Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

No special words of wisdom today…..Just a sharing a monthly chart of Dow Jones Cash Index.

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

No special words of wisdom today…..Just a sharing a monthly chart of Dow Jones Cash Index.

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Trading Systems 101: Filtering out the noise for proper evaluation

As we dive further into the twenty first century, many fantasy and futurist ideas from the past have slowly become a reality: watches double as phones, robots can clean our homes, and even though they can’t fly yet-our cars can greet us and give us directions. Many people believe that the evolution of all this technology has led to a decrease in human interaction, and while that may be true and a negative in some aspects; there can be an advantage when the emotional roller coaster of the human mind is taken out of the question.

Despite even the most logically set minds on Wall Street, psychology plays a huge role in the market. Emotions run high, there are hasty impulses, and often a lack of self-control. Most trading professionals will agree that the human element can, at times, severely impact the trading goals and strategies of the trader as they strive for profit and attempt to escape the pain of losses. This is where technology can save us from ourselves.

Well-designed automated trading systems ( visit: https://cannon.isystems.com ) can offer the possibility of neutralizing the main psychological enemies of traders. Algorithmic (Algo) trading systems are written by investment professionals who know the markets intimately and offer a fast and wise decision making process that eliminates emotion, procrastination, and irrational decisions that human nature draws out.

That being said, I get too many emails about systems claiming to have the crystal ball or producing results that are too good to be true. 99.9% of the time, if it is too good to be true it is simply not true…..

Continue reading “Trading Systems 101 + Levels & Economic Reports for October 25th 2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Most Common Pitfalls To Avoid When Trading Futures-Commodity Futures

500 experienced futures brokers were asked what caused most futures traders to lose money when comes to trading futures.

Their answers reflected the trading experience of more than 10,000 futures traders. Download the PDF and find out what they said.

Many futures traders trade without a plan. They do not define specific risk and profit objectives before trading. Even if they establish a plan, they “second guess” it and don’t stick to it, particularly if the trade is a loss. Consequently, they overtrade and use their equity to the limit (are undercapitalized), which puts them in a squeeze and forces them to liquidate positions. Usually, they liquidate the good trades and keep the bad ones.

Many traders don’t realize the news they hear and read has, in many cases, already been discounted by the market.

After several profitable trades, many speculators become wild and nonconservative. They base their trades on hunches and long shots, rather than sound fundamental and technical reasoning, or put their money into one deal that “can’t fail.”

Traders often try to carry too big a position with too little capital and trade too frequently for the size of the account.

Some traders try to “beat the market” by day trading, nervous scalping, and getting greedy.

Continue reading “Top 50 Trading Rules + Levels & Economic Reports for October 24th 2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Would you like to learn more about options on futures?

Perhaps use options to protect futures positions?

Maybe as a speculation?

Or maybe you have experience and understand the risks & rewards of selling option premium?

Download the report along with examples of different strategies at:

https://www.cannontrading.com/tools/education-futures-options-trading-101

Continue reading “Learn more about options on futures 10-20-2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Interesting read and topic by the CME group:

E-mini Russell 2000 Index Futures Spread Trading

Deflation Basics Series: The Quantity Theory of Money

By Elliott Wave International

Here’s our challenge.

In order to be aware of the investment pitfalls and opportunities that deflation can bring, we must first understand the basic elements of why it occurs. So our challenge is to try and make monetary economics, a subject that most people would find duller than watching paint dry on a wall, understandable and, dare I say it, fun! It’s a big ask but we like a test, and so here is the first in our Deflation Basics Series — The Quantity Theory of Money.

To read the rest of the article please click on the link below:

Continue reading “E-mini Russell 2000 Index Futures Spread Trading article 10.18.2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

I have touched about this topic before in different ways but definitely worth revisiting.

I call it: “There is more to daytrading futures than the mini SP 500….”

When we first started offering online futures trading, back in 1997, mini SP was the king.

Stock index futures had more volatility, the market was actually moving both up and DOWN..and it was the first electronic contract. 20 years later, there are almost no pits….ALL markets are electronic, stocks been going up, almost in a straight line and we are in zero rates/ zero volatility type of environment. I am sure this will change, big question is when.

Until it does….if you have not already done so here are a few pointers I am throwing at you for further thought, exploration:

I am sure there is more but hope these few pointers will help you explore trading the right way. Continue reading “Futures Trading Levels & Economic Reports for October 17th 2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Day Trading 101: Tight Stops? Wide Stops? Which One Should I Use?

Entry signals are very important but just as important if not more is trade management.

By: Ilan Levy-Mayer, Cannon Trading Commodities Broker & VP

This article was published on FinanceMagnates.com back in April but is definitely a timeless article.

Today I decided to touch more on an educational feature rather than provide a certain market outlook. Many of my clients and blog readers know that when it comes to short term trading I am a fan of adjusting your trading technique/ game plan according to your assessment of the type of trading day that is developing in front of you.

Many new and advanced traders spend HOURS on looking for entry signals. Back testing historical data, creating algorithms to use and much more. I know. I am one of these traders.

Trade management consists of many factors. Some are psychological and some are more mathematical and many are in between. Some of the basic elements of trade management before even entering the trade are: What will my stop loss be**? will I use a stop loss**? What will my target be? will I use a target or just trail the trade if it goes my way?

