Dear Traders,

Get Real Time updates and more on our private FB group!

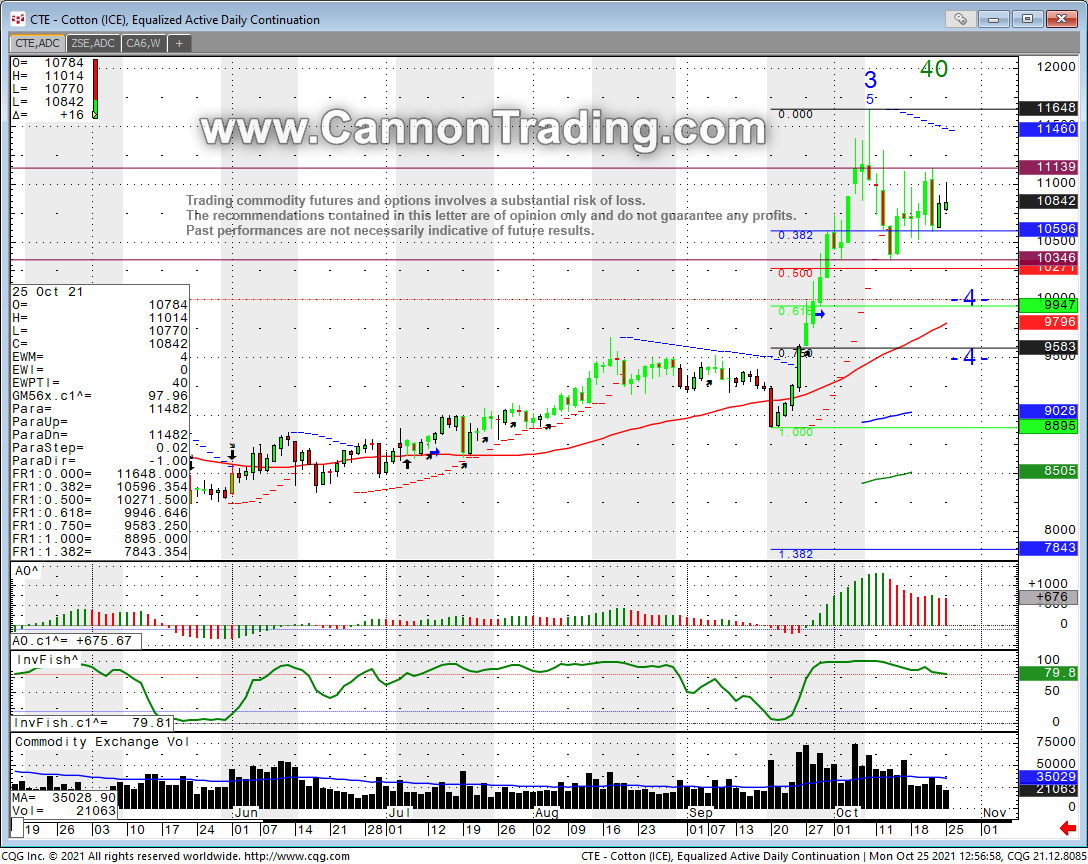

Cotton Futures: Another leg up or corrective price action first?

By John Thorpe, Senior broker

After the October 8th hi in the 116.50 area and the subsequent low Wednesday the 13th, 4 trading days later , in the 103.50 area (notional move of $6500.00 hi to lo ) today the markets expressed a slightly bullish tone to start the week at 108.42 up 14, the last 10 minutes saw profit taking. .

The

Cotton Futures market appears to be in a consolidation mode and preparing for a high energy move either up or down.. I would prepare to either buy an upside breakout with a stop order or sell one for a downside breakout with a stop.

contact your broker for instructions on placing a strategy order to accommodate such an eventuality. this market may just foment around here a few more days before we go high energy in either direction again. stayed tuned for updates.

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this letter are of opinion only and do not guarantee any profits.

There is not an actual account trading these recommendations.

Past performances are not necessarily indicative of future results.

