Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday August 31, 2016

Hello Traders,

Greetings!

December bonds are now front month for those of you trading bonds, ten years etc.!

December silver and December gold are also the front month!

Tomorrow is the last trading day of the month. Certain markets will experience certain trading behavior on the last trading day of the month.

Bonds are known to make some sharp moves right around 1:30 Central time ( 30 minutes before what used to be the pit close)

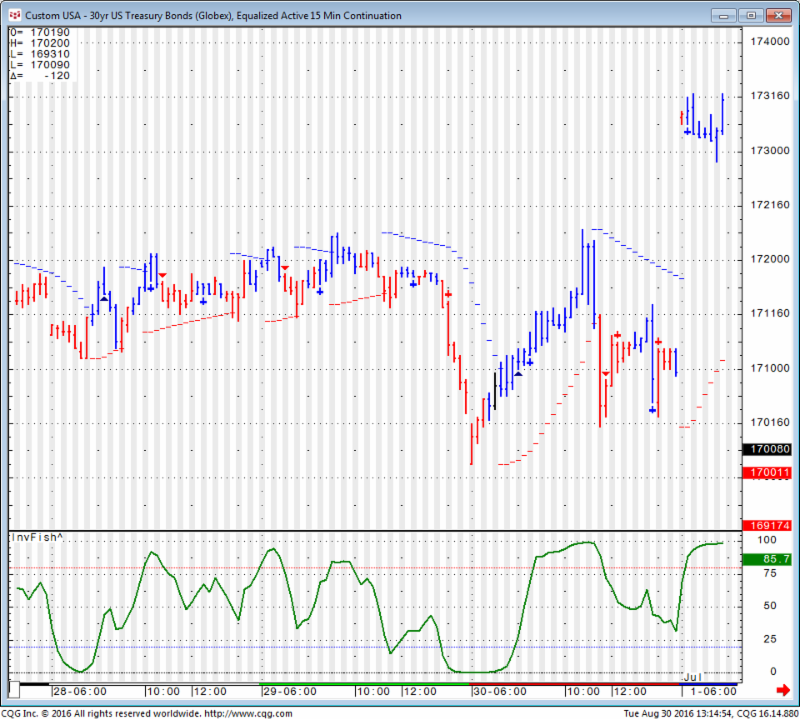

Here is a bond chart from last month’s last trading day….Pay attention to the WIDE range during the whole day and the large moves in the last hour!

Also tomorrow is Wednesday. Crude Oil numbers come out.

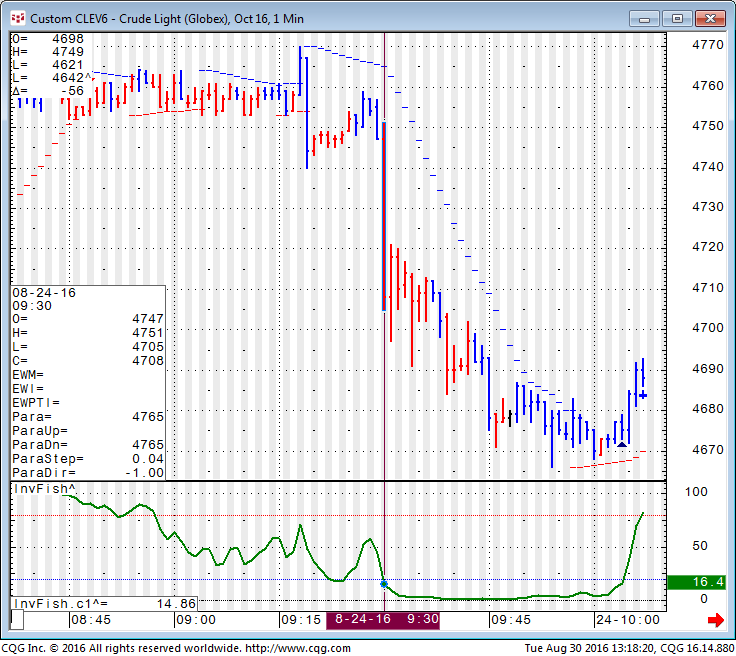

Here is what Crude did last week….1 minute chart right before and after report came out…

Keep a trading journal! Write notes.

