Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

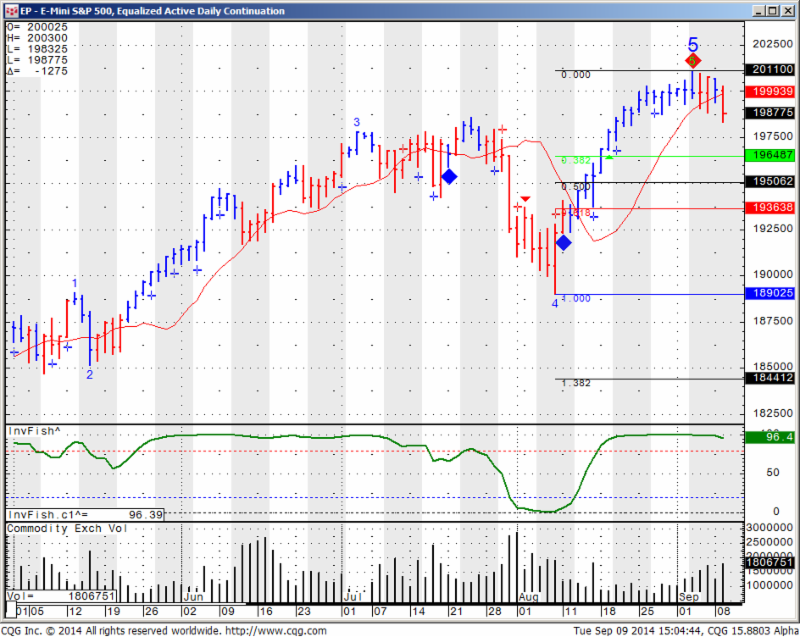

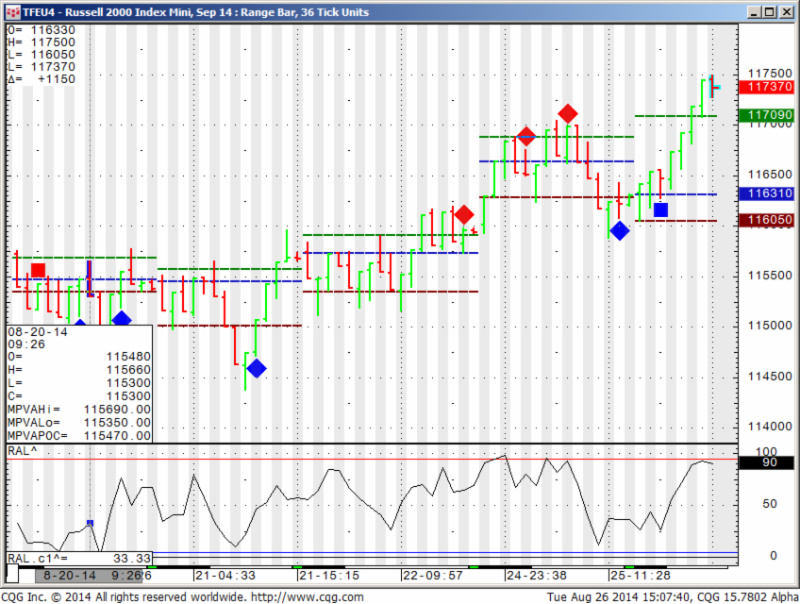

Stock Indices continue to make new highs but on VERY light volume….although I think the trend is up and the chart is more bullish than bearish, it is extremely hard for me to enter fresh longs at these prices because of two main reasons:

1. Very light volume

2. Extremely volatile Geo political arena

Even though I think there is a higher probability of a move higher, the chances for a BIG move is larger to the down side. So for now….I am staying on the sidelines ( swing trading wise).

As I sometimes like to do on Mondays, in order to have a perspective on the fundamentals behind the market, I share the weekly recap from our friends atwww.TradeTheNews.com

TradeTheNews.com Weekly Market Update: Feasting on Doves

– A slightly more hawkish tone was heard from the Fed this week, in the minutes of the July FOMC meeting and in speeches from leading officials. Fed Chair Yellen’s presentation at Jackson Hole was restrained and balanced, but the dovish Williams and moderate Lockhart both conceded that rate hikes would likely begin by mid-2015. The US yield curve flattened notably after all the talk. August Flash PMI manufacturing readings provided a view of the global economy at the midpoint of the third quarter: in the US, the Markit survey hit its highest level since April 2010, with big gains in all sub-indices; in Europe, the French data sank deeper into contraction while Germany flat-lined; in Asia, the China HSBC manufacturing PMI sank to a three-month low, while Japan’s rose to a five-month high. Violence in Iraq, Syria, and Ukraine kept markets jumpy, although it hardly prevented material gains in equities worldwide. For the week, the DJIA gained 2%, the S&P500 rose 1.7% and the Nasdaq added 1.6%.

