In this issue:

- StoneX/E-Futures Platform Updates

- Important Notices – Earnings, CPI, PPI, Housing

- Futures 102 – World Cup Trading Championship

- Hot Market of the Week – March 10 Year Notes

- Broker’s Trading System of the Week – ES intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

To our clients whose accounts are with StoneX and currently using the E-Futures Platform:

- The new StoneX Futures platform will be up and running Monday, Dec. 16th.

- Your existing LIVE user name and password will be accepted.

- Your existing exchange data subscriptions will migrate to the new platform.

- To login to the new trading interface please login here:

https://m.cqg.com/stonexfutures

- If you like a demo ( and did not have a demo of StoneX Futures yet) CLICK HERE

- In the mean time, your E-Futures platform will stay active until a date no earlier than Fri., Dec. 27th, with a firm decommission date to be announced

|

| Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

766 corporate earnings reports as the season swings into action with the largest U.S. Banks! A number of meaningful Economic data releases including CPI, PPI and There will be a series of FED Speakers throughout the week.

Earnings Next Week:

- Mon. Quiet (59rpts mid and smallcaps)

- Tue. Quiet (25rpts Mid and smallcaps)

- Wed. (162 rpts) Pre-Open JP Morgan Chase, Wells Fargo, Goldman Sachs, Black Rock, Citigroup, Bank of NY, Oracle after the close

- Thu. ( 186 rpts) Pre-open Tiawan Semiconductor, United HealthCare, BofA, Morgan Stanley, US Bank.

- Fri. Quiet (108 mid and small caps rpts)

FED SPEECHES:

- Mon. Quiet

- Tues. Schmid 9 am CST, Williams 2:05 CST

- Wed. Barkin 8:20 CST, Kashkari 9 am CST, Williams 10 am CST, Goolsbee 11 am CST

- Thu. Quiet

- Fri. Quiet

Economic Data week:

- Mon. Consumer Inflation Expectations,

- Tues. RedBook, PPI

- Wed. CPI, NY Empire State Manufacturing Index

- Thur. Jobless claims, Philly Fed, Retail Sales, Business Inventories, NAHB Housing Market Index

- Fri. Building Permits, Housing Starts, Industrial Production

|

Futures 102: World Cup Trading Championship

Minimum Starting Balance

The minimum starting account balance is $10,000 for Futures and $5,000 for Forex.

Win a Bull & Bear Trophy

1st place finishers win a coveted pewter bull and bear trophy. 2nd and 3rd place finishers win beautiful crystal bull and bear trophies.

Global media exposure.

Prove your abilities on the world’s stage and build credibility.

Launch Your Trading Career

Top finishers may be invited to have their trading featured on WorldCupAdvisor.com. Subscribers may pay to follow their trades automatically.

