Cannon Futures Weekly Letter Issue # 1221

In this issue:

- StoneX/E-Futures Platform Updates

- Important Notices – Earnings, FOMC, Rollover, The Week Ahead.

- Futures 102 – SP500 Outlook + Premium Daily Research Trial

- Hot Market of the Week – March Sugar

- Broker’s Trading System of the Week – NQ intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

- The new StoneX Futures platform will be up and running Monday, Dec. 16th.

- Your existing LIVE user name and password will be accepted.

- Your existing exchange data subscriptions will migrate to the new platform.

- To login to the new trading interface please login here:

https://m.cqg.com/stonexfutures

- If you like a demo ( and did not have a demo of StoneX Futures yet) CLICK HERE

- In the mean time, your E-Futures platform will stay active until a date no earlier than Fri., Dec. 27th, with a firm decommission date to be announced

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

- 122 corporate earnings reports and a number of meaningful Economic data releases including Core Personal Consumption and Expenditures Index (PCE) a closely watched Data point for the FED.Additionally, The final fed funds rate decision of 2024 will be announced on Wed. Dec. 18th, to be followed by Chairman Powell’s presser 30 minutes later.Below are the Rate change Probabilities as of this morning from the CME Fedwatch tool.

Prominent Earnings Next Week:

- Mon. Quiet (32 rpts)

- Tue. Quiet (19 rpts)

- Wed. Micron, Lennar Homes Post close

- Thu. Quiet (30 rpts)

- Fri. Quiet (18 rpts)

FED SPEECHES:

- Wed. 1:30 P.M. CST FOMC Chair Jerome Powell, leads Fed Presser on Rate decision.

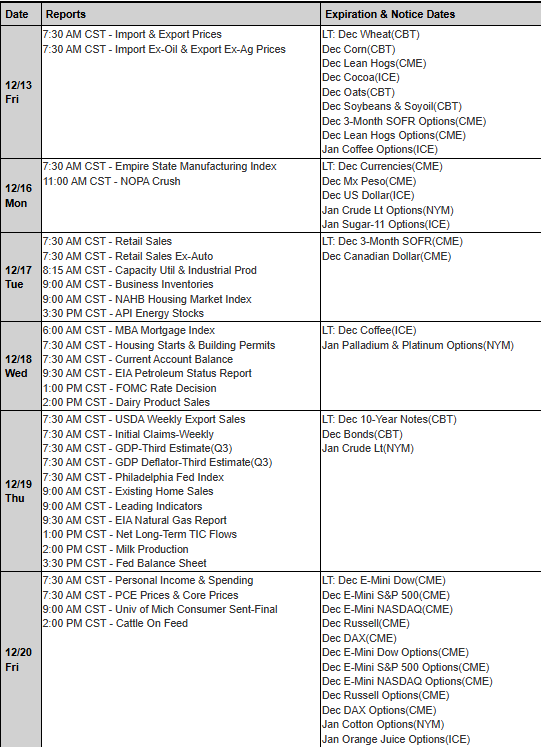

Economic Data week:

- Mon. NY Empire State Manu. Index, S&P Global PMI Composite,

- Tues. Retail Sales , Redbook, Industrial Production, Business Inventories, Housing Market Index,

- Wed. Bldg Permits, Housing Starts, FOMC Rate Decision, Economic projections

- Thur. Jobless claims, Core PCR, GDP Final, Philly Fed, Conference Board Leading Economic Indicators, Existing Home Sales

- Fri. Core PCE Price Index, Personal Income

- For stock index futures traders, it’s time to “roll over” and start trading the March ’25 futures contracts. This Friday, Dec. 20th at 8:30 A.M., Central Time, the Dec. ’24 futures contracts will officially halt trading and the exchange will cash settle all open positions.