– The FOMC minutes out on Wednesday indicated that the Fed appears to be shifting to a more balanced view of the economy from a more dovish position. The changes were of tone rather than anything material, although the minutes also showed a growing debate regarding the labor market. The minutes added a controversial new statement: “…a range of labor market indicators suggested that there remained significant underutilization of labor resources.” Both Bullard and Plosser have disagreed with the novel use of “significant” to describe labor resource underutilization. Yellen’s speech at Jackson Hole on Friday was balanced and pragmatic, noting both the positive developments in the jobs market and more negative trends, including slack in the mortgage market.

– The Ukraine situation seemed to be easing early in the week, as Kiev and Russian officials met and seemed to agree to protocols for allowing the Russian humanitarian mission into Ukraine. Meanwhile the Ukraine armed forces made even more gains against the rebels. By Friday, relations between Kiev and Moscow had soured again after the Russian side forced in the convoy without permission, prompting the Ukrainians to call it an invasion. In Iraq, the killing of a US journalist by ISIS hardened the US stance against the group, prompting very hawkish rhetoric out of administration figures, who suggested airstrikes against ISIS might be expanded into Syria.

– Shares of major US homebuilders gained steadily this week thanks to another month of strong gains in the August NAHB report and the July housing starts. The NAHB’s 55 reading was the third month of gains for the index, while July housing starts rose 8%, halting two straight months of declines. Some skeptics pointed out that multi-family units were the lion’s share of the gain, but single-family starts also saw solid improvement.

– Target’s earnings slid as its Canada operations continued to drag on results, and management cuts its FY view for the second time as traffic declined, even as the firm has ramped up promotional activity. TJX saw its earnings grow by single digits and the firm hiked its FY guidance. Teen retailer American Eagle topped very low expectations on a negative comp. L Brands saw modest growth and positive comps. Both Home Depot and Lowes saw very good quarterly results, and Home Depot said the housing market remains a modest tailwind for its business, and it observed an acceleration of big-ticket spending in the quarter.

– Bank of America reached a $16.7 billion agreement with DoJ to settle charges it misled investors into buying troubled MBS, confirming numerous reports from earlier in August. BoA will pay a $9.65 billion in cash and provide $7 billion of consumer relief to struggling homeowners and communities. The deal resolves nearly all of the legacy issues left over from the hastily-arranged crisis-era acquisitions of Countrywide and Merrill Lynch. The accord is expected to reduce Q3 earnings by about $5.3 billion, or about $0.43/share.

– Various long-running M&A dramas saw new developments this week. Valeant extended the expiration of its exchange offer to acquire Allergan to December 31, and there were reports that Allergan had approached Salix Pharmaceuticals or Jazz about a possible merger to fend off Valeant’s advances. CNBC threw cold water on the story, reporting that any potential deal could be months away, perhaps in December. Dollar General rolled out a $9.7 billion cash offer for Family Dollar, topping the $8.95 billion bid made in late July by Dollar Tree. Family Dollar rejected the proposal on the basis of antitrust regulatory considerations, although there were unconfirmed reports that it was open to concessions to resolve the compliance issues.

– EUR/USD hit one-year lows around 1.3220 this week as headwinds strengthened for the European economy. The Ukraine conflict continues to weigh on the single currency, and the opposite trajectories for EU and US monetary policy become even starker. Cable slumped to its lowest level since April thanks to soft July UK CPI inflation data and a significant decline in July PPI inflation numbers. GBP/USD tested below 1.6565 on Friday afternoon. The minutes for the BoE’s August meeting disclosed the first dissent on the committee since July 2011. The vote was 7-2, with Weale and Mccafferty dissenting.

– The surprise slowdown in China manufacturing in the first half of August prompted fresh speculation over a further policy stimulus from Beijing. The August HSBC flash manufacturing PMI turned lower for the first time since March, hitting a 3-month low of 50.3 and widely missing consensus of 51.5. Growth in new orders slowed and disinflationary trends resurfaced with a decrease in both input and output price components. Later on the Friday, China’s MIIT warned the economy is faced with strong downward pressure, while analysts with Barclays noted this PMI slump could result in as many as two interest rate cuts by the PBoC before the end of 2014.

– An underwhelming run of July economic data in Japan continued with a wider than expected trade deficit. Exports rose for the first time in three months, but soft yen boosted the import value of energy, contributing to the 25th consecutive month of negative trade. On Thursday, local press reported that Japan is looking to set aside as much as ¥1.0T in stimulus funds in the 2015 budget supporting small business, presumably to help soften any further blow to the economy if PM Abe decides to proceed with a second increase in consumption tax.

Source: http://www.tradethenews.com/?storyId=1590961

Continue reading “News on Stock Indices, Economic Reports & Levels 8.26.2014”