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Levels for Trade Date of 8.31.2016

| Contract Sept. 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2195.00 | 4835.33 | 18622 | 1257.73 | 96.91 |

| Resistance 2 | 2188.25 | 4816.92 | 18568 | 1252.97 | 96.52 |

| Resistance 1 | 2182.00 | 4796.58 | 18508 | 1249.43 | 96.29 |

| Pivot | 2175.25 | 4778.17 | 18454 | 1244.67 | 95.90 |

| Support 1 | 2169.00 | 4757.83 | 18394 | 1241.13 | 95.67 |

| Support 2 | 2162.25 | 4739.42 | 18340 | 1236.37 | 95.28 |

| Support 3 | 2156.00 | 4719.08 | 18280 | 1232.83 | 95.05 |

| Contract | Dec. Gold | Dec. Silver | Oct. Crude Oil | Dec. Bonds | Sept. Euro |

| Resistance 3 | 1341.2 | 19.32 | 48.48 | 171 7/32 | 1.1248 |

| Resistance 2 | 1335.0 | 19.18 | 47.99 | 170 29/32 | 1.1224 |

| Resistance 1 | 1324.3 | 18.93 | 47.20 | 170 20/32 | 1.1188 |

| Pivot | 1318.1 | 18.79 | 46.71 | 170 10/32 | 1.1164 |

| Support 1 | 1307.4 | 18.53 | 45.92 | 170 1/32 | 1.1128 |

| Support 2 | 1301.2 | 18.39 | 45.43 | 169 23/32 | 1.1104 |

| Support 3 | 1290.5 | 18.14 | 44.64 | 169 14/32 | 1.1068 |

| Contract | Dec. Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Oct. Nat Gas |

| Resistance 3 | 324.4 | 407.0 | 981.00 | 322.57 | 3.04 |

| Resistance 2 | 322.6 | 403.8 | 973.25 | 319.43 | 2.99 |

| Resistance 1 | 319.2 | 398.0 | 962.00 | 314.07 | 2.91 |

| Pivot | 317.3 | 394.8 | 954.25 | 310.93 | 2.86 |

| Support 1 | 313.9 | 389.0 | 943.0 | 305.6 | 2.8 |

| Support 2 | 312.1 | 385.8 | 935.25 | 302.43 | 2.74 |

| Support 3 | 308.7 | 380.0 | 924.00 | 297.07 | 2.66 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:10pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedAug 31 | 2:00am | EUR |

German Retail Sales m/m

|

0.5% | -0.1% | ||||

| GBP |

Nationwide HPI m/m

|

-0.1% | 0.5% | ||||||

| 2:45am | EUR |

French Consumer Spending m/m

|

0.3% | -0.8% | |||||

| EUR |

French Prelim CPI m/m

|

0.4% | -0.4% | ||||||

| 3:55am | EUR |

German Unemployment Change

|

-2K | -7K | |||||

| 4:00am | EUR |

Italian Monthly Unemployment Rate

|

11.5% | 11.6% | |||||

| 5:00am | EUR |

CPI Flash Estimate y/y

|

0.3% | 0.2% | |||||

| EUR |

Core CPI Flash Estimate y/y

|

0.9% | 0.9% | ||||||

| EUR |

Italian Prelim CPI m/m

|

0.1% | 0.2% | ||||||

| EUR |

Unemployment Rate

|

10.0% | 10.1% | ||||||

| 8:15am | USD |

ADP Non-Farm Employment Change

|

173K | 179K | |||||

| 9:45am | USD |

Chicago PMI

|

54.1 | 55.8 | |||||

| 10:00am | USD |

Pending Home Sales m/m

|

0.7% | 0.2% | |||||

| 10:30am | USD |

Crude Oil Inventories

|

1.1M | 2.5M |