Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Dear Traders,

* Wishing all of you the best in 2017 – Trading wise, health and all that you wish for! *** To start the new year, a look at a different approach to futures trading ( I highly recommend to speak with one of our brokers before attempting to take any action with a strategy you are NOT familiar with):

|

Moore Research Center, Inc.

Free Futures Trading Strategy Of The Month

|

||||||||

|

Seasonal

Strategy |

Entry

Date |

Exit

Date |

Win

Pct |

Win

Years |

Loss

Years |

Total

Years |

Average

Profit |

Average Profit

Per Day |

|

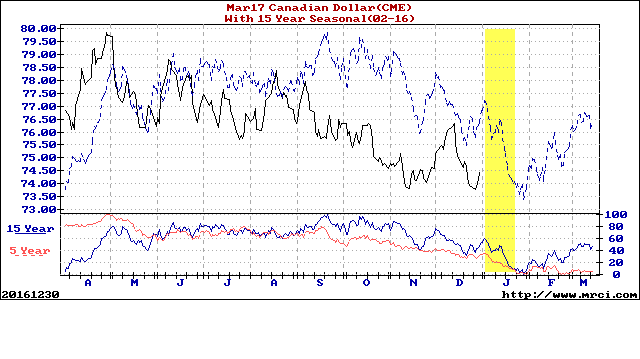

Sell Mar Canadian Dollar(CME)-CDH7

|

01/03/2017

|

01/22/2017

|

87

|

13

|

2

|

15

|

1395

|

70/20

|

|

Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 years. There are usually underlying fundamental circumstances that occur annually that tend to cause the futures markets to react in a similar directional manner during a certain calendar period of the year. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees, and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past or will in the future achieve profits utilizing these strategies. No representation is being made that price patterns will recur in the future. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Results not adjusted for commission and slippage.

*** Please vote! the competition ends January 31st and you can vote every day, even if you voted before. ****

GOOD TRADING

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Levels for Trade Date of 01.04.2017

| Contract March 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2281.50 | 4981.67 | 20062 | 1402.17 | 105.02 |

| Resistance 2 | 2270.50 | 4954.58 | 19971 | 1389.93 | 104.42 |

| Resistance 1 | 2261.50 | 4930.92 | 19886 | 1378.07 | 103.83 |

| Pivot | 2250.50 | 4903.83 | 19795 | 1365.83 | 103.23 |

| Support 1 | 2241.50 | 4880.17 | 19710 | 1353.97 | 102.64 |

| Support 2 | 2230.50 | 4853.08 | 19619 | 1341.73 | 102.04 |

| Support 3 | 2221.50 | 4829.42 | 19534 | 1329.87 | 101.45 |

| Contract | Feb. Gold | March Silver | Feb. Crude Oil | Mar. Bonds | March Euro |

| Resistance 3 | 1188.3 | 17.23 | 57.60 | 153 3/32 | 1.0669 |

| Resistance 2 | 1177.2 | 16.89 | 56.42 | 152 | 1.0596 |

| Resistance 1 | 1168.8 | 16.62 | 54.47 | 151 10/32 | 1.0518 |

| Pivot | 1157.7 | 16.28 | 53.29 | 150 7/32 | 1.0446 |

| Support 1 | 1149.3 | 16.00 | 51.34 | 149 17/32 | 1.0368 |

| Support 2 | 1138.2 | 15.66 | 50.16 | 148 14/32 | 1.0295 |

| Support 3 | 1129.8 | 15.39 | 48.21 | 147 24/32 | 1.0217 |

| Contract | March Corn | March Wheat | Mar. Beans | March SoyMeal | Feb. Nat Gas |

| Resistance 3 | 365.7 | 420.0 | 1010.67 | 323.23 | 3.81 |

| Resistance 2 | 362.1 | 417.0 | 1007.33 | 320.97 | 3.69 |

| Resistance 1 | 358.9 | 411.8 | 1001.17 | 316.53 | 3.51 |

| Pivot | 355.3 | 408.8 | 997.83 | 314.27 | 3.39 |

| Support 1 | 352.2 | 403.5 | 991.7 | 309.8 | 3.2 |

| Support 2 | 348.6 | 400.5 | 988.33 | 307.57 | 3.09 |

| Support 3 | 345.4 | 395.3 | 982.17 | 303.13 | 2.91 |

All times are Eastern time Zone (EST)

source:http://www.forexfactory.com/calendar.php

| Date | 3:51pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| WedJan 4 | 3:00am | EUR |

Spanish Unemployment Change

|

-44.2K | 24.8K | ||||

| 3:15am | EUR |

Spanish Services PMI

|

54.8 | 55.1 | |||||

| 3:45am | EUR |

Italian Services PMI

|

52.7 | 53.3 | |||||

| 3:50am | EUR |

French Final Services PMI

|

52.6 | 52.6 | |||||

| 3:55am | EUR |

German Final Services PMI

|

53.8 | 53.8 | |||||

| 4:00am | EUR |

Final Services PMI

|

53.1 | 53.1 | |||||

| 4:30am | GBP |

Construction PMI

|

52.6 | 52.8 | |||||

| GBP |

Net Lending to Individuals m/m

|

4.9B | 4.9B | ||||||

| GBP |

M4 Money Supply m/m

|

1.4% | 1.1% | ||||||

| GBP |

Mortgage Approvals

|

69K | 68K | ||||||

| 5:00am | EUR |

CPI Flash Estimate y/y

|

1.0% | 0.6% | |||||

| EUR |

Core CPI Flash Estimate y/y

|

0.8% | 0.8% | ||||||

| EUR |

Italian Prelim CPI m/m

|

0.3% | -0.1% | ||||||

| All Day | USD |

Total Vehicle Sales

|

17.9M | ||||||

| 2:00pm | USD |

FOMC Meeting Minutes

|