Movers and shakers!

By John Thorpe, Senior Broker

Fed Chair Powell speaks tomorrow.

WTI Backwardation:

For a short period of time now, the Crude oil markets structure has been in Backwardation. Backwardation is where the spot or front futures contract is trading at higher prices than the future or deferred months.

In the short run , this could be seen as bullish for the commodity, meaning there is a more aggressive need to own or hold the product now, rather than in the future. This could be the result of supply chain issues, geopolitical threats, or in very few cases short covering rallies.

Front Month WTI Crude, January is currently trading at 70.04 up 1.94 from yesterdays close. 40 cents higher than the next month February , and a full dollar higher than April contract currently trading at 69.04..

Backwardation can resolve itself in a day or within months, depending on the perception and severity of the supply side shortage or the demand side aggression.

You may have heard the opposite of Backwardation in the futures markets is Contango. Contango is typically considered a carrying charge market, where the future price or deferred contract prices are higher as a result of cost to carry, storage and insurance.

Today’s movers and shakers

updated: December 3, 2024 9:00 am

**US October 2024 Job Openings and Labor Turnover Summary (JOLTS): 7.744 mln; prior month 7.443 mln

Updated: December 3, 2024 11:33 am

San Francisco Fed President Daly: will have restrictive policy until inflation gets to 2%

Updated: December 3, 2024 11:40 am

Fed Governor Kugler: worries Congress and Trump administration will affect productivity

Tomorrow’s Movers and Shakers.

Fed Chairman Jerome Powell Speaks @ 12:45 CST NYTimes Dealbook Summit.

ADP 7:15 CST, SP Svcs PMI 8:45 CST, ISM Svcs PMI 9:00 CST

|

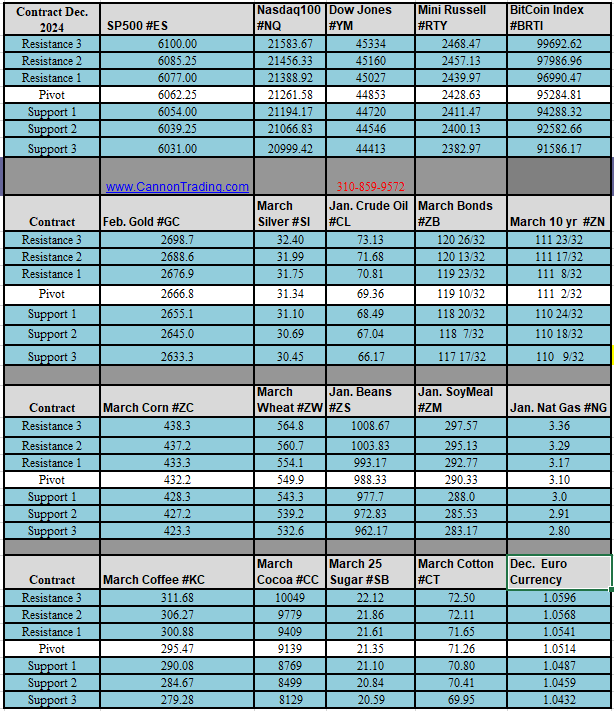

Daily Levels for December 4, 2024

Economic Reports

All times are Eastern Time ( New York)

Good Trading!

About: Cannon Trading is an independent futures brokerage firm established in 1988 in Los Angeles. Our mission is to provide reliable service along with the latest technological advances and choices while keeping our clients informed and educated in the field of futures and commodities trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|