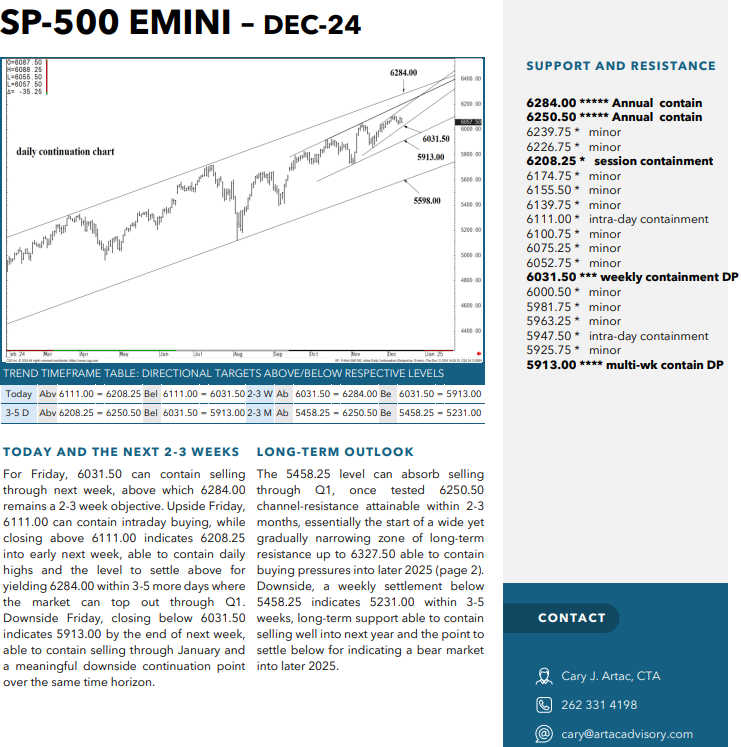

Futures 102: Daily Research Free Trial

Get Personalized Trading Reports Like the One Above Directly to your Inbox!

- Get qualified support and resistance levels for precise risk management on different commodity markets.

- Get pivot points that highlight shifts in the futures market momentum.

- Get technical forecasts to keep you on the right side of a specific commodity trading market.

- One on One “Daily Digest” with a dedicated series 3 professional.

-

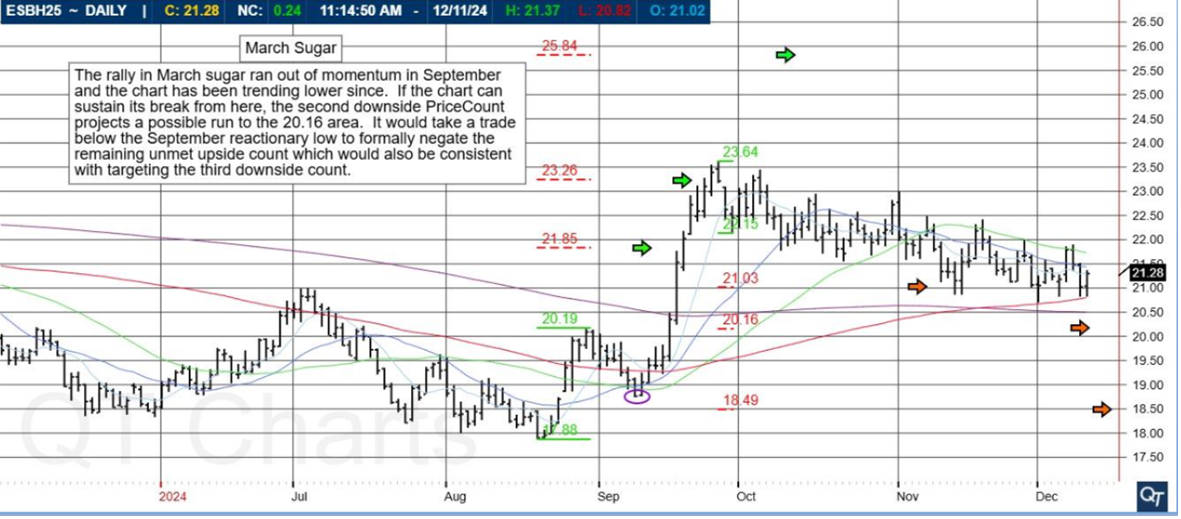

- Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

March Sugar

The rally in March sugar ran out of momentum and the chart has been trending lower since. If the chart can sustain its break from here, the second downside PriceCount projects a possible run to the 20.16 area. It would take a trade below the September reactionary low to formally negate the remaining unmet upside count which would also be consistent with targeting the third downside count.

