Jump to a section in this post:

1. Market Commentary

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

3. Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Support and Resistance Levels – March Corn, March Wheat, Jan Beans, March Silver

5.Economic Report for March 1, 2012

Happy Leap Day!

Hello Traders,

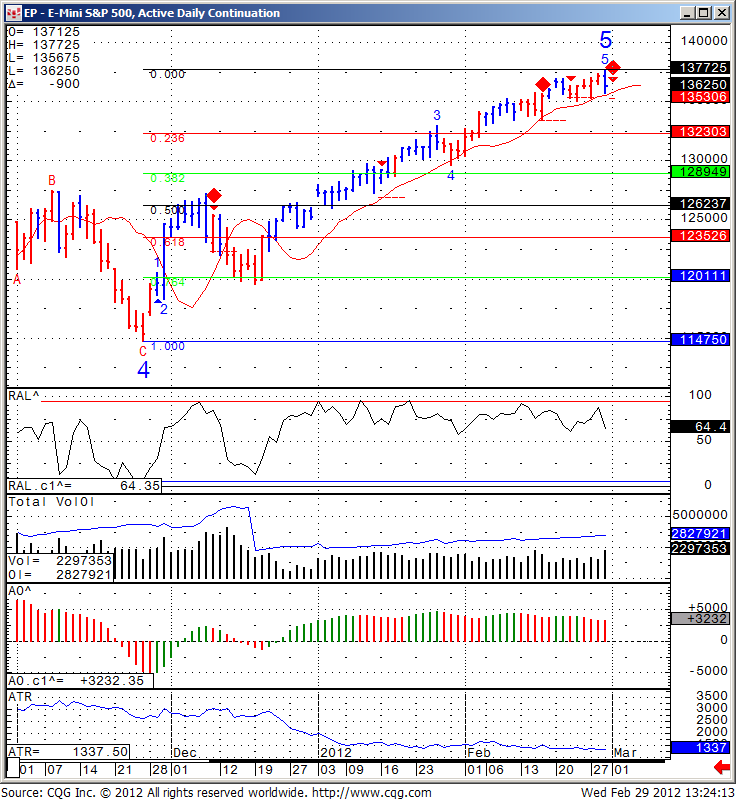

Daily chart of the Mini SP500 for your review below.

After more than a few narrow trading sessions on relatively low volume, we had a small reversal and breakout to the down side on above than avg. volume.

I would look to be a seller as a swing trading idea if the market breaks below 1356.

My recommended stop would be 1379.00 and my initial target would be 1323 followed by 1289.

Of course this is just my opinion using technical analysis and each trader should make their own trading decision based on their risk tolerance and their own judgment but I thought I would share it with the blog readers.

2. Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000

| Contract (March 2012) | SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance Level 3 | 1388.50 | 2671.67 | 13138 | 842.80 |

| Resistance Level 2 | 1382.75 | 2658.33 | 13087 | 836.20 |

| Resistance Level 1 | 1374.00 | 2640.67 | 13018 | 824.30 |

| Pivot Point | 1368.25 | 2627.33 | 12967 | 817.70 |

| Support Level 1 | 1359.50 | 2609.67 | 12898 | 805.80 |

| Support Level 2 | 1353.75 | 2596.33 | 12847 | 799.20 |

| Support Level 3 | 1345.00 | 2578.67 | 12778 | 787.30 |

3. Support & Resistance Levels for Gold, Euro, Crude Oil, and U.S. T-Bonds

| Contract | April. Gold | March Euro | April Crude Oil | March. Bonds |

| Resistance Level 3 | 1865.8 | 1.3610 | 110.56 | 144 6/32 |

| Resistance Level 2 | 1829.0 | 1.3549 | 108.99 | 143 15/32 |

| Resistance Level 1 | 1761.9 | 1.3438 | 107.97 | 142 18/32 |

| Pivot Point | 1725.1 | 1.3377 | 106.40 | 141 27/32 |

| Support Level 1 | 1658.0 | 1.3266 | 105.38 | 140 30/32 |

| Support Level 2 | 1621.2 | 1.3205 | 103.81 | 140 7/32 |

| Support Level 3 | 1554.1 | 1.3094 | 102.79 | 139 10/32 |

4. Support & Resistance Levels for Corn, Wheat, Beans and Silver

| Contract | May Corn | May Wheat | May Beans | May Silver |

| Resistance Level 3 | 669.4 | 680.5 | 1340.67 | 4057.3 |

| Resistance Level 2 | 665.3 | 676.0 | 1332.33 | 3907.7 |

| Resistance Level 1 | 661.7 | 672.0 | 1326.17 | 3681.8 |

| Pivot Point | 657.6 | 667.5 | 1317.83 | 3532.2 |

| Support Level 1 | 653.9 | 663.5 | 1311.7 | 3306.3 |

| Support Level 2 | 649.8 | 659.0 | 1303.33 | 3156.7 |

| Support Level 3 | 646.2 | 655.0 | 1297.17 | 2930.8 |

5. Economic Reports

4:00am EUR

Italian Monthly Unemployment Rate

5:00am EUR

CPI Flash Estimate y/y

5:00am EUR

Unemployment Rate

5:00am EUR

Italian Prelim CPI m/m

8:30am USD

Unemployment Claims

8:30am USD

Core PCE Price Index m/m

0.2%

0.2%

8:30am USD

Personal Spending m/m

8:30am USD

Personal Income m/m

10:00am USD

Fed Chairman Bernanke Testifies

10:00am USD

ISM Manufacturing PMI

10:00am USD

Construction Spending m/m

10:00am USD

ISM Manufacturing Prices

10:30am USD

FOMC Member Raskin Speaks

10:30am USD

Natural Gas Storage

All Day USD

Total Vehicle Sales

12:30pm USD

FOMC Member Lockhart Speaks