Cannon Futures Weekly Letter Issue # 1209

In this issue:

- Important Notices – Heavy Fed Speaking, Active Data, Few Earnings

- Futures 101 – Tick Size & Minimum Fluctuations

- Hot Market of the Week – March Sugar

- Broker’s Trading System of the Week – Copper Swing Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

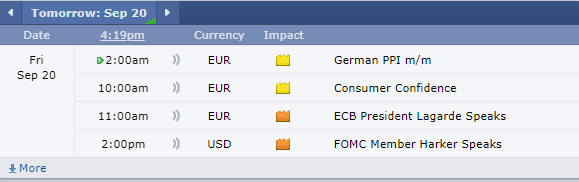

Important Notices – Next Week Highlights:

The Week Ahead

Heavy Fed Speak Week, active data and a few earnings highlight the week ahead.

Light Earnings, by largest Market Cap

- Wed, Micron Technologies After the close

- Thursday, Accenture pre-open, Costco after the close

Fed Speak schedule

- Mon. Goolsbee 9:15am CDT, Kashkari Noon CDT

- Tues. Bowman 8:00am CDT

- Wed. Kugler 3:00pm CDT

- Thu. Collins 8:10amCDT, Powell 8:20am CDT, Williams 8:25 CDT, Treasury Sec. Yellen 10:15am CDT

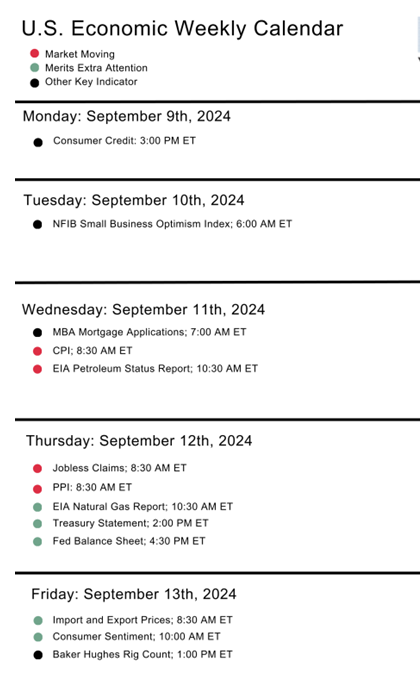

Big Economic Data week:

- Mon. S&P PMI Flash

- Tues. Case-Shiller Home prices, CB Consumer Confidence, Redbook, Richmond Fed.

- Wed. Building Permits, New Home Sales

- Thur. Jobless Claims, Core PCE Final, GDP Final, Durable goods, Pending Home sales

- Fri. Personal Income, Retail and Wholesale Inventories, Michigan consumer sentiment

How to Rollover on the E-Futures Platform video below

-

Futures 101: Tick Movements: Understanding How They Work

Minimum Price Fluctuation

All futures contracts have a minimum price fluctuation also known as a tick. Tick sizes are set by the exchange and vary by contract instrument.

E-min S&P 500 tick

For example, the tick size of an E-Mini S&P 500 Futures Contract is equal to one quarter of an index point. Since an index point is valued at $50 for the E-Mini S&P 500, a movement of one tick would be

.25 x $50 = $12.50

NYMEX WTI Crude Oil

The tick size of the NYMEX WTI Crude Oil contract is equal to 1 cent and the WTI contract size is 1,000 barrels. Therefore, the value of a one tick move is $10.

Summary

Tick sizes are defined by the exchange and vary depending on the size of the financial instrument and requirements of the marketplace. Tick sizes are set to provide optimal liquidity and tight bid-ask spreads.

The minimum price fluctuation for any CME Group contract can be found on the product specification pages.

