Cannon Futures Weekly Letter Issue # 1213

In this issue:

- Important Notices – Earnings & Fed Speakers

- Futures 101 – Ask a Broker: Day trading Futures? Margins?

- Hot Market of the Week – December Hogs

- Broker’s Trading System of the Week – Mini Russell Day Trading System

- Trading Levels for Next Week

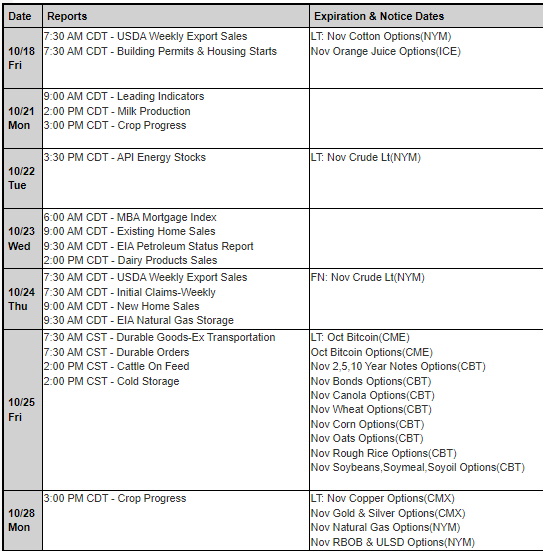

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

A fair amount of Speakers, Data and Earnings .

Just 2 ½ weeks to the U.S. Presidential Election. Nov 5th.

Economic Data:

Mon. CB Leading Indicators

Tue. Redbook, Richmond Fed

Wed. Mortgage Index

Thu. Chicago Fed Activity Index, Weekly Initial Jobless Claims, New Home Sales

Fri. Durable Goods, Michigan Consumer Sentiment.

Fed and ECB Speakers:

Mon. Logan, Kashkari, Schmid

Tue. 9A.M. Central ECB President Lagarde, Harker

Wed. Bowman, LaGarde 9 A.M. Central, Barkin

Thu. Hammack

Fri. quiet

Earnings: 608 3rd QTR. Reports this week

Prominent Companies reporting

Wed. Tesla, IBM, Coca-Cola

- Thu. UPS

|

|

|

“Trading Around Key Economic Reports” FREE SHORT Course you will learn:

- What is GDP?

- About the Retail Sales Report

- What is NFP ( non farm payroll) Report?

