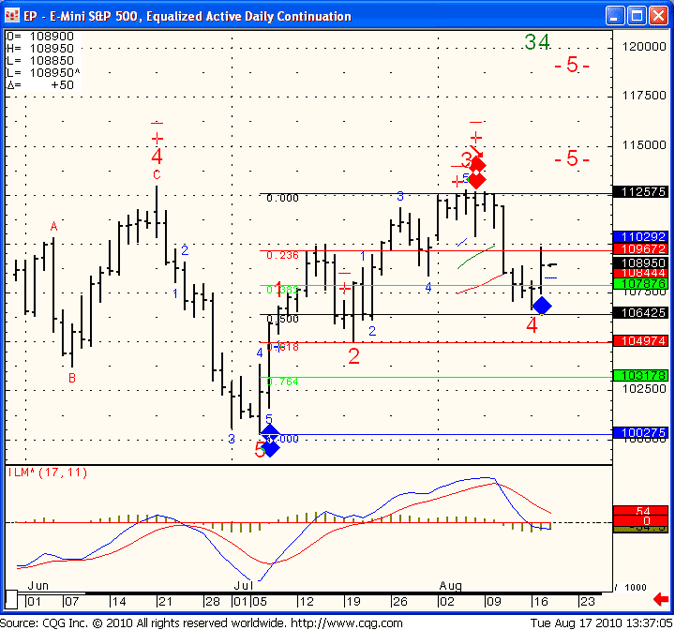

“If we break down below 1078, my guess is we will resume selling pressure”

Yesterday I wrote the following:

“On a different note, I got a blue diamond for tomorrow’s session which can mean potential up day if the futures market can break above 1083.00 or….continued decline if it fails to gain some upside momentum. Well the market broke 1083 overnight and continued as high as 1098 which is right above the nearest FIB level.”

What’s next one might ask? If we can hold 1078 then there is more upside potential, if we break down below 1078, my guess is we will resume selling pressure. Daily chart for review below:

Futures & Commodity Trading Levels (Potential Support/Resistance):

This Week’s Calendar from Econoday.Com

All reports are EST time

Wednesday August 18th – http://mam.econoday.com/byweek.asp?cust=mam

- MBA Purchase Applications – 7:00 AM ET

- EIA Petroleum Status Report – 10:30 AM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!