-

- Hot Market of the Week – December Gold

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

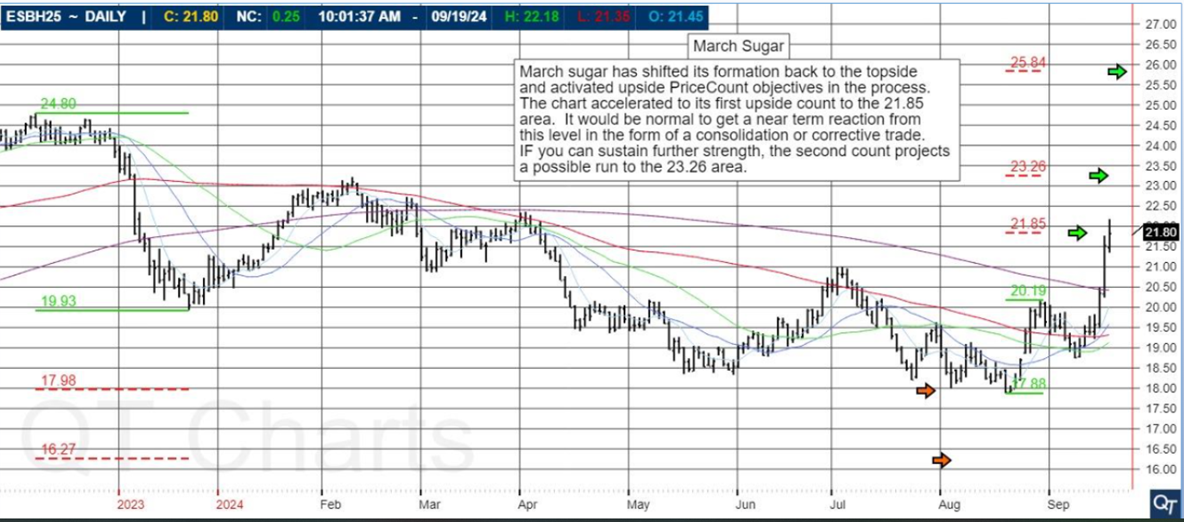

March 2025 Sugar

March sugar has shifted its formation back to the topisde and activated upside PriceCount objectives in the process. The chart accelerated to its first upside count to the 21.85 area. It would be normal to get a near term reaction form theis level in the form of a consolidation or corrective trdae. IF you can sustain further strength, the second count projects a possible run to the 23.26 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