Continue reading “Day Trading 101: Tight Stops? Wide Stops? Which One Should I Use? 10.13.2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Below you will see signals for crude oil from today’s session. Red square suggest major turning point going lower, red diamond, minor turning point and vise versa with the green circles.

If you like to try the same signals along with a 23 page PDF explaining more on the method, sign up for the free trial here.

Continue reading “Try our trading signals, Levels & Economic Reports for 10.12.2017”

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

* The Dow Jones has rallied over 4,000 points since the U.S. elections. This will not continue forever. Consider allocating some gains into alternative investments like trading systems shared below offered by Cannon Trading, a 29 year veteran.

TRADE SMART / BASE TRADING ON ACTUALS ONLY — for the current rankings as well as actual performance of trading systems traded at Cannon, click here.

Cannon Trading Company Inc. is registered with the CFTC and a member of the NFA.

** Updates to E-Futures Int’l: Our FREE trading platform now offers theoretical values ( delta, gamma, theta) on option chains!

Add this to margin calculator, news, server side advanced orders and MUCH more to make this the BEST free trading platforms in our opinion!

Try it for FREE if you have not done so yet.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Futures Trading Levels

10-11-2017

| Contract December 2017 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | BitCoin Index |

| Resistance 3 | 2561.17 | 6110.50 | 22826 | 1531.53 | 5408.32 |

| Resistance 2 | 2555.83 | 6097.25 | 22789 | 1524.77 | 5137.18 |

| Resistance 1 | 2549.92 | 6081.25 | 22751 | 1516.33 | 4957.44 |

| Pivot | 2544.58 | 6068.00 | 22714 | 1509.57 | 4686.30 |

| Support 1 | 2538.67 | 6052.00 | 22676 | 1501.13 | 4506.56 |

| Support 2 | 2533.33 | 6038.75 | 22639 | 1494.37 | 4235.42 |

| Support 3 | 2527.42 | 6022.75 | 22601 | 1485.93 | 4055.68 |

| Contract | December Gold | Dec. Silver | Nov. Crude Oil | Dec. Bonds | Dec. Euro |

| Resistance 3 | 1301.1 | 17.35 | 50.49 | 152 25/32 | 1.1846 |

| Resistance 2 | 1294.5 | 17.19 | 50.14 | 152 18/32 | 1.1823 |

| Resistance 1 | 1290.8 | 17.09 | 49.83 | 152 11/32 | 1.1808 |

| Pivot | 1284.2 | 16.93 | 49.48 | 152 4/32 | 1.1785 |

| Support 1 | 1280.5 | 16.82 | 49.17 | 151 29/32 | 1.1771 |

| Support 2 | 1273.9 | 16.66 | 48.82 | 151 22/32 | 1.1748 |

| Support 3 | 1270.2 | 16.56 | 48.51 | 151 15/32 | 1.1733 |

| Contract | Dec. Corn | Dec. Wheat | November Beans | Dec. SoyMeal | Nov. Nat Gas |

| Resistance 3 | 352.3 | 445.8 | 983.75 | 324.27 | 2.93 |

| Resistance 2 | 351.2 | 443.7 | 979.75 | 322.43 | 2.91 |

| Resistance 1 | 350.3 | 439.8 | 973.25 | 318.97 | 2.87 |

| Pivot | 349.2 | 437.7 | 969.25 | 317.13 | 2.85 |

| Support 1 | 348.3 | 433.8 | 962.8 | 313.7 | 2.8 |

| Support 2 | 347.2 | 431.7 | 958.75 | 311.83 | 2.79 |

| Support 3 | 346.3 | 427.8 | 952.25 | 308.37 | 2.75 |

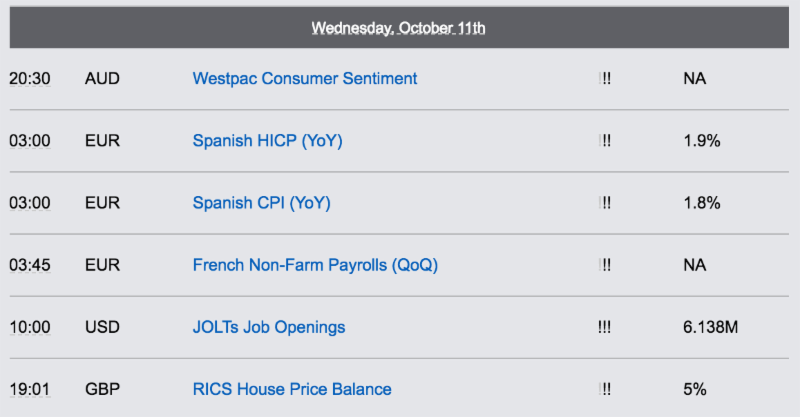

Economic Reports, source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

____________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_____________________________________________________________

Dear Traders,

Futures and forex trading is not suitable for all investors, and involves risk of loss. Futures are a leverage instrument, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money initially deposited for a futures product. CME Group is the trademark of CME Group, Inc. The Globe logo is a trademark of Chicago Mercantile Exchange, Inc. Continue reading “The World Cup Championship of Futures Trading – Trading Levels for Oct 10th”