What Makes a “Best Futures Broker” According to Trustpilot

When consumers search for the best futures broker on Trustpilot, they’re typically drawn to firms exhibiting:

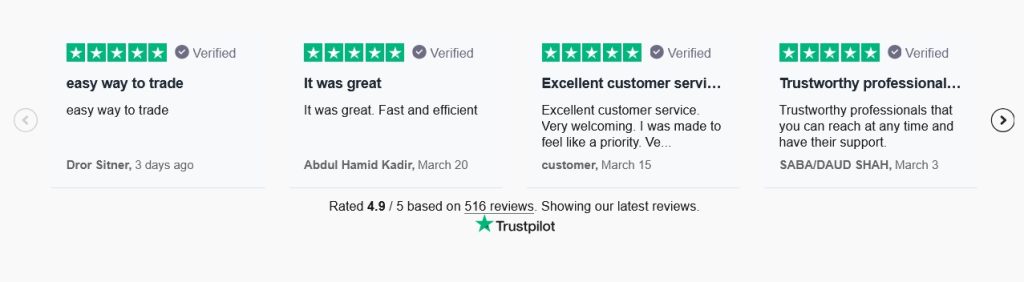

- Consistently high TrustScore and 5-star reviews

The strongest brokers will have a near-perfect TrustScore (4.8–5.0) with dozens or hundreds of glowing 5-star reviews from verified traders.

- Exceptional responsiveness and client service

Reviews often emphasize a broker’s timeliness, attention, and accessibility—especially when dealing with complex futures contracts.

- Professional, knowledgeable account managers

Personalized guidance from experienced brokers—often cited by name—reassures both novice and seasoned traders.

- Seamless account setup and onboarding

Efficient processes reinforce confidence that traders can get started without friction.

- Robust, user-friendly trading platforms

Support for multiple platforms—desktop, web, mobile—and integrations like cqg platform enhance the trading experience.

- Transparent regulation and industry standing

Membership in the NFA, CFTC, and accreditation from entities like the BBB serve as hallmarks of legitimacy.

A broker with even one of these strengths may be considered “good,” but the best futures broker combines all of them—an achievement reflected in both user sentiment and platform ratings on Trustpilot.

Trustpilot’s Global Role in Consumer Choice

Trustpilot has evolved over decades (founded in 2007) into a trusted global review platform. Its credibility stems from:

- Open public reviews: Anyone can post honest feedback, which prevents manipulation of ratings.

- Verified purchasers: Many reviews are tied to real transactions, ensuring authenticity.

- Rigorous policies: Trustpilot prohibits incentivized or fraudulent reviews, adding trustworthiness bbb.org+12au.trustpilot.com+12cannontrading.com+12at.trustpilot.com+1trustpilot.com+1.

- Transparency and accountability: Brokers like Cannon Trading provide replies, showing engagement and openness.

- Global reach: Reviews from across continents give a broad window into user experience.

As a result, Trustpilot is consistently consulted by traders researching brokers: search terms like “best futures broker Trustpilot”, or “futures broker Trustpilot”, yield Cannon Trading among top results.

Core Qualities Shared by the Best Futures Brokers on Trustpilot

By analyzing top-rated brokers, including Cannon Trading, we identify several repeating themes:

- Stellar TrustScore and volume of reviews

- Cannon Trading holds a TrustScore of 4.9–5.0 based on 525 reviews, nearly all rated 5 stars reviews.birdeye.com+1trustpilot.com+1.

- Quick, accessible support

- One review calls out, “Kimberly is very responsive and helpful” trustpilot.com+6ca.trustpilot.com+6trustpilot.com+6.

- Another praises, “fast professional customer service” from reps Ilan & Kim trustpilot.com+2ca.trustpilot.com+2trustpilot.com+2.

- Personalized attention from real brokers

- A user noted: “Trustworthy professionals that you can reach at any time and have their support” cannontrading.com+14uk.trustpilot.com+14ca.trustpilot.com+14.