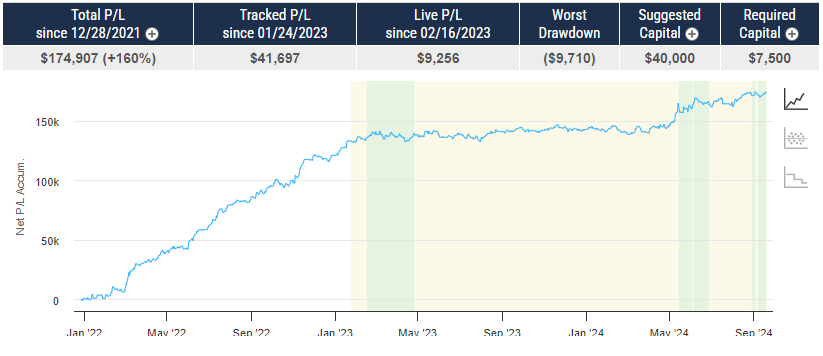

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

Balance Cont. v.22

PRODUCT

HG – Copper

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$25,000.00

COST

USD 150 / monthly

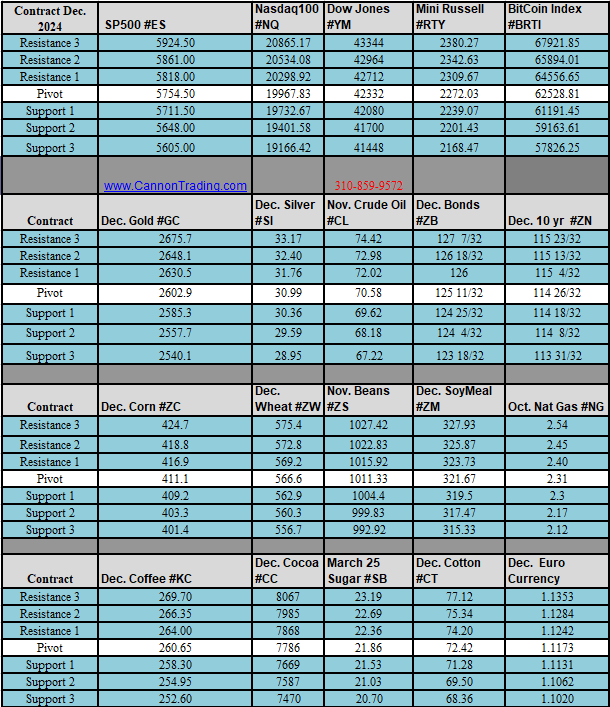

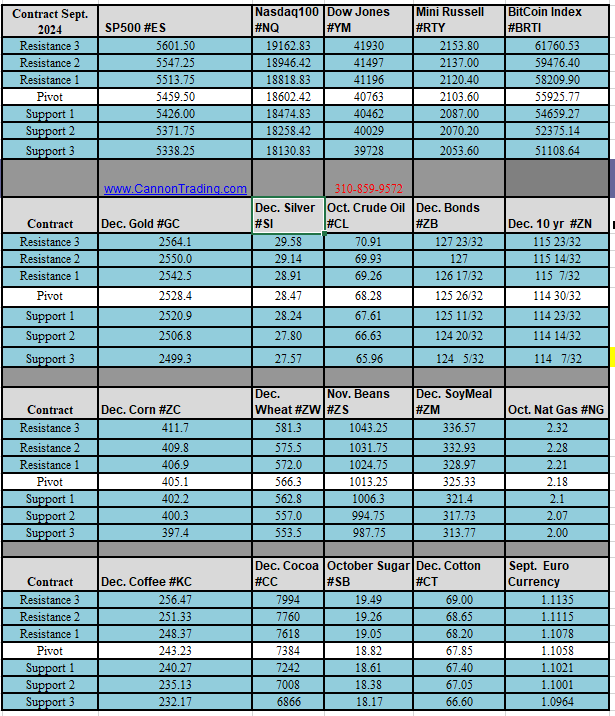

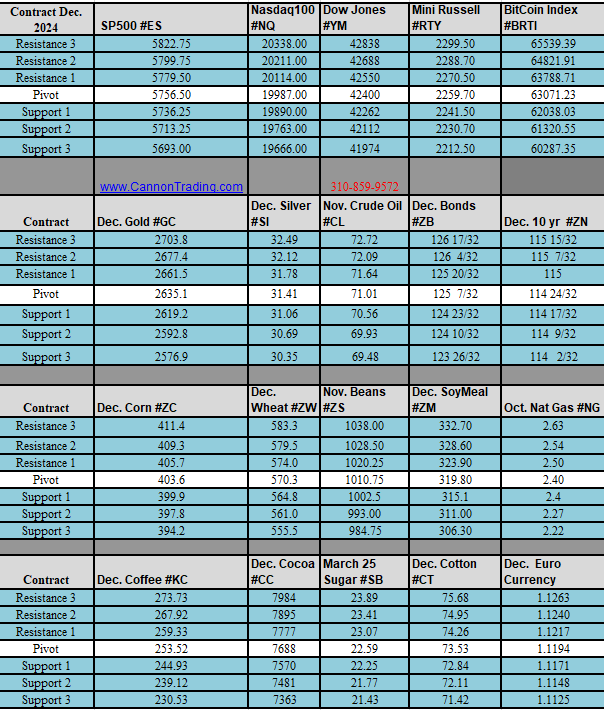

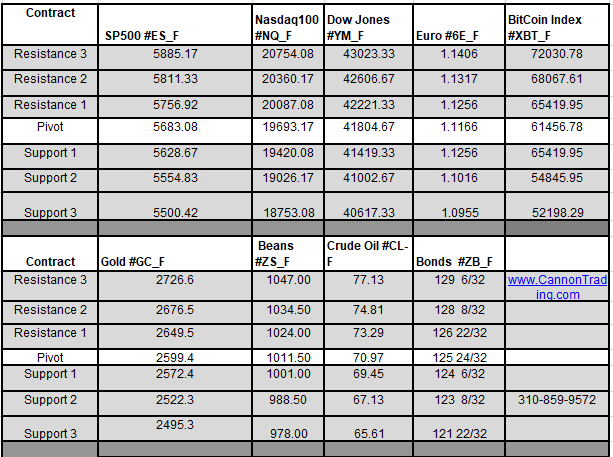

Daily Levels for September 23rd 2024

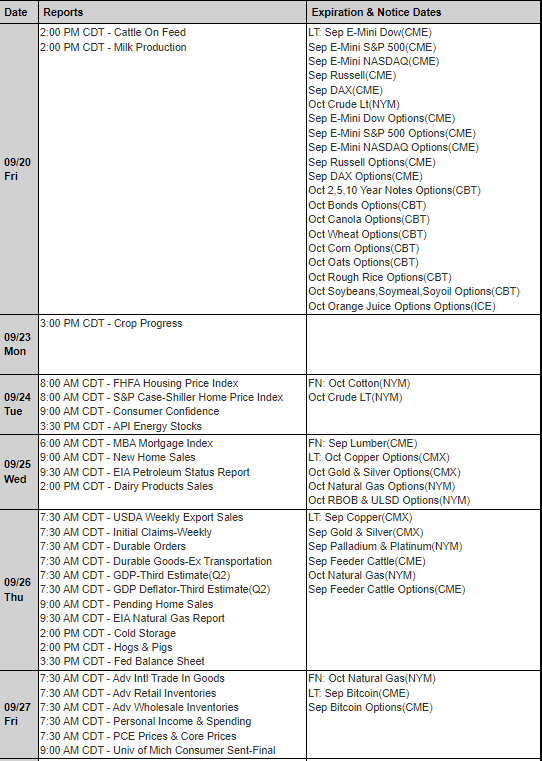

Trading Reports for Next Week

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.