Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday November 23, 2016

Greetings!

Dear Traders,

If you enjoy our blog and the information we share, please vote for us as #1 under the “Blog Section” and provide us with the strength and energy to continue and providing you with the best tips and information on this blog!!

You can vote daily, both for the blog and for Cannon Brokerage services!!

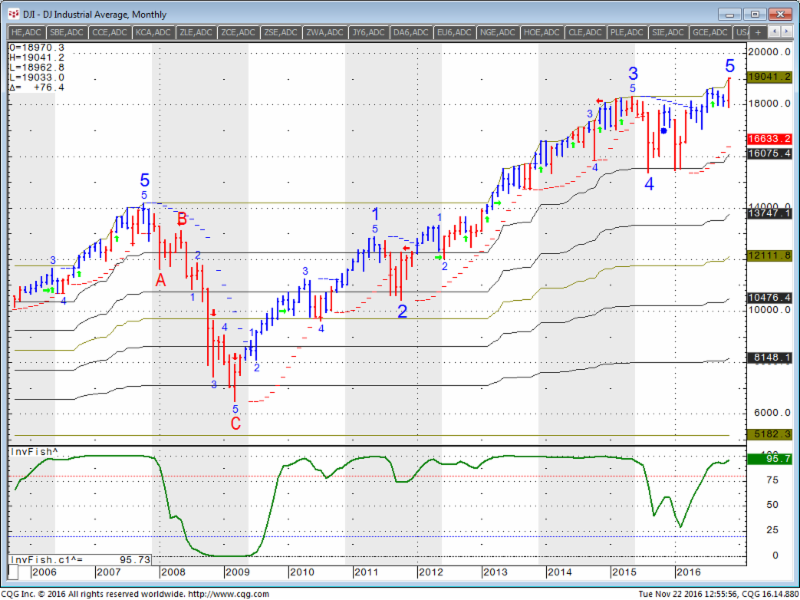

Stocks continue to make all time highs….MONTHLY chart of the Dow Jones Industrial for your review below:

On a different note, please review Thanksgiving holiday trading schedule:

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Levels for Trade Date of 11.23.2016

| Contract Dec. 2016 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2216.67 | 4914.25 | 19136 | 1353.13 | 102.06 |

| Resistance 2 | 2209.83 | 4899.50 | 19074 | 1344.47 | 101.72 |

| Resistance 1 | 2205.42 | 4886.50 | 19036 | 1339.83 | 101.40 |

| Pivot | 2198.58 | 4871.75 | 18974 | 1331.17 | 101.06 |

| Support 1 | 2194.17 | 4858.75 | 18936 | 1326.53 | 100.74 |

| Support 2 | 2187.33 | 4844.00 | 18874 | 1317.87 | 100.40 |

| Support 3 | 2182.92 | 4831.00 | 18836 | 1313.23 | 100.08 |

| Contract | Dec. Gold | Dec. Silver | Jan. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1235.5 | 17.21 | 51.01 | 155 4/32 | 1.0746 |

| Resistance 2 | 1228.2 | 17.05 | 50.11 | 154 23/32 | 1.0707 |

| Resistance 1 | 1220.2 | 16.85 | 48.98 | 154 1/32 | 1.0671 |

| Pivot | 1212.9 | 16.68 | 48.08 | 153 20/32 | 1.0632 |

| Support 1 | 1204.9 | 16.48 | 46.95 | 152 30/32 | 1.0596 |

| Support 2 | 1197.6 | 16.32 | 46.05 | 152 17/32 | 1.0557 |

| Support 3 | 1189.6 | 16.12 | 44.92 | 151 27/32 | 1.0521 |

| Contract | Dec. Corn | Dec. Wheat | Jan. Beans | Dec. SoyMeal | Dec. Nat Gas |

| Resistance 3 | 356.9 | 416.0 | 1052.75 | 335.13 | 3.10 |

| Resistance 2 | 354.3 | 413.8 | 1043.00 | 330.57 | 3.06 |

| Resistance 1 | 352.7 | 410.5 | 1036.50 | 327.73 | 3.00 |

| Pivot | 350.1 | 408.3 | 1026.75 | 323.17 | 2.96 |

| Support 1 | 348.4 | 405.0 | 1020.3 | 320.3 | 2.9 |

| Support 2 | 345.8 | 402.8 | 1010.50 | 315.77 | 2.86 |

| Support 3 | 344.2 | 399.5 | 1004.00 | 312.93 | 2.80 |

source:http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

| Date | 4:01pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedNov 23 | 3:00am | EUR |

French Flash Manufacturing PMI

|

51.5 | 51.8 | ||||

| EUR |

French Flash Services PMI

|

52.1 | 51.4 | ||||||

| 3:30am | EUR |

German Flash Manufacturing PMI

|

54.8 | 55.0 | |||||

| EUR |

German Flash Services PMI

|

54.1 | 54.2 | ||||||

| 4:00am | EUR |

Flash Manufacturing PMI

|

53.2 | 53.5 | |||||

| EUR |

Flash Services PMI

|

53.1 | 52.8 | ||||||

| Tentative | EUR |

German 10-y Bond Auction

|

0.12|1.5 | ||||||

| 6:30am | GBP |

MPC Member Forbes Speaks

|

|||||||

| 7:30am | GBP |

Autumn Forecast Statement

|

|||||||

| 8:30am | USD |

Core Durable Goods Orders m/m

|

0.2% | 0.1% | |||||

| USD |

Unemployment Claims

|

241K | 235K | ||||||

| USD |

Durable Goods Orders m/m

|

1.2% | -0.3% | ||||||

| 9:00am | USD |

HPI m/m

|

0.5% | 0.7% | |||||

| 9:45am | USD |

Flash Manufacturing PMI

|

53.6 | 53.4 | |||||

| 10:00am | USD |

New Home Sales

|

591K | 593K | |||||

| USD |

Revised UoM Consumer Sentiment

|

91.6 | 91.6 | ||||||

| USD |

Revised UoM Inflation Expectations

|

2.7% | |||||||

| 10:30am | USD |

Crude Oil Inventories

|

5.3M | ||||||

| 12:00pm | USD |

Natural Gas Storage

|

30B | ||||||

| 2:00pm | USD |

FOMC Meeting Minutes

|