As we mentioned in the previous article, first stage is usually the one where a newer trader doesn’t acknowledge the role of psyhcology in his trading. It happens out of ignorance or arrogance.

In a former case (ignorance) it’s simply lack of knowledge and mistaken notion that one can trade succeffully if given “right” system or indicator ot tip or whatever causes one to enter and exit his/her positions. It usually takes a while before a trader starts seeing how his mindset influences his trading and how his personal traits shine through his trading decisions. It comes as a surprize realization that different traders will get different results while trying to apply the same system. It is counter-intuitive, isn’t it?

In a latter case (arrogance), a trader shows some kind of denial – it’s “not me” attitude, thinking that goes along the lines “maybe it’s a problem for some but I am in control of myself,” “this stuff is for weak-minded” etc. Needless to say, it’s rarely the case… and even more importantly, it’s not so much about weak vs. strong mind as it is about influence one’s personality has over one’s trading.

In any case, the important thing at this stage is to come to appreciate this aspect of trading. It happens when one sees how much truth there is in saying “everyone gets what they want out of market” (Ed Seykota I think?) Again, seems counter-intuitive, right? After all, don’t we all want to succeed, to make winning trades, to make money? Sure… but it’s not about what our conscious mind wants, it’s about what our inner core dictates, and that is not always easy to realize and control.*

Simple example to illustrate the idea: do you know people who repeat certain behavior patterns harmful to themselves? Getting themselves into relationships with the types that make them miserable, over and over again? Repeating the same mistakes in their interaction with others, obviously not learning from the past? I bet you do (although you personally never act like this, right?) So, why do we do it even though we see (or could see if we looked) that these behavioral patterns hurt us? Because those patterns are not just some easy to break habits; rather they are a part of our personality, of who we are, and it takes much more than simple decision not to do that anymore to change our ways. Pretty much the same thing happens in trading – we know what not to do yet we continue doing it.

As soon as one realizes all this, the first stage is completed. The role of psychology in trading is acknowledged, denial is over – and this forms the foundation for a change.

*My favorite example of this phenomenon is the Russian movie Stalker. The plot line briefly: there is a certain machine granting wishes (stalkers in the movie are the people who take clients to it through the many dangerous traps). The machine grants wishes alright but there is catch: it’s not a wish that you stand in front of the machine and announce that will be granted… it’s a wish that constitutes your essence, your core, your deep desire – and it’s not necessary the one you realize and announce to yourself and to the world. Pretty much what happens in trading and pretty much what the author of that saying (everyone gets what they want in trading) meant.

Vadym Graifer is an author of the unique A Taoist Trader course devoted to trading philosophy and psychology

To read the rest of the articles in this series go to: http://www.traderplanet.com/profile/RealityTrader

GOOD TRADING!