- Understanding US housing Data

- FOMC

- Understanding Oil Data Report

- Importance of Consumer Confidence Survey

-

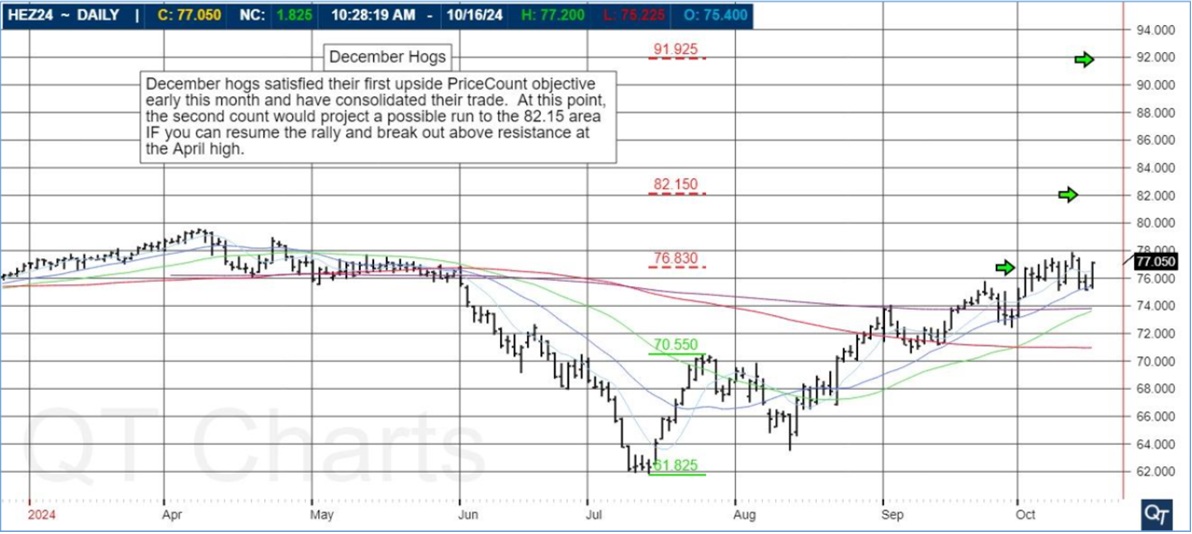

- Hot Market of the Week – December Hogs

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Hogs

December hogs satisfied their first upside PriceCount objective early this month and have consolidated their trade. At this point, the second count would project a possible run to the 82.15 area IF you can resume the rally and break out above resistance at the April high.

PriceCounts – Not about where we’ve been , but where we might be going next!

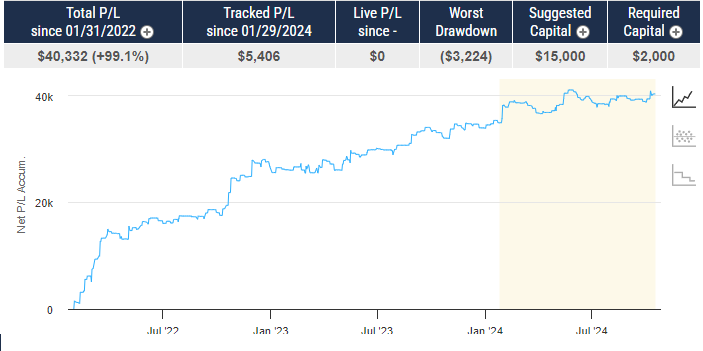

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

MVA 998 RTY 208

PRODUCT

RTY – Mini Russell 2000

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$10,000

COST

USD 80 / monthly

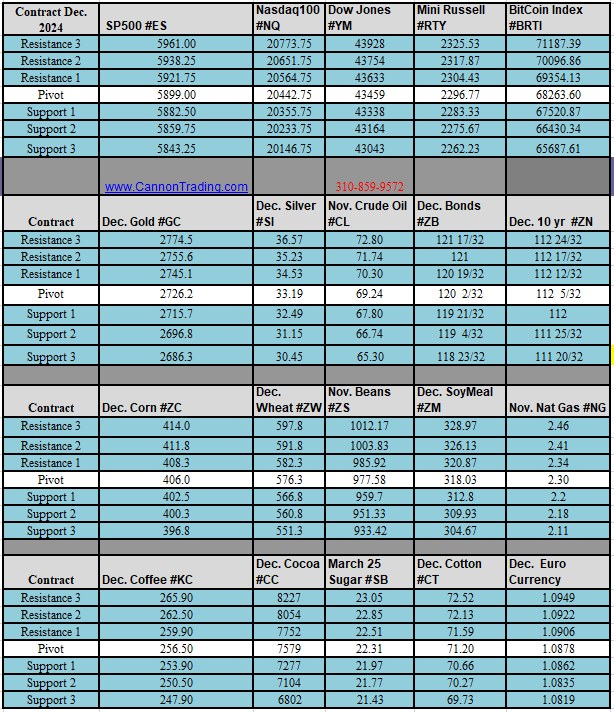

Daily Levels for October 21st, 2024

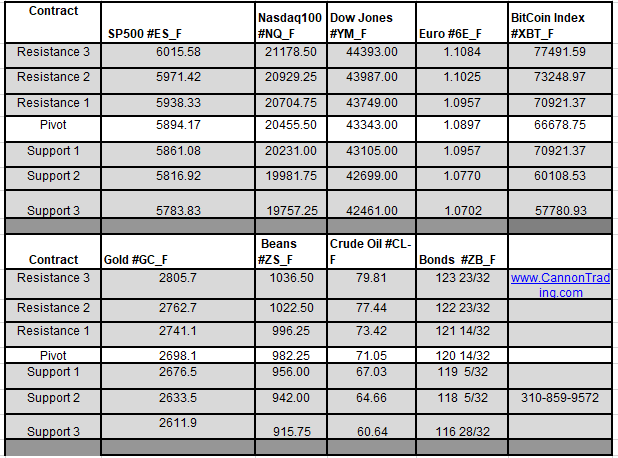

Weekly Levels for the week of October 21st, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.