Dear Traders,

Get Real Time updates and more on our private FB group!

Tomorrow, June 10th is rollover day in US stock index futures.

Starting tomorrow many traders will start trading the SEPTEMBER contract rather than the JUNE contract.

Symbol for Sept. is U.

Example: ESU21

The rollover period will be complete by next Friday when June contracts expire into cash.

Here are a few pointers from Austin Lachapelle, Cannon Trading Broker:

With the volume looking to change in the equity indices my recommendation is to make sure you are trading strategies on larger time-frames till the end of this week. If using volume indicators be more cautious on the data that has been gathered. The June contract will start rolling into the September tomorrow. I recommend switching your charts and trading to the September month by days end. Be a little more cautious on the close Thursday and Friday as larger players will begin to sell the June and could possibly be more cautious when buying the September at these levels.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

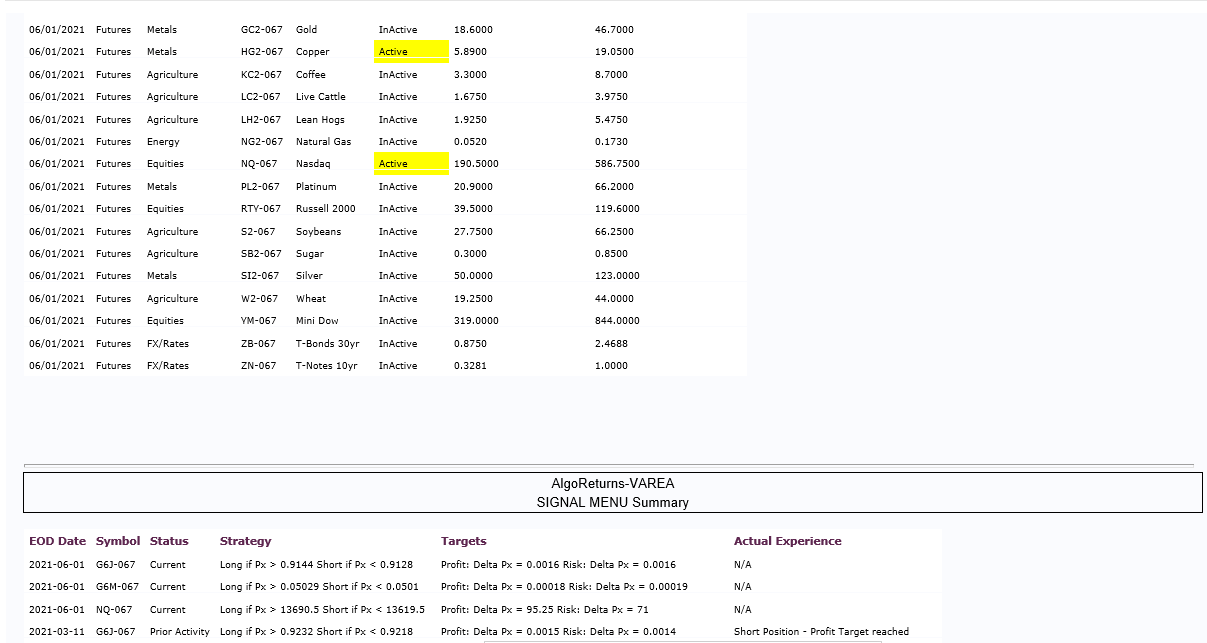

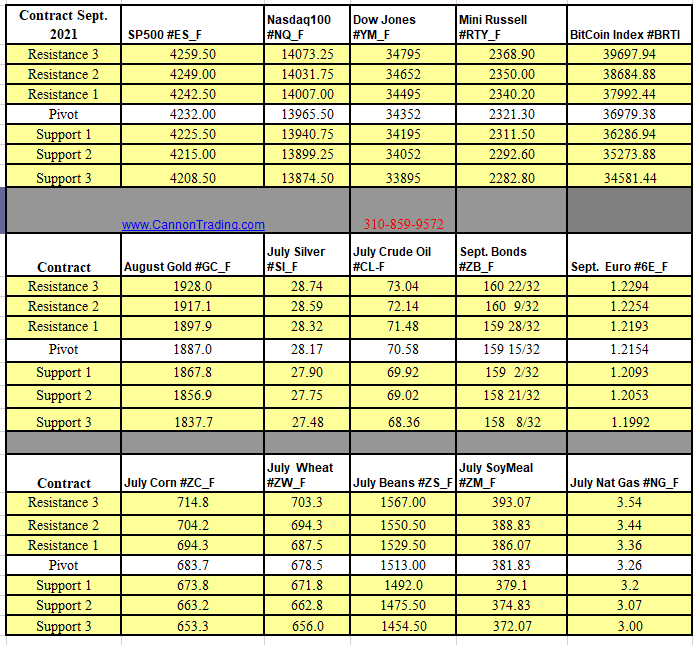

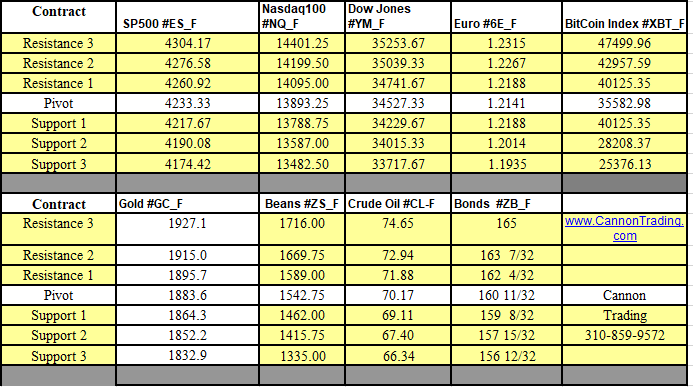

Futures Trading Levels

6-10-2021

Tomorrows levels published today will still show June contract until the Sept. volume is higher.

To get the Sept. levels do the following:

Substract 9 points for the Sept. ES

Substract 95 points for the Sept. YM

Substract 10 points for the Sept. NQ

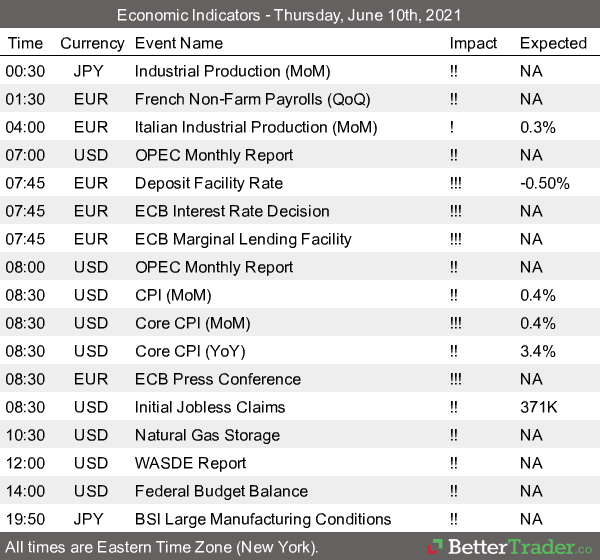

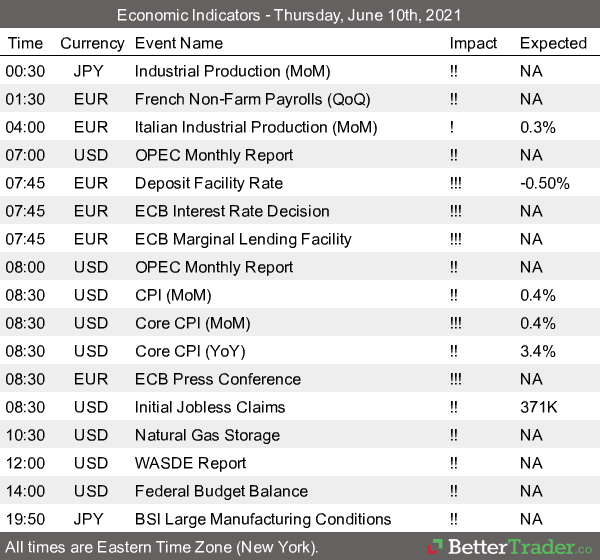

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.