

| Resistance 1 | 371.1 | 471.1 | 906.08 | 270.33 | 1.88 |

| Pivot | 368.4 | 467.4 | 900.92 | 268.17 | 1.84 |

| Support 1 | 366.8 | 462.8 | 896.8 | 266.6 | 1.8 |

| Support 2 | 364.2 | 459.2 | 891.67 | 264.47 | 1.74 |

| Support 3 | 362.6 | 454.6 | 887.58 | 262.93 | 1.68 |

Economic Reports

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:01pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| TueMar 22 | 4:00am | EUR | French Flash Manufacturing PMI | 50.2 | 50.2 | ||||

| EUR | French Flash Services PMI | 49.5 | 49.2 | ||||||

| 4:30am | EUR | German Flash Manufacturing PMI | 50.9 | 50.5 | |||||

| EUR | German Flash Services PMI | 55.1 | 55.3 | ||||||

| 5:00am | EUR | German Ifo Business Climate | 106.1 | 105.7 | |||||

| EUR | Flash Manufacturing PMI | 51.4 | 51.2 | ||||||

| EUR | Flash Services PMI | 53.5 | 53.3 | ||||||

| 5:30am | GBP | CPI y/y | 0.4% | 0.3% | |||||

| GBP | PPI Input m/m | 0.4% | -0.7% | ||||||

| GBP | Public Sector Net Borrowing | 5.4B | -11.8B | ||||||

| GBP | RPI y/y | 1.3% | 1.3% | ||||||

| GBP | Core CPI y/y | 1.2% | 1.2% | ||||||

| GBP | HPI y/y | 6.9% | 6.7% | ||||||

| GBP | PPI Output m/m | 0.0% | -0.1% | ||||||

| 6:00am | EUR | German ZEW Economic Sentiment | 6.3 | 1.0 | |||||

| EUR | ZEW Economic Sentiment | 8.2 | 13.6 | ||||||

| 9:00am | USD | HPI m/m | 0.5% | 0.4% | |||||

| 9:30am | GBP | MPC Member Forbes Speaks | |||||||

| 9:45am | USD | Flash Manufacturing PMI | 51.6 | 51.0 | |||||

| 10:00am | EUR | Belgian NBB Business Climate | -6.0 | -6.6 | |||||

| USD | Richmond Manufacturing Index | -1 | -4 |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.