Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday July 1, 2016

Hello Traders,

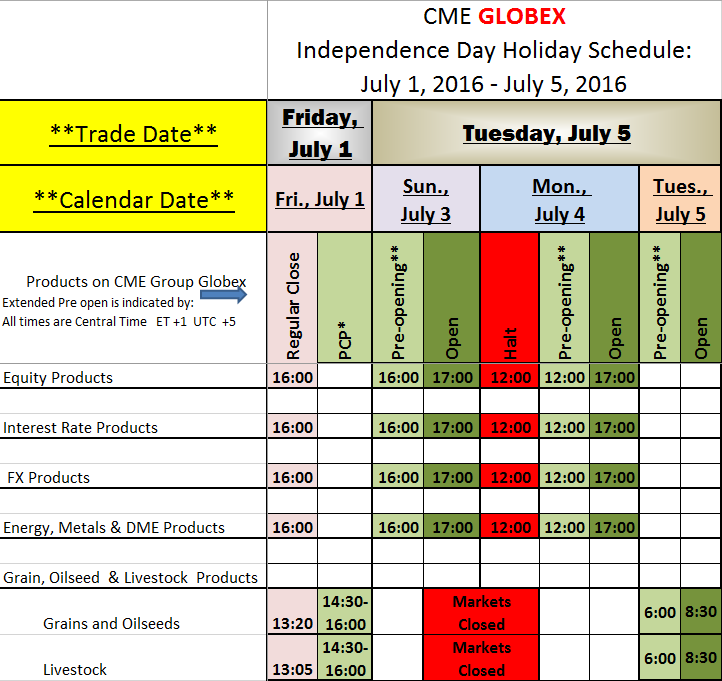

4th of July Trading Schedule:

Please have a Safe and Happy Holiday!!

From the CME Globex Control Center, here is the summary of KEY changes, per CME market segment –

Friday – ALL REGULAR closes

Sunday night – NORMAL OPEN times for all markets, EXCEPT grains and meats = remain closed.

Monday – ALL open markets go into HALT at 12:00 noon

– (except grains and meats = stay closed)

Monday night – NORMAL OPEN times – (except grains and meats = stay closed)

Tuesday morning – grains and meats pre-open 6:00 am, OPEN at 8:30 am

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

| Contract Sept. 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2134.58 | 4501.67 | 18169 | 1184.67 | 97.42 |

| Resistance 2 | 2112.92 | 4456.08 | 17998 | 1166.83 | 96.95 |

| Resistance 1 | 2099.83 | 4429.67 | 17898 | 1157.37 | 96.46 |

| Pivot | 2078.17 | 4384.08 | 17727 | 1139.53 | 95.99 |

| Support 1 | 2065.08 | 4357.67 | 17627 | 1130.07 | 95.50 |

| Support 2 | 2043.42 | 4312.08 | 17456 | 1112.23 | 95.03 |

| Support 3 | 2030.33 | 4285.67 | 17356 | 1102.77 | 94.54 |

| Contract | Aug. Gold | Sept. Silver | Aug. Crude Oil | Sept. Bonds | Sept. Euro |

| Resistance 3 | 1341.0 | 19.72 | 50.74 | 175 10/32 | 1.1324 |

| Resistance 2 | 1333.8 | 19.31 | 50.18 | 174 17/32 | 1.1254 |

| Resistance 1 | 1329.8 | 19.08 | 49.29 | 173 16/32 | 1.1191 |

| Pivot | 1322.6 | 18.67 | 48.73 | 172 23/32 | 1.1122 |

| Support 1 | 1318.6 | 18.44 | 47.84 | 171 22/32 | 1.1059 |

| Support 2 | 1311.4 | 18.03 | 47.28 | 170 29/32 | 1.0989 |

| Support 3 | 1307.4 | 17.80 | 46.39 | 169 28/32 | 1.0926 |

| Contract | Dec. Corn | Sept. Wheat | Nov. Beans | Dec. SoyMeal | Aug. Nat Gas |

| Resistance 3 | 401.3 | 471.5 | 1247.42 | 435.50 | 3.05 |

| Resistance 2 | 392.9 | 462.5 | 1204.08 | 421.00 | 3.00 |

| Resistance 1 | 382.1 | 454.0 | 1178.67 | 411.00 | 2.96 |

| Pivot | 373.7 | 445.0 | 1135.33 | 396.50 | 2.90 |

| Support 1 | 362.8 | 436.5 | 1109.9 | 386.5 | 2.9 |

| Support 2 | 354.4 | 427.5 | 1066.58 | 372.00 | 2.81 |

| Support 3 | 343.6 | 419.0 | 1041.17 | 362.00 | 2.77 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:16pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| FriJul 1 | 3:15am | EUR |

Spanish Manufacturing PMI

|

52.1 | 51.8 | ||||

| 3:45am | EUR |

Italian Manufacturing PMI

|

52.7 | 52.4 | |||||

| 3:50am | EUR |

French Final Manufacturing PMI

|

47.9 | 47.9 | |||||

| 3:55am | EUR |

German Final Manufacturing PMI

|

54.5 | 54.4 | |||||

| 4:00am | EUR |

Final Manufacturing PMI

|

52.6 | 52.6 | |||||

| EUR |

Italian Monthly Unemployment Rate

|

11.7% | 11.7% | ||||||

| 4:30am | GBP |

Manufacturing PMI

|

50.0 | 50.1 | |||||

| 5:00am | EUR |

Unemployment Rate

|

10.1% | 10.2% | |||||

| 9:45am | USD |

Final Manufacturing PMI

|

51.4 | 51.4 | |||||

| 10:00am | USD |

ISM Manufacturing PMI

|

51.3 | 51.3 | |||||

| USD |

Construction Spending m/m

|

0.6% | -1.8% | ||||||

| USD |

ISM Manufacturing Prices

|

63.9 | 63.5 | ||||||

| All Day | USD |

Total Vehicle Sales

|

17.3M | 17.4M |