PriceCounts – Not about where we’ve been , but where we might be going next!

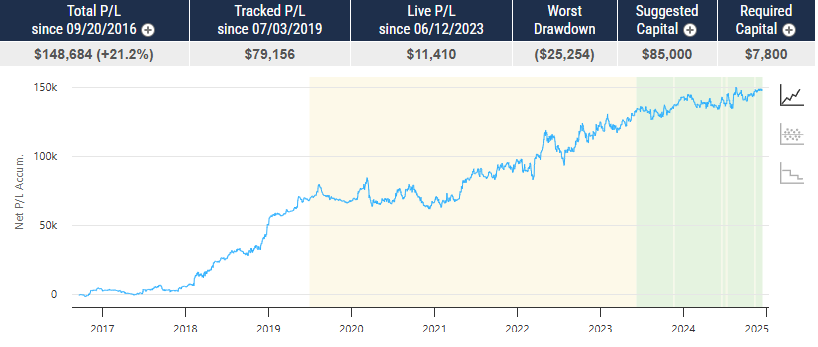

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

Fusion NQ

PRODUCT

Nasdaq 100 Mini

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 150 / monthly

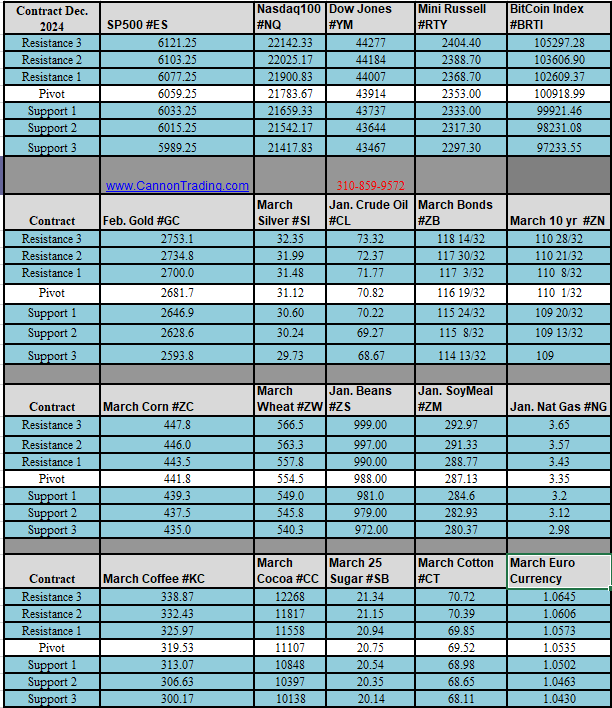

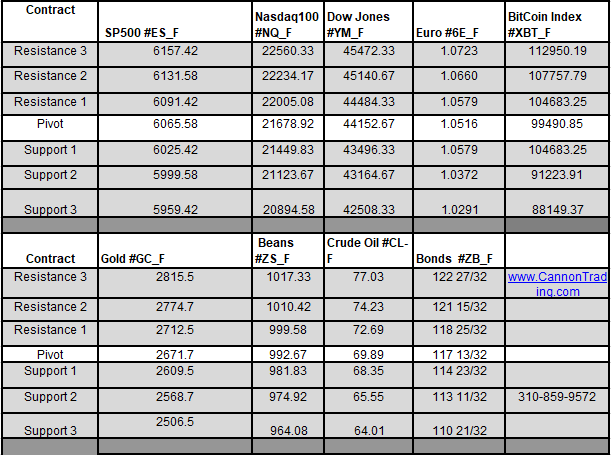

Daily Levels for December 16th, 2024

Weekly Levels for the week of

December 16th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.