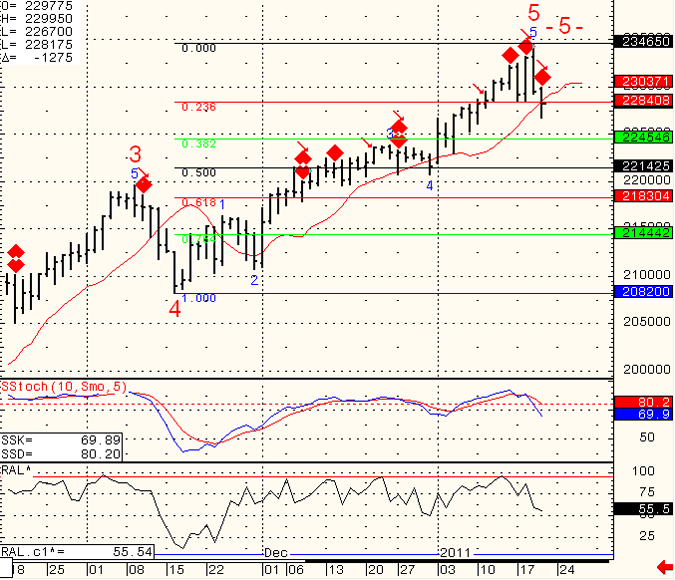

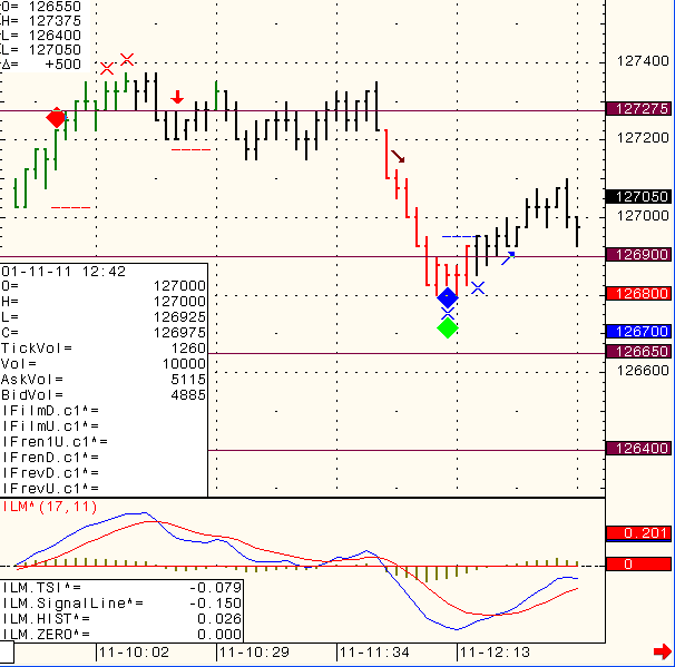

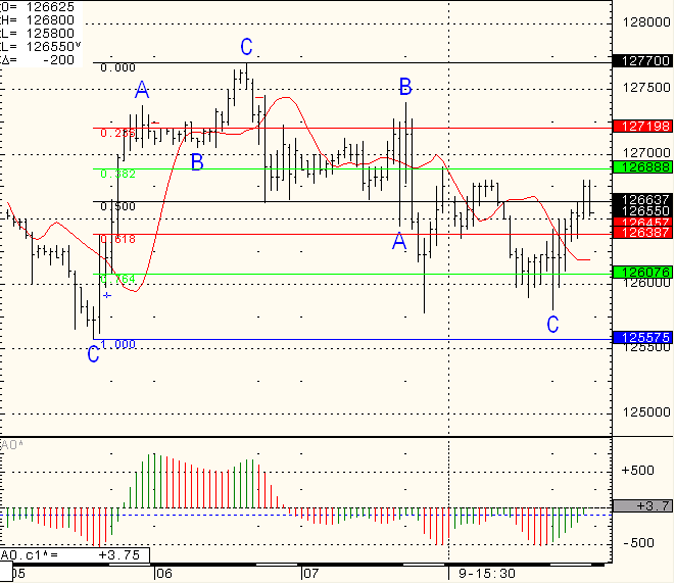

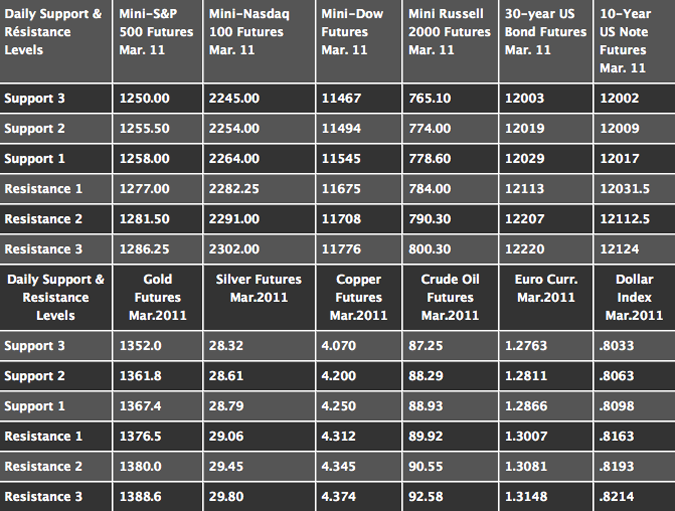

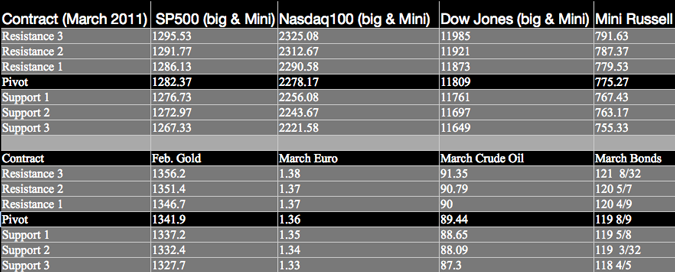

TRADING LEVELS!

Economics Report Source: http://www.forexfactory.com/calendar.php

Monday, January 24, 2011

Treasury Currency Report

Tentative USD

Tuesday, January 24, 2011

HPI m/m

9:00am USD

CB Consumer Confidence

10:00am USD

HPI m/m

10:00am USD

Richmond Manufacturing Index

10:00am USD

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Company, Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!