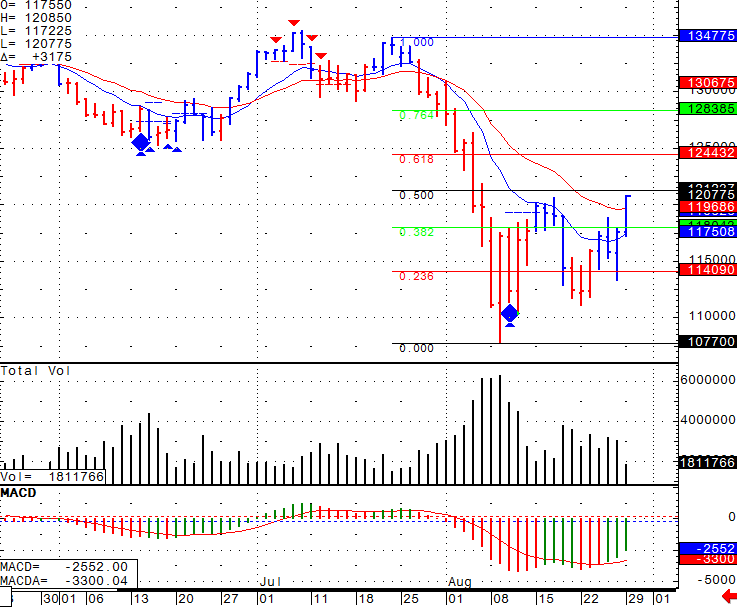

Market rallied close to 3% on the SP and Dow Jones. Again it did so on much lighter volume than when it sold off last few weeks but nonetheless one CANNOT argue with price action. We are approaching the 50% retracement level from the highs made on July 8th to lows made Aug 9th. That level on the mini SP is 1212.50. I believe that the 1212 to 1219 zone is an important resistance level to watch. If we break above it with meaningful volume, it may be a sign of further room to the upside, on the other hand if we fail against it and volume picks up with price action going lower, it may be a sign of resumed selling. As always in our business… time will tell. Plenty of economic reports this week, both in the US and in Europe. Last but not least it is the end of the month…. Wishing you great trading this week and Daily chart of the mini SP 500 for your review below.

Daily Futures chart for Mini S&P 500 from August 29th, 2011

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

GOOD TRADING!

TRADING LEVELS!

Economic Reports Tuesday August 30th, 2011

S&P/CS Composite-20 HPI y/y

9:00am USD

CB Consumer Confidence

10:00am USD

FOMC Member Kocherlakota Speaks

12:15pm USD

FOMC Meeting Minutes

2:00pm USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!