Cannon Trading / E-Futures.com

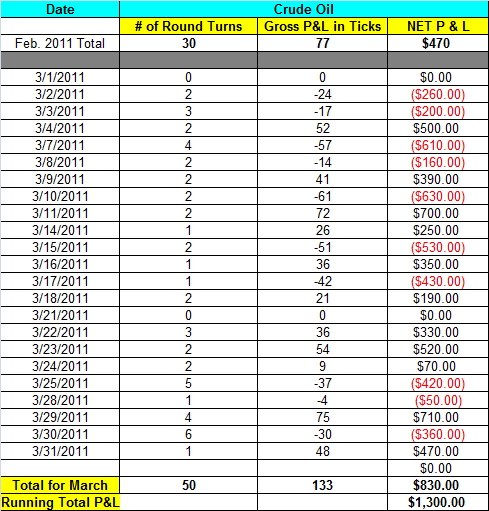

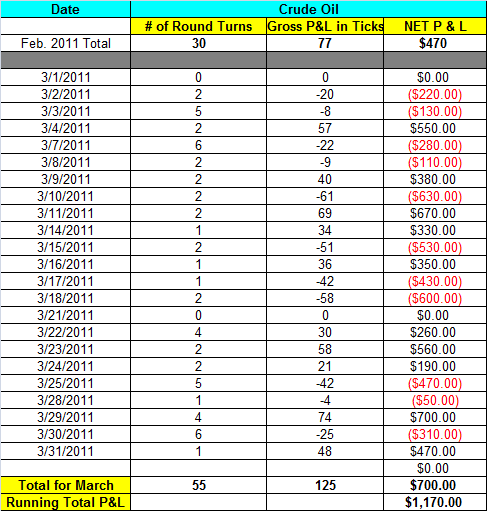

Below you will see two different tables for Crude Oil since we are now executing the system for more than a few clients, using two different trading engines with two different clearing house. Since the system is only executed “semi Automatically” you will see some differences in the results. This is simply part of REAL LIVE, REAL TIME TRADING versus hypothetical trading. In hypothetical trading and/or back testing, computers assume perfect conditions, getting filled on all limit orders etc.

in REAL LIVE trading, there are times when you limit gets hit but you don’t get filled, there is room for human or machine errors etc.

NET RESULTS AFTER COMMISSIONS BELOW:

Group A:

Group B:

* Past performance is not indicative of future results.

About NZL Crude Oil Day-Trading system:

The computerized trading system, “NZL-Crude Oil Day Trading” is based on a mathematical algorithm that tries to identify exhaustion in either selling or buying along with a possible short term trend reversal. This system trades the Crude Oil future contract only. The system uses volume charts to determine entry and exit ( rather than the more familiar time charts). The algorithm takes into consideration volume, momentum and speed of market in an attempt to recognize situation where “fear and greed” are at extremes. It is followed by measuring possible targets for profits along with stops. This specific system takes the approach that statistically the percent of winning trades is larger than losing trades but in return it uses larger stops than targets.

We recommend $7500 of risk capital per 1 contract traded

Futures and options trading is risky and not suitable for everyone. There is a substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products.

Past performance is not indicative of future results.

GOOD TRADING!

TRADING LEVELS!

Economic Reports Friday April 1, 2011

FOMC Member Plosser Speaks

8:15am USD

Non-Farm Employment Change

8:35am USD

Unemployment Rate

8:30am USD

Average Hourly Earnings m/m

8:30am USD

FOMC Member Dudley Speaks

9:00am USD

ISM Manufacturing PMI

10:00am USD

Construction Spending m/m

10:00am USD

ISM Manufacturing Prices

10:00am USD

Total Vehicle Sales

All Day USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!