- “Excellent brokerage, direct contact with a broker for everything” trustpilot.com+1ca.trustpilot.com+1.

- Smooth account onboarding

- “The account was straight forward and easy to set up” au.trustpilot.com.

- “My account opening experience – Quick, efficient and professional” uk.trustpilot.com.

- Technical expertise and problem-solving

- “A couple of technology issues but Wil just worked around them and didn’t let them get in the way” uk.trustpilot.com+1trustpilot.com+1.

- “They were diligent and help me through every process” au.trustpilot.com+6ca.trustpilot.com+6ca.trustpilot.com+6.

- Longevity and industry knowledge

- Users mention years-long relationships: “I have been trading through Cannon with Ilan and Kimberly for more than 8 years” at.trustpilot.com+13trustpilot.com+13uk.trustpilot.com+13.

- “Follow him for 8 years” trustpilot.com.

- Multiple platform flexibility

- Reviews praise the variety: “wide array of platforms, tools and features” cannontrading.com+10trustpilot.com+10ca.trustpilot.com+10.

- Cannon’s own blog states: “Wide Range of Free Trading Platforms” au.trustpilot.com+2cannontrading.com+2uk.trustpilot.com+2.

- Regulatory compliance and trust

- Cannon is a member of NFA, CFTC, BBB, signaling oversight and accountability cannontrading.comtrustpilot.com+1at.trustpilot.com+1.

How Cannon Trading Epitomizes These Qualities

Cannon Trading Company doesn’t just mirror these traits—they live them in day to day operations.

A) Trustpilot Excellence: 5 Star TrustScore & Reviews

- Cannon Trading has amassed nearly 525 reviews, almost all rated 5/5, yielding a TrustScore around 4.9–5.0 cannontrading.com+2cannontrading.com+2bbb.org+2au.trustpilot.com.

- A Trustpilot UK review confirms: “Great customer service” with a 5 out of 5 stars rating ca.trustpilot.com+3uk.trustpilot.com+3trustpilot.com+3.

B) Decades of Futures Industry Experience

- Founded in 1988, Cannon has over three decades in futures reviews.birdeye.com+13trustpilot.com+13cannontrading.com+13.

- An independent overview notes: “Founded in 1988, Cannon has remained a stalwart in the industry… with over 35 years” cannontrading.com.

C) Regulatory Strength & Reputation

- Cannon is registered with the NFA, regulated by the CFTC, and accredited by the BBB trustpilot.com+1at.trustpilot.com+1.

- Acknowledging “highest standards of service and integrity in the industry” supports trustworthiness cannontrading.com+2trustpilot.com+2at.trustpilot.com+2.

D) Client-Centric Responsiveness

- Multiple reviews highlight responsiveness:

- “Ilan answered all my questions and patiently navigated me through the trading platforms” ca.trustpilot.com+2uk.trustpilot.com+2trustpilot.com+2.

- “Kimberly is very responsive and helpful” au.trustpilot.com+4trustpilot.com+4ca.trustpilot.com+4.

- “A couple of technology issues but Wil just worked around them” uk.trustpilot.com.

- “Excellent service. Prompt response to any questions or concerns. Knowledgeable. Reliable. Friendly and professional.” trustpilot.com.

E) Simple and Efficient Onboarding

- “The account was straight forward and easy to set up.” au.trustpilot.com.

- “My account opening experience – Quick, efficient and professional.” uk.trustpilot.com.

F) High Technical Competence

- “They were diligent and help me through every process.” ca.trustpilot.com.

- “Excellent service! Responsive problem solving.” trustpilot.com.

G) Personalized Broker Relationships

- “Trustworthy professionals… that you can reach at any time.” uk.trustpilot.com.

- “Excellent brokerage, direct contact with a broker for everything.” uk.trustpilot.com+3trustpilot.com+3ca.trustpilot.com+3.