ENTER NOW

|

|

|

|

|

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

FREE TRIAL AVAILABLE

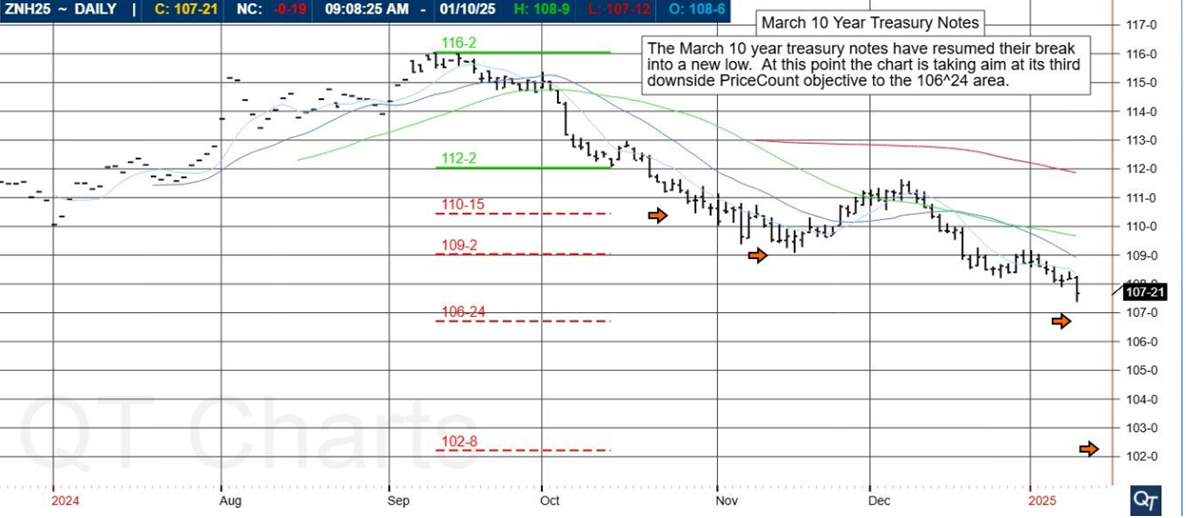

March 10 Year Treasury Notes

The March 10 year treasury notes have resumed their break into a new low. At this point the chart is taking aim at its third downside PriceCount objective to the 106^24 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

|

|

|

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

ES NZL

PRODUCT

Mini SP500

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$36,000

COST

USD 199 / monthly

Get Started

Learn More |

|

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

|

|

|

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

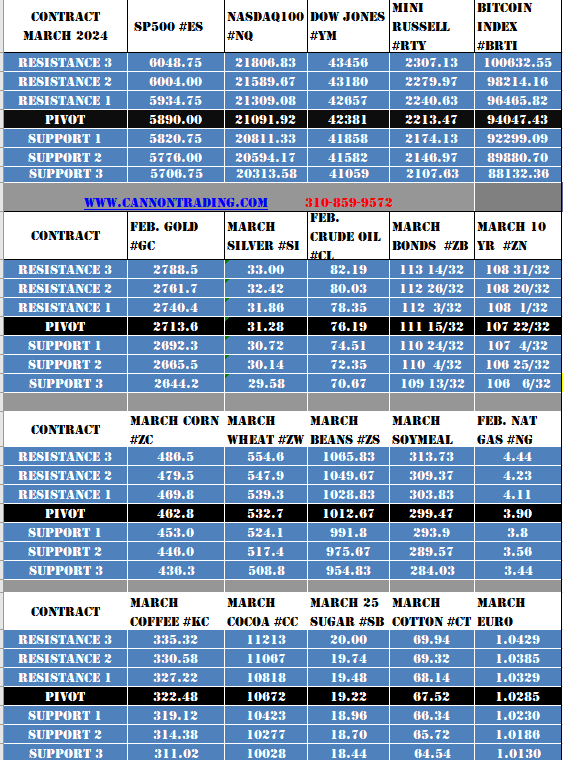

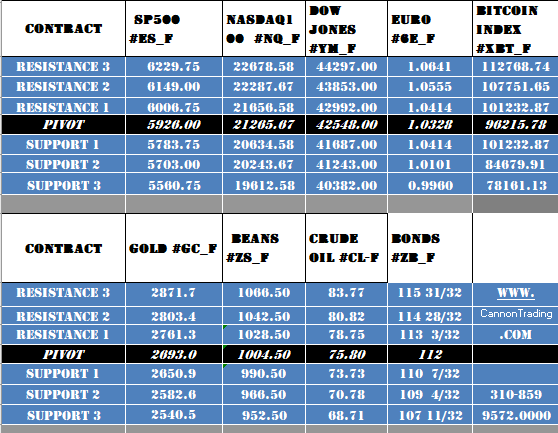

Daily Levels for January 13th, 2025

Weekly Levels

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

Good Trading!

About: Cannon Trading is an independent futures brokerage firm established in 1988 in Los Angeles. Our mission is to provide reliable service along with the latest technological advances and choices while keeping our clients informed and educated in the field of futures and commodities trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|