Cotton Futures Daily Chart Below

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

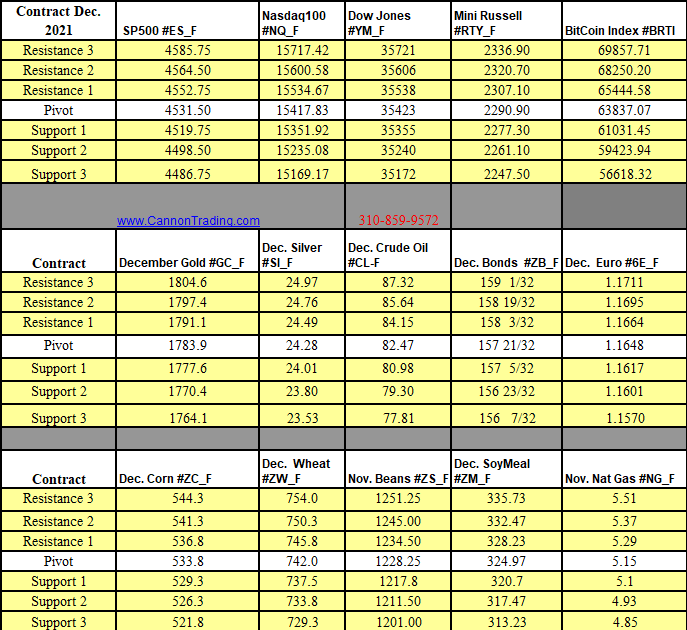

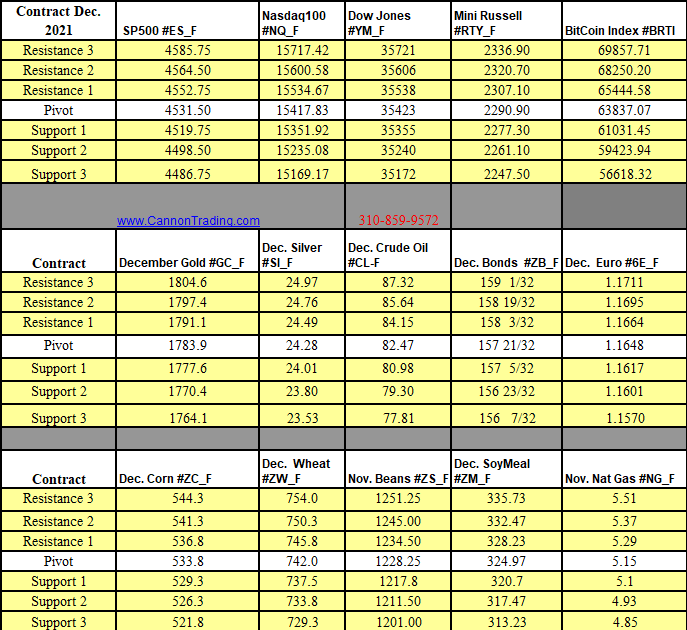

Futures Trading Levels

10-26-2020

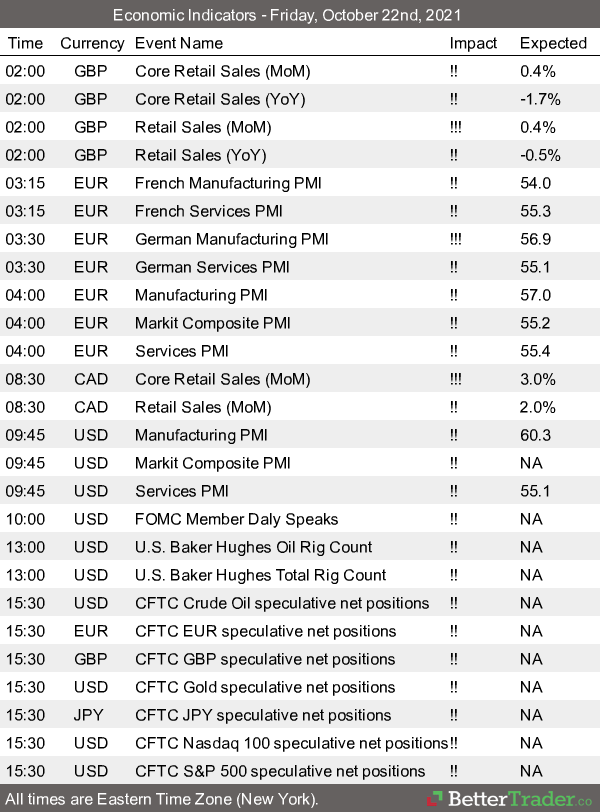

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.