Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Dear Traders,

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Dear Traders,

* Sometimes our biggest challenge when trading is simply NOT TO GET INTO A TRADE….One of my client said: “I am getting paid to wait”…

** This week and next week, crude oil numbers come out Thursday at 10 AM central since the markets were closed Monday.

Learning to be selective and controlling to urge to just get into a trade because otherwise “you feel you are not doing your job” is not easy but this is definitely one of the steps you as a trader must master in order to be part of the very small percentage of traders who actually make it….

New Year’s 2017 Day Holiday Schedule for CME / Globex and ICE Exchanges

Equity, Interest Rate, FX, Energy, Metals & DME Products

Friday, Dec 30

1600 CT / 1700 ET / 2200 UTC – Regular close

Monday, Jan 2

New Years Observed – Globex closed

Monday, Jan 2

1700 CT / 1800 ET / 2300 UTC – Regular open for trade date Tuesday, Jan 3

Tuesday, Jan 3

1600 CT / 1700 ET / 2200 UTC – Regular close

Grain, Oilseed & MGEX Products

Friday, Dec 30

Regular close – Per each product schedule

Monday, Jan 2

New Year’s Observed – Globex closed

Monday, Jan 2

1900 CT / 2000 ET / 0100 UTC – Open for trade date Tuesday, Jan 3

Tuesday, Jan 3

0700 CT / 0800 ET / 1300 UTC – MGEX Apple Juice open

0800 CT / 0900 ET / 1400 UTC – Grain, Oilseed & MGEX products pre-open

0830 CT / 0930 ET / 1430 UTC – Grain, Oilseed & MGEX products reopen

Regular close – Per each product schedule

Livestock, Dairy & Lumber Products

Friday, Dec 30

Regular Close – Per each Product

Monday, Jan 2

New Years Observed – Globex closed

Monday, Jan 2

1700 CT / 1800 ET / 2300 UTC – Dairy – Regular open for trade date Tuesday, Jan 3

Tuesday, Jan 3

830 CT / 930 ET / 1430 UTC – Livestock markets open

900 CT / 1000 ET / 1500 UTC – Lumber market open

Regular close – Per each product schedule

Globex® New Year’s 2017 Holiday Schedule

More details at: http://www.cmegroup.com/tools-information/holiday-calendar/files/2017-new-years-holiday-schedule.pdf

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe

at +44 800 898 013 or in Asia at +65 6532 5010

Ice Futures New Year’s 2017 Holiday Trading Schedule

Detailed holiday hours: https://www.theice.com/holiday-hours

The above sources were compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* 25 Proven Strategies for Trading Options

If you are currently trading options on futures or are interested in exploring them further, check out our newly updated trading guide, featuring 25 commonly used options strategies, including butterflies, straddles, strangles, backspreads and conversions. Each strategy includes an illustration demonstrating the effect of time decay on the total option premium involved in the position.

Options on futures rank among our most versatile risk management tools, and are offered on most of our products. Whether you trade options for purposes of hedging or speculating, you can limit your risk to the amount you paid up-front for the option while maintaining your exposure to beneficial price movements. Download PDF here

****

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* Check out Cannon Trading’s interview with well-known market technician, Carolyn Boroden, the Fibonacci Queen.

** Christmas Trading Schedule

****

Continue reading “Futures Holiday Trading Schedule 12.21.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* Check out Cannon Trading’s interview with well-known market technician, Carolyn Boroden, the Fibonacci Queen.

**Check out our top performing trading systems!

Live results. Explore different systems by different developers and if interested, have these systems “auto trade”.

Please contact your broker or just call us at +310 859 9572.

****

Continue reading “Trader’s interview with the Fibonacci Queen! – Carolyn Boroden 12.20.2016”

