Cannon Futures Weekly Letter Issue # 1215

In this issue:

- Important Notices – Elections, FOMC – Volatile Week ahead.

- Futures 102 – Crude Oil Outlook + Premium Daily Research

- Hot Market of the Week – March sugar

- Broker’s Trading System of the Week – Nikkei 225 Swing System

- Trading Levels for Next Week

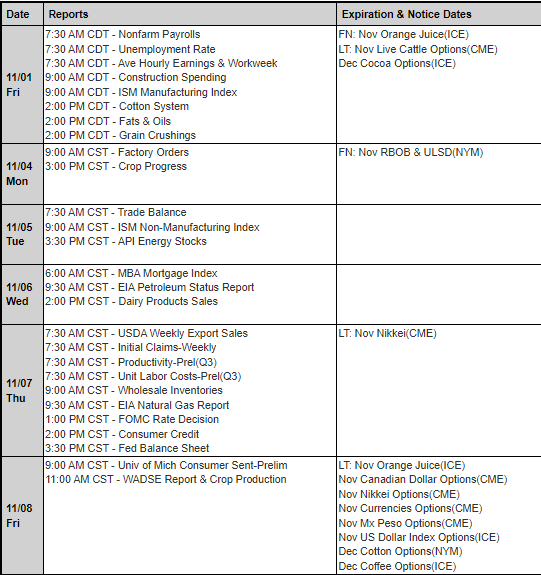

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Time change, Clocks “Fall Back” 1 hour in U.S. Nov. 2nd, US Presidential Election Nov 5th, Fed Rate announcement (expectations are .25 cut), 3756 corporate earnings reports and a few Economic data releases. To wit, Market volatility could be very high next week.

Many clearing firms will be raising margins to protect from and for the undercapitalized in what could be extreme moves related to the US Election outcomes which may not be known for hours or days following poll closings Tuesday evening.

Tuesday is the 60th U.S. Quadrennial Presidential Election, Polls close @ 7:00 P.M. in each of the 4 time zones. (a recent Nevada Supreme Court Ruling allows un-postmarked mail-in ballots received within 3 days past the official poll closing may be counted)

Prominent Earnings this Week:

- The following are the largest cap stocks reporting and for those that are little known, however their market cap is in the billions of dollars, I have provided lists of their core services, you will agree they fulfill critical roles in our internet of things infrastructure.

- Wed. Qualcomm, ARM Holdings (operates as a holding company, which engages in the licensing, marketing, research, and development of microprocessors, systems IP, graphics processing units, physical IP and associated systems IP, software, and tools.) Gilead Sciences report post close.

- Thu. Arista Networks (engages in the development, marketing, and sale of cloud networking solutions. Its solutions include EOS, a set of network applications, and Gigabit Ethernet switching and routing platforms. Its product categories include Core, Cognitive Adjacencies, and Network Software and Services) AirBNB

FED SPEECHES:

- Mon. quiet

- Tue. quiet

- Wed. Day 1 FOMC

- Thu. Day 2 FOMC Rate Decision 1pm CST, Powell Presser @ 1:30 pm CST

- Fri. quiet

Big Economic Data week:

- Mon. Factory Orders

- Tues. U.S. Trade Balance, ISM Services PMI, Redbook

- Wed. Quiet

- Thur. Retail Inventories, Jobless Claims, FED RATE Decision

- Fri. Michigan Consumer Sentiment, agricultural numbers>WASDE 11:00 a.m. CST

|

Futures 102: Crude Oil In Depth Analysis

Please click here to instantly view a PDF with Crude Oil outlook for the short, medium and long term.

With tensions in Middle East yoyoing…you may want o read and view the outlook provided by Artac Advisory!

-

- Hot Market of the Week – March Sugar

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March Sugar

March sugar is attempting to break out of a bull flag formation. If successful, it would support a challenge of the September high and potentially the contract high from late 2023. At this point, new sustained highs would project a possible run to the third upside PriceCount objective to the 25.84 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

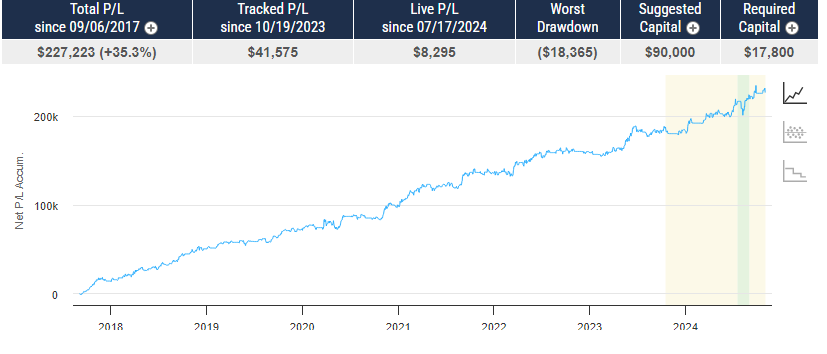

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

QuantumFusion ProMax

PRODUCT

NK – Nikkei 225

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 165 / monthly

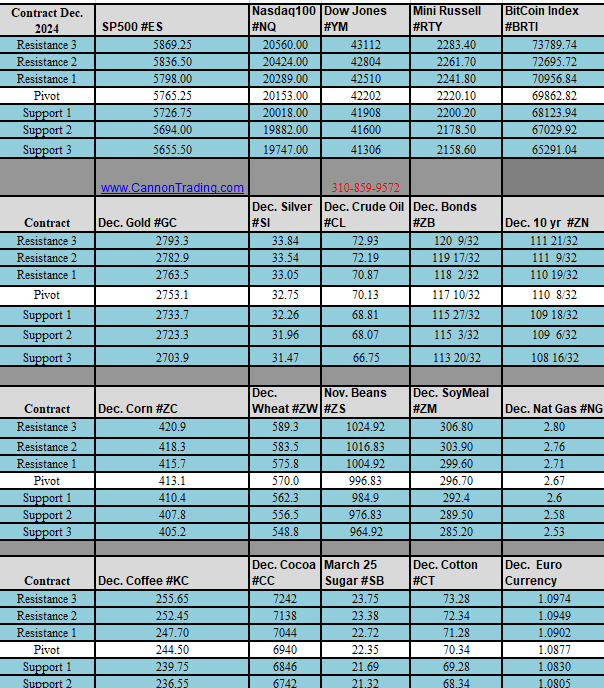

Daily Levels for November 4th, 2024

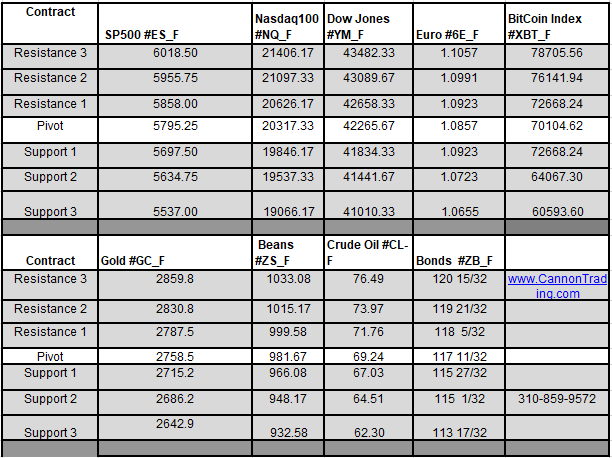

Weekly Levels for the week of November 4th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.