Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

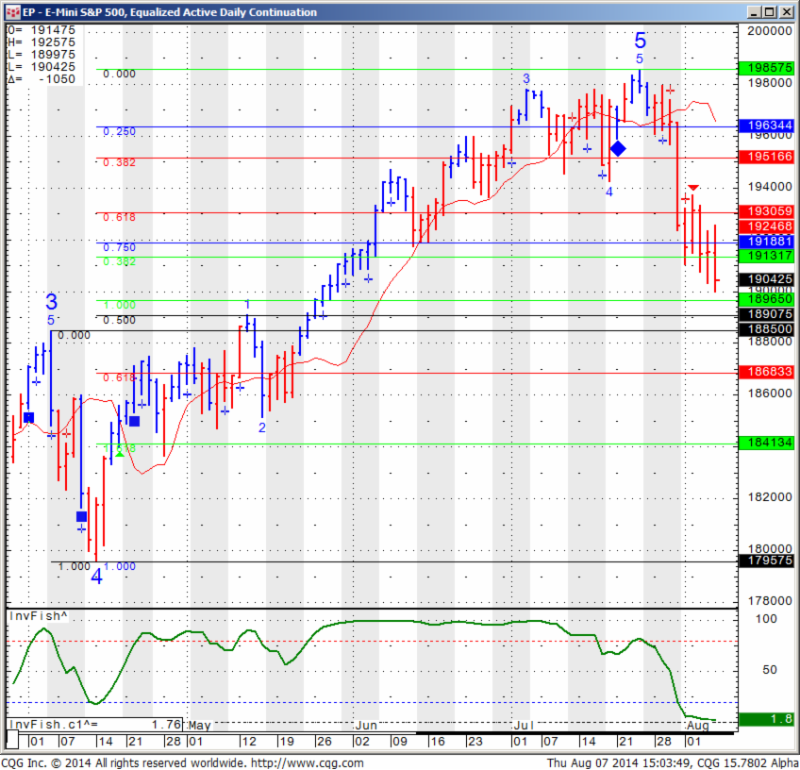

SP 500 made new lows and about to test a series of support levels as one can see in the daily chart below:

We have few levels of support between 1885 and 1896.50 in case we break again below the psychological 1900 mark.

I mentioned a couple of days ago support of 1795 by mistake and was asked by few of the readers. That was a typo the support I meant to write is 1895.

Looks like we will visit that level and zone very soon, maybe as early as night session. My best guess is for an initial bounce of that level. Just a guess. Either way I will look to see what kind of reaction we get if and when we get down there.

A strong bounce may signal some more upside, however a break below 1895-1885 level may actually make my 1795 typo into a reality…

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Sept. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 1946.75 | 3937.00 | 16607 | 1144.83 | 81.99 |

| Resistance 2 | 1936.25 | 3914.75 | 16533 | 1137.57 | 81.86 |

| Resistance 1 | 1920.75 | 3885.25 | 16428 | 1127.03 | 81.72 |

| Pivot | 1910.25 | 3863.00 | 16354 | 1119.77 | 81.59 |

| Support 1 | 1894.75 | 3833.50 | 16249 | 1109.23 | 81.45 |

| Support 2 | 1884.25 | 3811.25 | 16175 | 1101.97 | 81.32 |

| Support 3 | 1868.75 | 3781.75 | 16070 | 1091.43 | 81.18 |

| Contract | December Gold | Sept.Silver | Sept. Crude Oil | September Bonds | Sept. Euro |

| Resistance 3 | 1331.7 | 2036.3 | 99.21 | 140 26/32 | 1.3452 |

| Resistance 2 | 1324.0 | 2024.7 | 98.46 | 140 4/32 | 1.3424 |

| Resistance 1 | 1318.3 | 2011.3 | 98.04 | 139 24/32 | 1.3395 |

| Pivot | 1310.6 | 1999.7 | 97.29 | 139 2/32 | 1.3367 |

| Support 1 | 1304.9 | 1986.3 | 96.87 | 138 22/32 | 1.3338 |

| Support 2 | 1297.2 | 1974.7 | 96.12 | 138 | 1.3310 |

| Support 3 | 1291.5 | 1961.3 | 95.70 | 137 20/32 | 1.3281 |

| Contract | Dec Corn | Sept. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 375.3 | 562.8 | 1086.33 | 354.73 | 36.45 |

| Resistance 2 | 373.4 | 562.5 | 1082.17 | 352.37 | 36.30 |

| Resistance 1 | 372.3 | 562.0 | 1080.08 | 349.93 | 36.17 |

| Pivot | 370.4 | 561.8 | 1075.92 | 347.57 | 36.02 |

| Support 1 | 369.3 | 561.3 | 1073.8 | 345.1 | 35.9 |

| Support 2 | 367.4 | 561.0 | 1069.67 | 342.77 | 35.74 |

| Support 3 | 366.3 | 560.5 | 1067.58 | 340.33 | 35.61 |

source: http://www.forexfactory.com/calendar.php

All times are Eastern time Zone (EST)

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.