The Day After FOMC – What will the Markets Do?

By Mark O’Brien, Senior Broker

General:

The Federal Reserve lowered interest rates by a quarter percentage point today, lowering the Fed’s benchmark federal-funds rate to a range between 4.25% and 4.5%, a two-year low.

“Today was a closer call but we decided it was the right call,” Powell told reporters at its post-announcement press conference. “It was the best decision to foster achievement of both of our goals,” referring to price stability and maximum employment.

The Fed cut rates at its two previous meetings, beginning with a half-percentage-point reduction in September and a quarter-point cut last month.

The Federal Reserve downgraded its view of how inflation will progress next year. Back in September officials had penciled in around four cuts next year. New projections released Wednesday show officials expect to make fewer rate reductions next year. Most penciled in two cuts for 2025 if the economy grows steadily and inflation continues to decline.

Stock Indexes:

The Dec. E-mini Dow Jones futures contract and its related cash index are approaching a fifty-year record with today’s sell-off capping a 10-day losing streak – its worst since an 11-day slide in 1974. Despite the streak, the Dow sits roughly 5% from an all-time high.

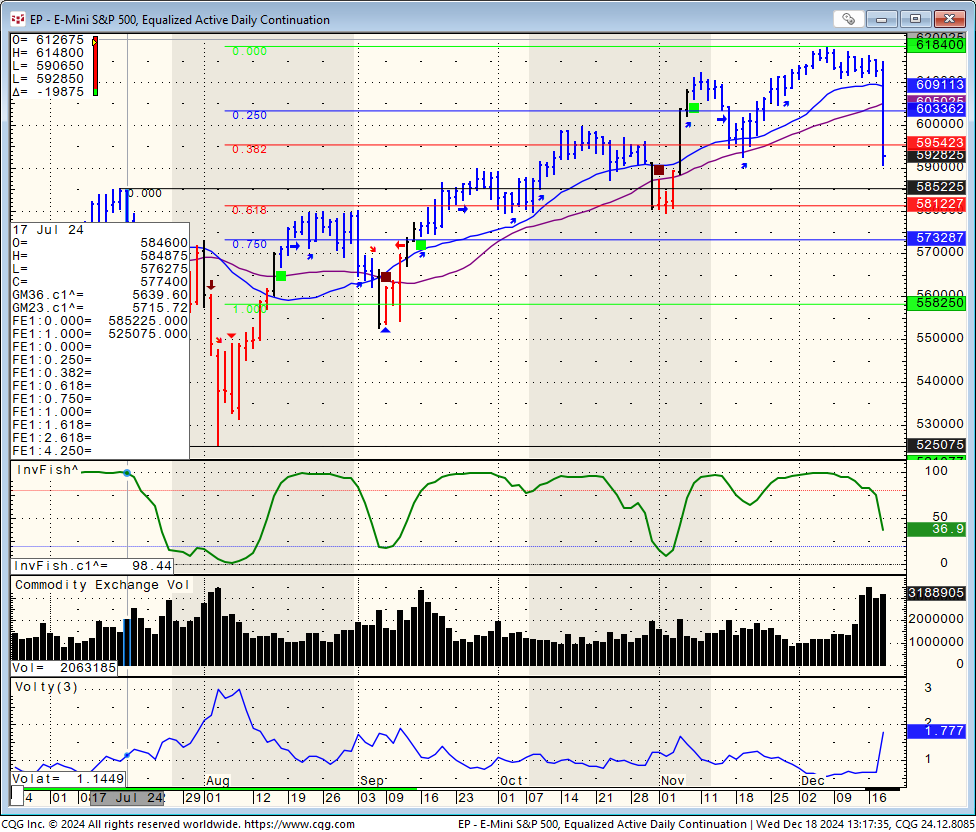

Stock index futures across the board sold off after the announcement. The Dec. E-mini S&P 500 has fallen ±160 points / ± 2.6% as of this typing, moving further away from its all-time closing high 6096.75 on Dec. 4.

Crypto:

After trading intraday yesterday to yet another all-time high of 108,960, December Bitcoin futures have fallen ±8000 points below 10100 late this session.

Daily Chart of the mini SP500 below:

|