Christmas Holiday Schedule December 2016 for CME / Globex & Ice Exchanges

*Dates and times are subject to change 1 Last updated 10/27/2016

Christmas Holiday Schedule CME / Globex 2016

Equity, Interest Rate, FX, Energy, Metals & DME Products

Friday, Dec 23

1600 CT / 1700 ET / 2200 UTC – Regular close

Monday, Dec 26

Christmas Day Observed – Globex closed

Monday, Dec 26

1700 CT / 1800 ET / 2300 UTC – Regular open for trade date Tuesday, Dec 27

Tuesday, Dec 27

1600 CT / 1700 ET / 2200 UTC – Regular close

Grain, Oilseed & MGEX Products

Friday, Dec 23

1205 CT / 1305 ET / 1805 UTC – Early close

1215 CT / 1315 ET / 1815 UTC – Early MGEX Wheat & Apple Juice close

1230 CT / 1330 ET / 1830 UTC – Early Mini-Sized grain close

1230 CT / 1330 ET / 1830 UTC – Early MGEX Indices close

Monday, Dec 26

Christmas Day Observed – Globex closed

Monday, Dec 26

1900 CT / 2000 ET / 0100 UTC – Regular open for trade date Tuesday, Dec 27

Tuesday, Dec 27

0700 CT / 0800 ET / 1300 UTC – MGEX Apple Juice open

0800 CT / 0900 ET / 1400 UTC – Grain, Oilseed & MGEX products pre-open

0830 CT / 0930 ET / 1430 UTC – Grain, Oilseed & MGEX products reopen

Regular Close – Per each product schedule

Livestock, Dairy & Lumber Products

Friday, Dec 23

1200 CT / 1300 ET / 1800 UTC – Early close for Lumber & Dairy

1202 CT / 1302 ET / 1801 UTC – Early close for Lumber Options

1215 CT / 1315 ET / 1815 UTC – Early close for Livestock Futures & Options

Monday, Dec 26

Christmas Day Observed – Globex closed

Globex® Christmas Holiday Schedule

*Dates and times are subject to change 2 Last updated 10/27/2016

Monday, Dec 26

1700 CT / 1800 ET / 2300 UTC – Dairy – Regular open for trade date Tuesday, Dec 27

Tuesday, Dec 27

830 CT / 930 ET / 1430 UTC – Livestock markets open

900 CT / 1000 ET / 1500 UTC – Lumber market open

Regular Close – Per each product schedule

More details at: http://www.cmegroup.com/tools-information/holiday-calendar/files/2016-christmas-holiday-schedule.pdf

*Dates and times are subject to change

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe

at +44 800 898 013 or in Asia at +65 6532 5010

Ice Futures Christmas Holiday Trading Schedule 2016

Detailed holiday hours: https://www.theice.com/holiday-hours

The above sources were compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

*Check out our top performing trading systems!

Live results. Explore different systems by different developers and if interested, have these systems “auto trade”.

Please contact your broker or just call us at +310 859 9572.

** ALGO free trial for possible signals like you see in the chart below

****

Continue reading “ALGO Free Trial for Possible Signals 12.16.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

*Check out our top performing trading systems!

Live results. Explore different systems by different developers and if interested, have these systems “auto trade”.

Please contact your broker or just call us at +310 859 9572.

**March is NOW front month for stock indices, currencies, most grains, all financials and more. You should NOT be trading any December contracts at this point…..

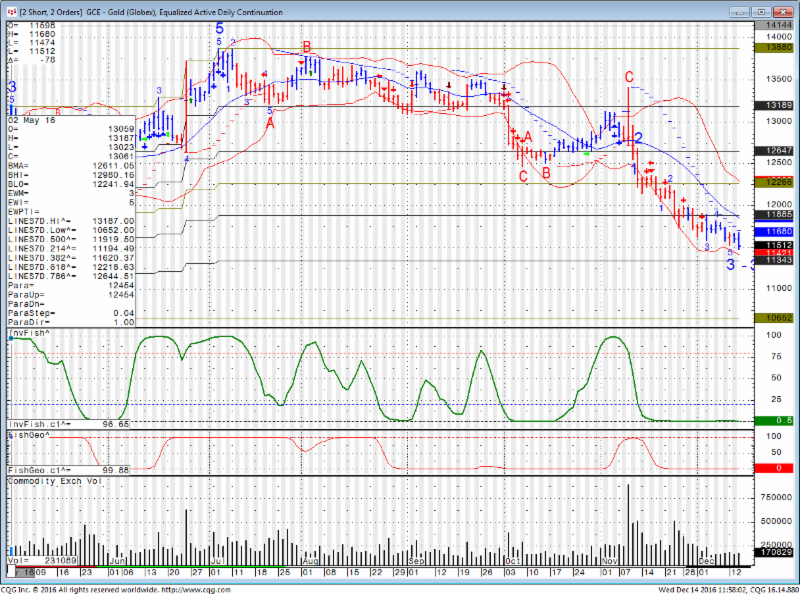

*** Gold broke major support levels, daily chart for your review below. 1134 is next major support level:

****

Continue reading “Top Performing Futures Trading Systems 12.15.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Two main notices today:

1. We will have a webinar tomorrow right after the close on getting started in scalping.

2. We have FOMC coming out tomorrow – some notes on that as well!

1. Join us for a webinar on Dec 14, 2016 at 1:00 PM PST.

Getting Started in Scalping/Ultra Short Term Trading

Register now!

https://attendee.gotowebinar.com/register/8467547232373354500

Join us for a 60 -minute webinar on Wednesday Dec 14th at 3:00 P.M., Central Time.

The term ‘scalping’ now covers many different styles of trading with one common trait. You are in and out of the market in a very short time period. Frequency of trades is usually but not always high.

In this webinar, we’ll look at specific techniques for short term trading and why you might want to consider using these techniques.

– The benefits and risks of short term trading

– Market making techniques

– Market state – when to scalp

– The role of correlated markets

– Scalping volatility

– Scalping around volume

– Scalping around depth/front running the front runners

– Scalping mid-leg absorption

– Scalping around high visibility areas

– Stops – definitely not what you think

Risk free demo will be available.

SPACE is LIMITED, so reserve your space now! https://attendee.gotowebinar.com/register/8467547232373354500

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time

After registering, you will receive a confirmation email containing information about joining the webinar.

2. The second, tomorrow is FOMC meeting.

Be careful.

The FOMC interest rate decision is due at 2:15 ET in the US tomorrow as well as Crude Oil Inventories earlier that day.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

The following are suggestions on trading during FOMC days:

Continue reading “Webinar – Getting Started With Scalping 12.14.2016”