- Clients repeatedly reference individuals by name—e.g. Ilan, Kim, Joe—indicating personal care.

H) Robust Platform Offering: Including CannonX powered by CQG

- Cannon offers a “wide array of platforms, tools and features” trustpilot.com+1ca.trustpilot.com+1.

- Their branded platform, CannonX powered by CQG, is built on the CQG framework, a respected industry standard supporting futures trading, futures contract trading, and trading futures with advanced analytics and low latency.

- Many reviews mention demo setups and support for technical tools—e.g. Excel DDE integration via CQG-based systems reviews.birdeye.com+15uk.trustpilot.com+15cannontrading.com+15.

CannonX Powered by CQG: Technology That Empowers Traders

CannonX powered by CQG brings together:

- Access to futures contracts and real‑time data.

- Slick desktop/web/mobile platforms ideal for active trading futures.

- Technical charting, analytics, and execution speed expected by professionals.

- Custom integration (e.g., Excel/DDE) praised by experienced users uk.trustpilot.com.

Customers highlight that personal brokers are there to walk them through setup, reinforcing that technology is powerful yet user-friendly when backed by human expertise.

Ethos and Culture at Cannon Trading Company

The company’s tone on Trustpilot and its own materials reflects:

- Integrity: Emphasizing unfiltered broker interactions over automated systems cannontrading.com+6cannontrading.com+6au.trustpilot.com+6.

- Support: “Real, licensed futures brokers are just a call away—a rarity in today’s automated world” cannontrading.com.

- Transparency: Regulated by NFA/CFTC/BBB, promoting accountability trustpilot.com+1at.trustpilot.com+1.

- Client-centricity: Over forty years of testimonials about “help”, “advice”, “support”, “patience” and professionalism.

Summation: Cannon Trading as Trustpilot’s “Best Futures Broker”

Bringing it all together:

| Key Quality | Cannon Trading Evidence |

| High TrustScore | 4.9–5.0 from 525+ 5-star reviews |

| Quick & personalized service | Reviews mention Ilan, Kimberly, Joe, Mark, etc. |

| Decades of experience | Founded 1988, >35 years |

| Regulation & trust | NFA, CFTC, BBB |

| Diverse platforms | Free platforms, CannonX powered by CQG |

| Tech-savvy with problem resolution | Reviews on troubleshooting |

| Smooth account setup | “Easy to set up” |

By consistently delivering across key categories associated with “best futures broker” on Trustpilot, Cannon Trading not only meets expectations—but is repeatedly confirmed by clients as a top-tier choice.

Interspersed Direct Quotes from Trustpilot (≥5 Examples)

- “Ilan answered all my questions and patiently navigated me through the trading platforms.” at.trustpilot.com+9cannontrading.com+9cannontrading.com+9uk.trustpilot.com

- “Trustworthy professionals that you can reach at any time and have their support.” uk.trustpilot.com

- “A couple of technology issues but Wil just worked around them and didn’t let them get in the way.” uk.trustpilot.com

- “Excellent brokerage, direct contact with a broker for everything.” trustpilot.com+1ca.trustpilot.com+1

- “My account opening experience – Quick, efficient and professional.” uk.trustpilot.com

- “Great service. Prompt response to any questions or concerns. Knowledgeable. Reliable. Friendly and professional.” trustpilot.com

- “They were diligent and help me through every process. Great choice.” ca.trustpilot.com

- “I have been trading through Cannon with Ilan and Kimberly for more than 8 years.” ca.trustpilot.com+4trustpilot.com+4au.trustpilot.com+4

For any trader querying “best futures broker Trustpilot”, the evidence suggests that Cannon Trading Company stands out. With numerous 5-star Trustpilot ratings, decades of experience in futures trading, stable regulatory standing, dedicated client service, and wide platform access—particularly via CannonX powered by CQG—they embody what top brokers promise and what users demand. Their performance, as reflected in reviews from real traders, validates the label of best futures broker.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading