Cannon Futures Weekly Newsletter Issue # 1161

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Trading Updates: Labor Day Schedule

- Trading Resource of the Week – First Notice & Last Trading Days

- Hot Market of the Week – December Wheat

- Broker’s Trading System of the Week – Micro NQ and ES Trading Systems

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Labor Day 2023 Holiday Schedule for CME / Globex and ICE Exchange

-

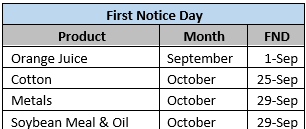

Trading Resource of the Week – : LT and FN ( Last trading & first Notice Days)

Below are the contracts which are entering First Notice or Last Trading Day for the upcoming month. Be advised, for contracts that are deliverable, it is requested that all LONG positions be exited two days prior to First Notice and ALL positions be exited the day prior to Last Trading Day.

-

Hot Market of the Week – December Wheat

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Wheat resumed it’s slide into new contract lows. Using the recent peak as the current leg, our next PriceCount objective is projected at $5.97

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

-

Broker’s Trading System of the Week

Are you interested in seeing how two different intraday trading systems perform in real time, live trading?

Cannon Trading offers you weekly updates on the results of these systems, which trade the MNQ (micro mini Nasdaq) and the ES (mini SP) respectively.

You can compare and contrast their strategies, risks, and returns, and decide which one suits your trading goals better. All you need is a minimum account size of $10,000 for the MNQ system and $25,000 for the ES system.

Sign Up for a Free Personalized Consultation with a Broker from Cannon Trading Company

Questions about the markets? trading? platforms? technology? trading systems? Get answers with a complimentary, confidential consultation with a Cannon Trading Company series 3 broker.

-

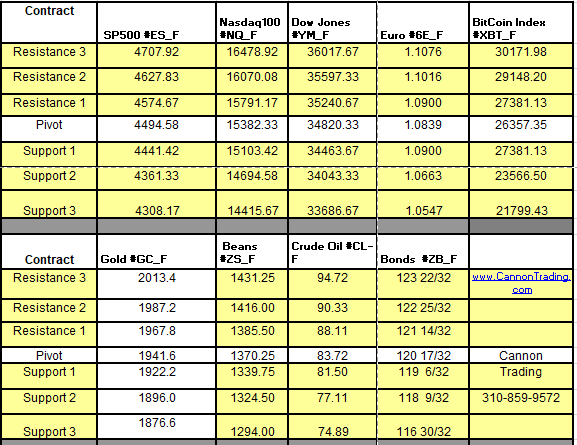

Trading Levels for Next Week

Daily Levels for September 4th/5th, 2023

Weekly Levels

-

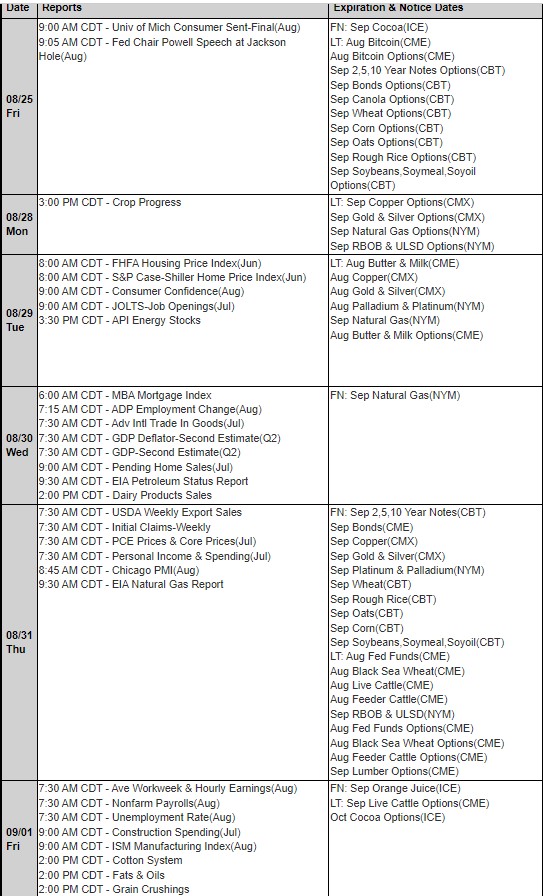

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week: www.mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.